Mixed Inflation Figures From the UK

Inflation report was released a while ago in Britain, but the impact was minimal due to Brexit.

•

Last updated: Wednesday, January 16, 2019

The inflation report from the UK was released a while ago. The Bank of England Chairman was holding a speech meanwhile. Not much was expected from his speech today, being where we are with Brexit, and he did leave it all to Brexit. Let’s have a look at the inflation figures though:

| UK Data | Actual | Expected | Previous |

| CPI MoM | 0.2% | 0.2% | 0.2% |

| CPI YoY | 2.1% | 2.1% | 2.3% |

| CPI Core YoY | 1.9% | 1.8% | 1.8% |

| HPI YoY | 2.8% | 3.0% | 2.7% |

| RPI MoM | 0.4% | 0.5% | 0.4% |

| RPI YoY | 2.7% | 2.9% | 3.2% |

| PPI Input MoM | -1.0% | -1.5% | -2.3% |

| PPI Input YoY | 3.7% | 3.7% | 3.8% |

| PPI Output MoM | -0.3% | 0.1% | 0.2% |

| PPI Output YoY | 3.1% | 2.9% | 3.1% |

As you can see, PPI (producer price index) input and output declined and that is due to falling Oil prices. Crude Oil has made a pullback higher in the lat several weeks, but that will take some time to reflect in producer prices.

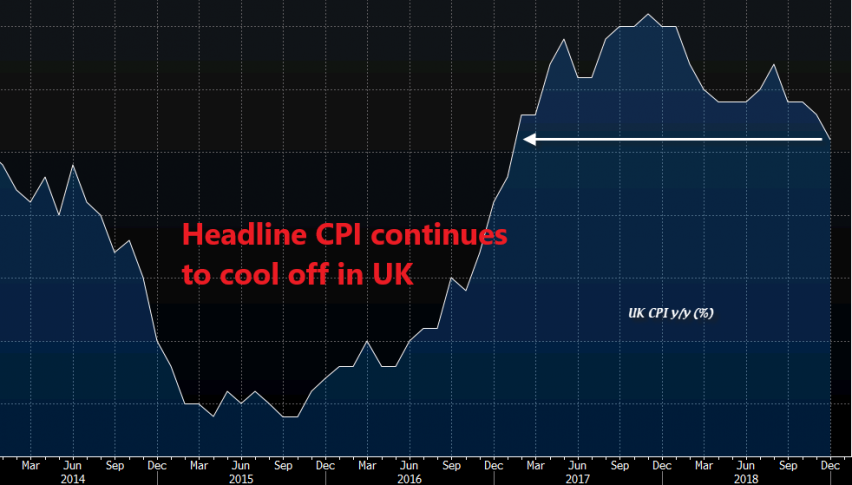

Headline inflation falls again to 2.1% from 2.3% previously, but core inflation ticked higher to 1.9% from 1.8% previously, beating expectations as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.