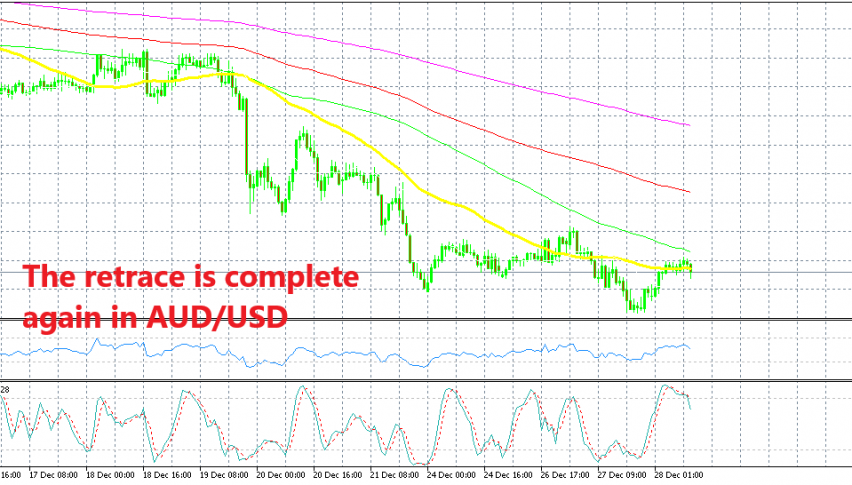

Yesterday, we opened a sell forex signal in AUD/USD. This forex pair had been retracing higher on the H1 chart and it reached the 50 SMA (yellow) which provided resistance and eventually reversed the price lower despite being pierced for a few hours.

The price action was strange as you would expect at this time of the year because EUR/USD was climbing higher together with GBP/USD when AUD/USD reversed lower. But, this pair continued to push lower even though EUR/USD closed the day higher.

So, we got our pips from that signal and today we thought to give it another try, given the chart setup. The chart setup looks pretty much the same as yesterday. AUD/USD has retraced higher overnight and it has pierced the 50 SMA once again.

Although, the retrace higher looks exhausted now because the stochastic indicator is overbought and the candlesticks point to a bearish reversal soon. The previous two candlesticks have formed two dojis which are reversing signals after the bullish retrace. So, we are again in this trade and it seems like the reverse is already underway.

It’s a great trade idea sir,

i am one of your follower.

Thanks for this analysis.

Thanks, it’s our job. The retrace stretched further above though, but it started reversing on Friday aftrenoon and will likely resume the downtrend on Monday.