US Session Forex Brief, Jan 2 – Manufacturing Remains Weak in the Eurozone

Manufacturing has been the main data today and the numbers form the Eurozone showed that this sector still remains weak.

Today is the first trading day of 2019 and we’ve already seen quite some volatility in the financial markets. Stock markets ended the old year on the right footing during the last few days as they closed near last week’s high. They opened with a small bullish gap and pushed higher in the first hour of trading, but they reversed lower, making it seem like they will resume the bearish trend again.

The USD was feeling pretty weak in the last few days of trading in 2018 as forex traders adjusted and closed some of the long term positions from last year. The USD has been in strong demand the entire year so it made sense to see it close the year on a bearish footing. The Buck got sold again today during the Asian session, but it started reversing early in the European session and it has gained more than 100 pips against most major currencies today, so the Buck seems to back on its feet now.

Although, the USD is still down against safe haven assets. USD/JPY lost around 100 pips today and GOLD continues to surge higher, gaining around $10 from the bottom to the top today. So, the market sentiment still remains negative in financial markets and the decline in stocks confirms it.

The main economic data today were the manufacturing reports from the UK and the Eurozone. The decline in the manufacturing PMI reports from the Eurozone stopped in December, but this sector remains in a pretty weak spot. In the UK, manufacturing jumped higher in December, but that was due to stockpiling before the Brexit deadline. Anyway, let’s have a look at the numbers.

The European Session

- Spanish Manufacturing PMI – The manufacturing PMI from Spain has been on a declining trend during the last several months, although the number for November posted a small jump which was encouraging. But, it was expected to decline again in December from 52.6 points to 52.4 points. Although, it missed expectations and came at 51.1 points. That is the weakest reading since August 2016.

- Italian Manufacturing PMI – The manufacturing PMI from Italy has been below 50 points for two months which shows a contraction. Manufacturing was expected to cool off further today, from 48.6 points in November to 48.5 in December. But, today’s report showed a jump to 49.2 points. That’s good, but it still remains below 50 points which still means contraction.

- French Final Manufacturing PMI – Manufacturing has been on a declining trend in France as well. The first reading of the manufacturing PMI in France came at 50.7 points, but the final reading for December which was released today fell to 49.7 points. That is the first contraction since September 2016 but the surveying firm Markit said that the yellow vests protests in France during December might have had some impact on the production.

- German Final Manufacturing PMI – The final reading for the German manufacturing PMI in December came as expected at 51.5 points. Although, as is the case with the other European countries, the manufacturing trend is negative and it might as well fall into contraction soon.

- Eurozone Final Manufacturing PMI – The first reading for the Eurozone manufacturing PMI jumped a little higher early in December to 51.8 points from 5.5 points previously. Although, the final reading for December which was released today was expected to cool off to 51.4 points again and it came exactly as expected. I bet the European Central Bank is taking notice of this and this should be negative for the Euro in the months to come if the trend continues to be bearish.

- UK Manufacturing PMI – The UK manufacturing PMI for November was revised higher today to 53. 6 points from 53.1 points previously. Today’s number which was for December was expected to cool off to 52.5 points, but it jumped unexpectedly higher to 54.2 points. Although, the surveying firm Markit said that this was due to some stockpiling before a possible hard Brexit.

- UK PM May Bring the Brexit Deal to the Parliament Again – The UK Foreign Secretary said earlier today that Theresa May will find a way to bring the Breit deal back to the British Parliament for a vote. He added that a second national Breit vote would be very damaging for the UK.

The US Session

- US Government Shutdown Continues – The US Government shut down late last month. The Congress is set to be meeting today but the main issue on the agenda is the Democrat takeover of the Senate which will happen tomorrow. This shouldn’t be a good thing for the US Dollar, but right now the Buck is still surging.

- Canadian Manufacturing PMI – The Canadian manufacturing PMI report has showed a bearish trend for this sector during the past months, but the number for November showed a sudden jump higher from 53.9 point previously to 54.9 points. Although, today’s number which were for December turned bearish again coming at 53.6 points.

- US Final Manufacturing PMI – The US Manufacturing PMI has been holding steady in the last several months more or less. Although, today it is expected to decline to 53.9 points from 55.3 points previously.

- NZD Global Dairy Price Index – The dairy price index had been mostly negative since the middle of June. Although, it turned positive in the previous two weeks. There are no estimates for this indicator since it is an auction, but let’s hope we see another positive number today.

Trades in Sight

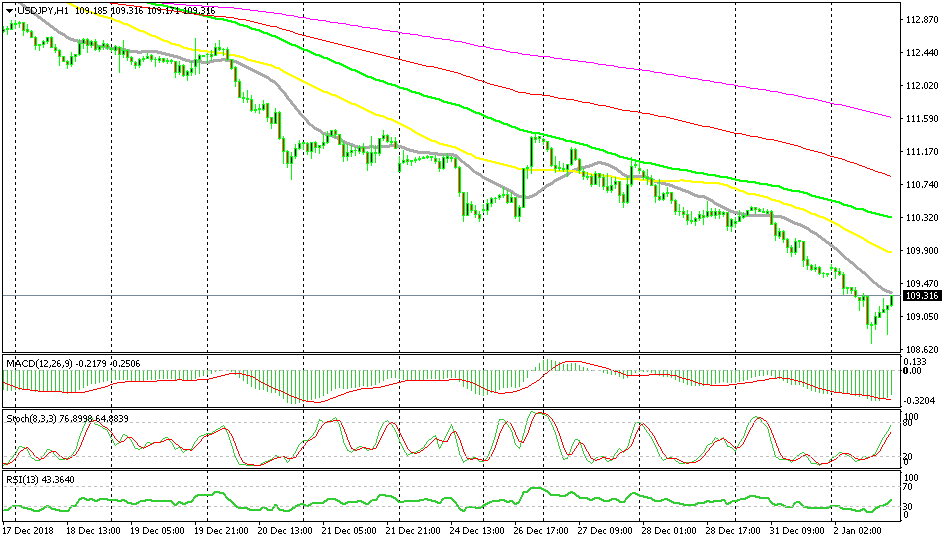

Bearish USD/JPY

- The trend has been bearish for weeks

- The retrace higher is complete

- The 20 SMA provided resistance

- The bearish trend has picked up pace

The 20 SMA (grey) is providing resistance

A while ago we went short on USD/JPY. The market sentiment has turned negative again today which has sent the JPY higher. This forex pair has been on a bearish trend in the last few weeks and the trend has picked up pace as the pair slips lower. It broke below 109 earlier today but it has been retracing higher in the last several hours. Although, the retrace seems to be almost complete now as the stochastic indicator nears the overbought area while the 20 SMA is providing resistance at the top side.

In Conclusion

The market sentiment continues to be negative today and we are seeing some large moves once again. Although the US Dollar has found its right footing and is surging higher, don’t count too much on it because the markets are still thin on liquidity until next week when all forex traders come back from the Christmas break.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account