US Session Forex Brief, Jan 15 – Markets Seem Nervous Ahead of the Brexit Vote

The Brexit vote and Draghi's speech are approaching and he markets seem confused right now.

Today is the vote on Theresa May’s Brexit deal in the British Parliament. I would have expected a heated debate since early morning today, but I suppose everything has been said and now we just have to wait for the vote. Sure there will be more debates as the day progresses, but there’s not much to say anymore. It’s either that the British Parliament accepts the deal and the UK goes ahead with leaving the EU in an orderly manner, or they reject it, which seems like a more likely outcome.

This seemed to be the case until a few days ago, but things have become more complicated for GBP traders now. If the British Parliament decided to vote the deal off, then new options have arisen.

The German Foreign Minister Heiko Maas commented a while ago saying that if the Brexit deal is rejected today, there might be new talks with the EU; that’s one option. Then, we have the option of Britain heading towards new general elections as the Labour leader Jeremy Corbyn has suggested in the previous days. If they win, it is probable that they call another Brexit referendum. Finally, there is the possibility of Britain crashing out of the EU without a deal. Hence, the volatility and the strange price action in GBP pairs.

The other currencies as well as stocks and commodities are also behaving strange today, which suggests that traders are uncertain what direction to take today.

In the Asian session, the market sentiment turned positive and stock markets made a bullish reversal, while safe havens such as Gold and the JPY lost around 50 pips. But, the sentiment turned negative again during the European session and USD/JPY has turned lower again while Gold has climbed higher in the last few hours.

The European Session

- French and Spanish CPI – The consumer price index reports which show inflation for December in Spain and France were released early this morning. The French CPI remained flat that month at 0.0% as expected, while the year-on-year CPI also remained unchanged at 1.6%. The Spanish CPI declined by 0.4% that month as expected, while the YoY number came at 1.2%.

- Rejecting the Deal Today Damages Democracy for Gove – UK Environment Minister Michael Gove has been one of the main Brexiteers together with Boris Johnson and a few others who made Brexit possible in the first place. Today he is saying that a defeat for May’s Brexit plan would be damaging for the democracy. He added that there is a danger of a no-deal Brexit or no Brexit at all and a no-deal Brexit will see short-term economic damage. Seems like he has shifted positions. Perhaps it has to do with the new job as Environment Minister.

- Merkel Has Given No Extra Assurances on Brexit – There was an article in The Sun this morning suggesting that Theresa May has apparently said that the German leader suggested the EU could grant extra concessions once the troubled agreement is voted down. That proves to be wrong as the German Government spokesperson came out saying that the newspaper has reported the contents of the phone call between Merkel and May wrongly. The spokesperson also says that there were no assurances made by Merkel on Brexit beyond what was discussed at the EU Summit back in December.

- German GDP – The German GDP report was published this morning showing that the German economy grew at 1.5% in 2018 and 2.2% in 2017. This is the weakest reading since 2013. The report notes that the slowdown in both exports and imports growth relative to 2017 confirms the weakness in export demand towards German goods and also highlights that domestic demand isn’t nearly as robust to single-handedly prop up the economy.

- North Ireland DUP Party to Reject Breit Deal – The leader of the DUP Party tweeted earlier saying that her Party won’t vote the deal, not that we didn’t already know that. Here is the tweet: “Tonight will be historic but for the wrong reasons. We will oppose the toxic backstop & vote against the WA. It’s time for a sensible deal which governs our exit from the EU & supports all parts of the UK.”

- Eurozone Trade Balance – The trade balance has been shrinking in Europe falling to 12. billion Euros in October. Although, that was revised higher today to 13.5 billion. Today’s report which is for November was expected at 13.2 billion, but instead increased to 15.1 billion.

- Germany’s Maas Leaves A Window Open For Britain – German Foreign Minister Heiko Maas came out this morning saying that if the Brexit deal is rejected today, there could be new talks with the EU. Although, he is not giving up hope that there will be a positive vote later today.

- UK Govt Is Not Discussing Extending Article 50 – The spokesman of the UK Prime Minister May made these comments a while ago. He added that there was discussion on process before, during and after the vote and that there are ongoing discussions between May and DUP on Brexit deal vote.

The US Session

- DUP’s Foster Commenting Again – Arlene Foster is back up with more comments confirming that they will not vote the Brexit deal. Although she adds that they will continue to talk to May, they are not in favour of extending Article 50.

- US PPI Inflation – US producer price index missed expectations falling by 0.2% in December against -0.1% expected.Core PPI also declined in December by 0.1%. Core YoY CPI also missed expectations coming at 2.7% against 3.0% expected. Although, it ticked higher from 2.6% in last month’s reading. This decline in producer price inflation can be attributed to falling Oil prices, so nothing to be worried about. Although, the FED might mention this in the coming meetings.

- US Empire State Manufacturing Index – This index has been on a steady trend, holding above 20 points for many months. Although we saw it slash in half in December when it came at 10.9 points against 20.1 points expected. Today, this index was expected to grow slightly to 11.6 points but it declined further to 3.9 points. This might actually be a problem in months to come.

- ECB President Draghi Speaks – The ECB President Mario Draghi is due to testify on the ECB’s 2017 Annual Report before the European Parliament, in Strasbourg. The economy of the Eurozone has shown great signs of weakness recently, with industrial production taking a deep dive in November. The ECB has been pointing at next September for the first rate hike, but now that is not so certain. The odds for a rate hike by September 2019 have declined dramatically so let’s see what he has to say today.

Trades in Sight

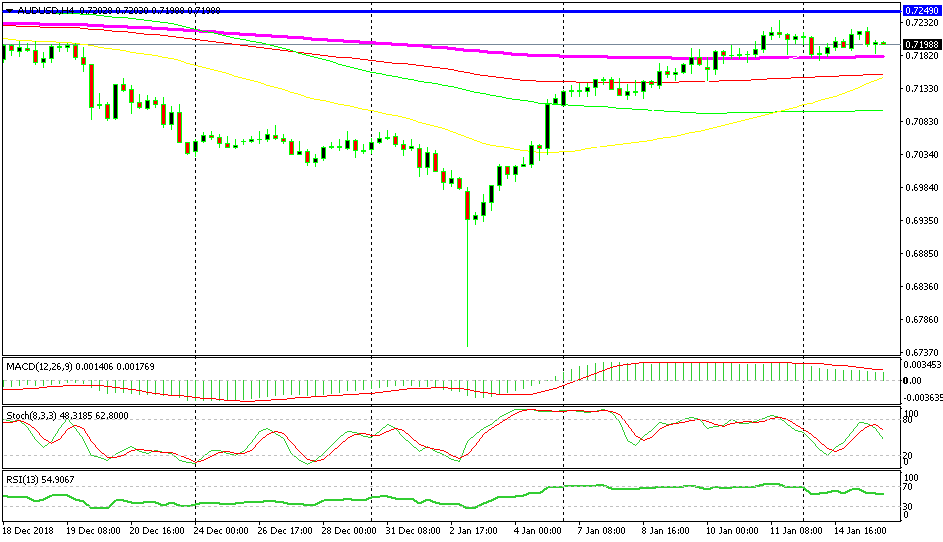

Bearish [[AUD/USD]]

- The trend is bullish

- The retrace lower is complete

- The 200 SMA is providing support, again

AUD/USD finding support at the 200 SMA

Yesterday we missed the chance to go long on this pair from the 200 SMA (purple) and make some good pips. The picture looks pretty similar again today, although we already went long on NZD/USD. So, AUD/USD has been on a bullish trend since the crash on January 2nd. It has broken above all moving averages during this time on the H4 chart and the last moving average, the 200 SMA (purple), has now turned into support. Stochastic is oversold which means that the retrace lower is complete. So, the chart setup looks set for a bullish continuation.

In Conclusion

Markets are still uncertain what to do now as the time of the Brexit vote which is scheduled for 20:00 GMT approaches. There’s also the ECB President Mario Draghi coming up in less than an hour, speaking in Strasbourg at the European Parliament, so brace for some more volatility as the US session gets underway, guys.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account