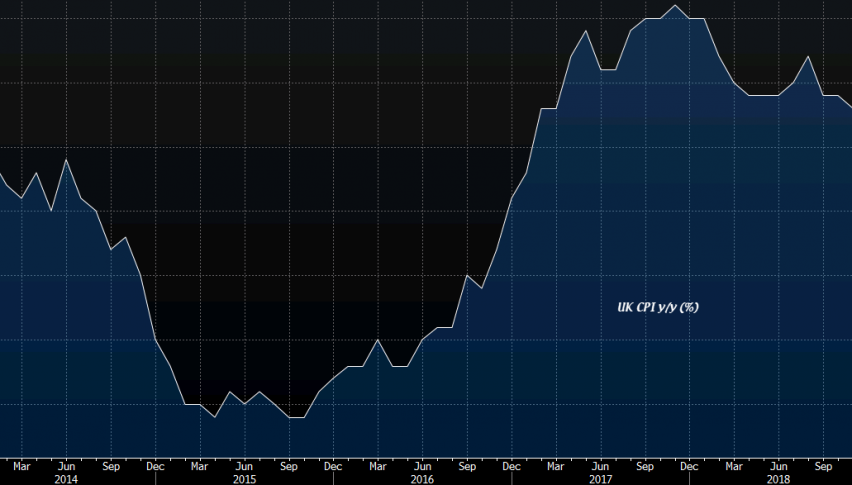

Inflation Cools Off Further in UK

The inflation report from Britain was released a while ago and the numbers were pretty much in line with expectations.

Today is an inflation day for forex traders since we have two major inflation reports being released. The CPI (consumer price index) report from the UK was released a while ago and later in the US session, we have the Canadian CPI report coming out.

Earlier on the German PPI (producer price index) was also released and it grew by 0.1% while expectations were for a 0.1% decline. In Britain, inflation was expected to tick lower in November and it did, but let me just list all the numbers from the inflation report below.

| CPI YoY | 2.3% | 2.3% | 2.4% |

| Core CPI YoY | 1.8% | 1.8% | 1.9% |

| CPI MoM | 0.2% | 0.2% | 0.1% |

| PPI Input YoY | 5.6% | 4.6% | 10.3% |

| PPI Input MoM | -2.3% | -2.9% | -0.8% |

| PPI Output YoY | 3.1% | 2.9% | 3.3% |

| PPI Output YoY | 0.2% | -0.1% | 0.3% |

| RPI YoY | 3.2% | 3.2% | 3.3% |

| HPI YoY | 2.7% | 3.3% | 3.0% |

As you can see from the table above, which is the best I could put together, most of the important numbers are in line with expectations. What stands out are the HPI YoY (house price index) which cooled off in November. That’s a good thing though since the housing market in Britain has been suffering from high demand and thus the pretty quick rise in house prices, especially in the Southeast, near London.

The PPI (producer price index) input declined by a massive 2.3% which is the first decline since March. Although, that’s smaller than expectation of a 2.9% decline. But these are not the most important inflation figures, so the GBP is little changed from this report.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account