US Session Forex Brief, Dec 18 – The Buck Gets Smashed Ahead of the Last Rate Hike for the Year

The USD has been declining in anticipation of a dovish FED tomorrow, but I think traders might be wrong.

Last week, the US Dollar resumed the bullish trend, pushing higher against all major currencies as well as against Gold. That was the situation right until the last hours of Friday when the Buck retreated before the weekend, losing around 50 pips across the board. That was a sign that something was not right. The USD usually gets some strong bids towards the end of the year, so it didn’t make much sense, especially when fundamentals for all other currencies are dovish.

The commodity Dollars don’t have a reason to climb because the Chinese economy is cooling off, inflation or economic growth are pretty anemic in Japan, the GBP is doomed due to Brexit, the Eurozone economy is on a soft patch, and the CAD keeps following Oil down the drain. So, everything was and still is bullish for the USD. After all, the US economy is doing pretty great, especially when compared to the other developed economies, as well as to emerging markets which are also on a soft patch.

But, the USD turned pretty bearish this week and the reason for this is the FED meeting tomorrow evening European time. The Federal Reserve is widely expected to increase interest rates for the fourth time this year tomorrow, which should be bullish for the Buck in itself. But, the market is anticipating a dovish rhetoric from the FED regarding the future of the rate hikes. The FED mentioned in the last meeting that interest rates are near neutral now, meaning that they might slow down next year with rate hikes if we get to neutral.

That’s what the market is worried about for tomorrow and that’s the reason the Dollar has been diving. Donald Trump hates rate hikes and he has been trying to bully the FED into not hiking them with tweets in the last two days. Anyway, let’s get on with today’s forex events.

The European Session

- Italian Budget Saga – EU’s Moscovici commented early this morning on this hot issue saying that the EU is working hard so Italy doesn’t face sanctions. He is hopeful about reaching a deal on the budget with Italy and also stated that France should be working to lower its deficit. Although, he added later that France won’t be sanctioned even though their budget deficit will surpass 3% of the GDP next year. Moscovici supported his comment with the fact that this is a special occasion for France and that rules allow for limit breaks if they are “limited, temporary and exceptional”, while Italy is launching a multi-year stimulus package and the debt is already sky high. The Italian politicians have accepted to lower growth forecasts to around 1% from 1.5% previously which looks more realistic, so it seems that the EU will pass this one, but I have this feeling that the Italians are trying to play the EU for now and then go do their thing with the budget next year. Di Maio said later on that Italy has done all it could on the budget.

- German Ifo Business Climate – The Ifo business climate indicator has been declining constantly since it peaked near 104 points in August. Last month it declined to 102 points and today it was expected to cool off further to 101.8 points, but it missed expectations coming at 101 points.

- Eurozone Inflation – The consumer price index (CPI) declined by 0.1% in Spain as anticipated and the HICP declined by 0.2%. Although, the annualized numbers for both these inflation indicators remained unchanged at 1.7%.

- ECB’s Rehn Sounding Dovish – The ECB member Olli Rehn said a while ago that low interest rates continue to support inflation goals and the ECB should consider reviewing policy framework. Does this mean that the ECB should trash the planned rate hike altogether for next year? Eurozone inflation is surely cooling off from what we saw yesterday.

- Donald Trump Tweets About the FED – Donald Trump hates rate hikes from the FED. He tweeted on the issue yesterday and he tweeted again today. Here is the tweet: “I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make yet another mistake. Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!”

- ECB’s Makuch Sounds Dovish Too – The Slovakian ECB member Jozef Makuch commented as well today and he sounded even more dovish then Rehn. He said that the ECB may need to rephrase guidance if the slowdown continues. So, no rate hikes from the ECB next year then.

The US Session

- Canadian Manufacturing Sales – Manufacturing sales declined by 0.4% in August as we saw in the report released in October, but they increased again in September by 0.2%. Today’s number which showed manufacturing sales for October was expected at 0.3%, but instead, manufacturing sales fell again this time by 0.1%.

- US Building Permits – US Building permits were expected to increase by 1.26 million in November which is the normal range, after last month when they increased by 1.27 million. Although, the actual number came at 1.33 million, beating expectations.

- US Housing Starts – The number of new houses getting started with construction in November was expected to remain unchanged at 1.23 million, same as in October. The number has been on an increasing trend in the last several months and it kept that trend as the housing starts for November came at 1.33 million.

- Theresa May Preparing for No-Deal Brexit? – Theresa May’s Spokesman commented a while ago that the UK Government needs to ramp up no-deal preparations. He said that businesses and the people need to prepare for no-deal Brexit, although leaving with a deal remains the most likely scenario.

Trades in Sight

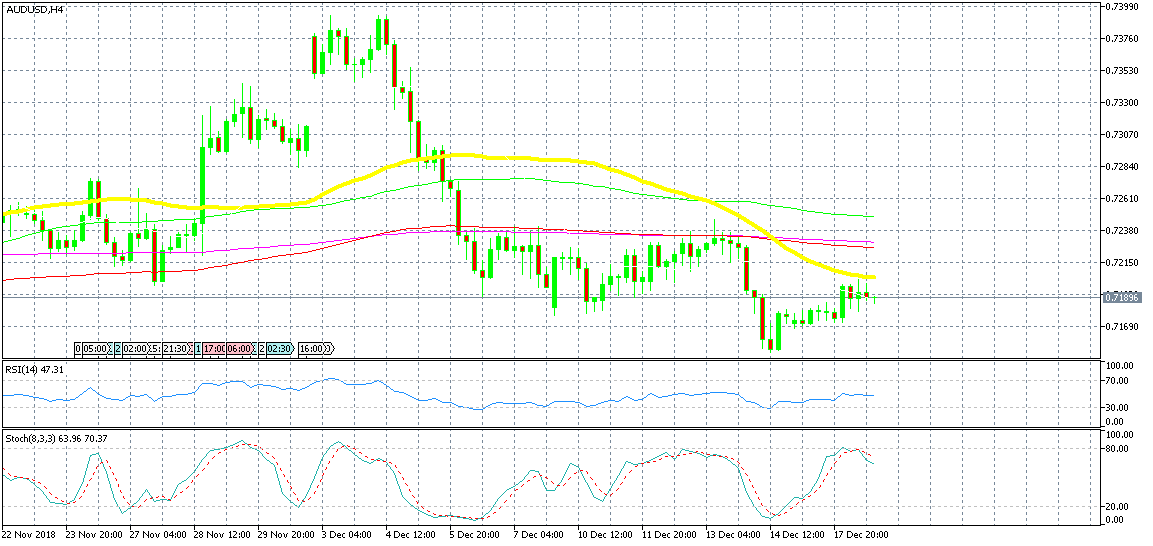

Bearish AUD/USD

- The trend is bearish for AUD/USD

- The retrace higher is complete

- Fundamentals are bearish

- The 50 SMA is providing resistance

The 100 SMA is providing solid resistance

We are already bearish on this pair with a sell forex signal which we opened yesterday. The price moved higher overnight though on the weaker sentiment surrounding the US Dollar, but it has reached the 50 SMA (yellow) on the H4 chart which is providing resistance. Stochastic is also overbought and is turning lower now, which means that the retrace higher is complete. Besides, the fundamentals are bearish for the Aussie as the Chinese economy keeps cooling off. So, let’s see if this pair will resume the bearish trend soon.

In Conclusion

The market is waiting for the FED meeting tomorrow and it is trying to correct itself ahead of that meeting, as well as trying to anticipate the future of the rate hikes. Hence the quick decline of the US Dollar in the last two days. Although, I think that forex traders might be pushing too much ahead of the meeting tomorrow because there are no other currencies to be bullish about apart from the USD. But, this is how forex works, it’s a crowd mentality.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account