US Session Forex Brief, Feb 1 – Trading Manufacturing, Inflation and Employment Today

Manufacturing activity has slowed across the globe as today's manufacturing PMI reports showed.

Today is the first day of the month when major economies publish their manufacturing reports for the previous month. During the Asian session, we had the Japanese and the Chinese manufacturing figures being released, while in the European session the inflation report from Europe came out, as well as inflation figures. Later on, we will get to see how the manufacturing sector has been performing in the US, but before that, the US employment and earnings figures will be released.

Final manufacturing PMI from Japan stood at 50.0 points last month in Japan which means that this sector fell flat. Although, this indicator increased slightly to 50.3 points, so hopefully this sector will pick up in Japan.

Chinese manufacturing PMI came at 49.7 points last month, showing that this sector is contracting. Today, this indicator was expected to cool off further to 49.5 points, but it came at 48.3 points. So, the Chinese manufacturing sector is feeling the pressure of US trade tariffs. AUD/USD lost around 40 pips during early Asian session but has recuperated in the European session. Although, if manufacturing continues to weaken in China, it will eventually send the Aussie tumbling.

In Europe, the UK manufacturing PMI missed expectations which sent the GBP 70 pips lower, although it remains in expansion. Not so in Germany and Italy where manufacturing fell deeper into contraction, especially in Italy. At least, manufacturing increased in Spain and remained unchanged in France, which left the Eurozone manufacturing PMI unchanged.

The headline inflation from the Eurozone slipped lower again, losing another two points in January after the decline we saw in December. But core inflation ticked higher which takes some pressure off the European Central Bank. Later in the US session we have the US employment report which includes earnings and the unemployment rate and after that, the US manufacturing figures will be released.

- Swiss December Retail Sales – Retail sales turned negative in November in Switzerland declining by 0.5%. Today’s report which is for November was expected to show a 0.1% increase in sales, but instead, they declined again, this time by 0.3%.

- Spanish Manufacturing PMI – Unlike in the rest of the developed world where the economy is weakening, we have seen some improving economic numbers from Spain recently. Manufacturing PMI was expected to decline from 51.1 points previously to 50.5 in January. But, this indicator beat expectations, increasing to 52.4 points.

- Italian Manufacturing PMI – Manufacturing fell into contraction in Italy since October and it has only been getting worse. Manufacturing PMI was expected to decline further for January to 49.0 points from 49.2 points previously, but it declined further to 47.8 points.

- German Manufacturing PMI – The manufacturing sector fell into contraction in Germany in December as this indicator declined to 49.9 points. Today’s report which was for January was expected to remain unchanged but it showed another decline to 49.7 points.

- Eurozone Manufacturing PMI – Final manufacturing PMI has been on a declining trend in the Eurozone as well in recent months. Last month it fell to 50.5 points which is close to contraction. Today, expectations were that it would remain unchanged and so it did, coming at 50.5 points.

- UK Manufacturing PMI – Last month we saw a surprising jump in manufacturing activity for December and the number for November was revised higher as well. Today, manufacturing PMI was expected to cool off to 53.5 points form 54.2 previously, but it missed expectations coming at 52.8 points which sent the GBP 70 pips lower.

- Eurozone CPI Inflation – The consumer price index declined to 1.6% in December in the Eurozone, from 1.8% in November. Today’s number which was for January was expected to lose another two points and it did, coming at 1.4%. Although, core inflation ticked higher from 1.0% to 1.1%, which saved the ECB this time.

- UK Still Wants to Change the Backstop – Earlier this morning the Irish Minister of European Affairs said that the Brexit deal cannot be reopened. The Irish government and European Union are clear on the matter he added and technology is not the answer to resolve Irish border issue. But, the UK PM spokesman James Slack said that the UK is looking at options to secure a change in the backstop. He expects to discuss those with the EU shortly, o the game of chicken continues. Who will back up first?

The US Session

- US Average Hourly Earnings – US average hourly earnings broke out of the 0.2% range in December, increasing by 0.4%. Today, earnings are expected to come at 0.3%, which is a slowdown in the pace but that would still be a satisfactory pace of growth.

- US Non-Farm Employment Change – Non-farm employment change surprised everyone last month showing a 312k increase in jobs during December. Today’s report which will be for January is expected to fall back in the range though at 165k new jobs.

- US Unemployment Rate – The unemployment rate jumped 2 points higher last month to 3.9% from 3.7% previously. Although, that was attributed to the 2 point increase in the participation rate. Today, the unemployment rate is expected to remain unchanged at 3.9% but I have the feeling that we might see a decline, especially if the participation rate falls.

- Canadian Manufacturing PMI – The manufacturing activity has been on a slowing trend in Canada as well as in other developed countries. Last month it declined from 54.9 points to 53.6 points. There are no estimates for this month.

- US Manufacturing PMI – US manufacturing activity cooled off quite a lot in December as last month’s number came at 54.1 points, down from 59.3 points in November. Today, this indicator is expected to remain unchanged at 54.1 points again.

Trades in Sight

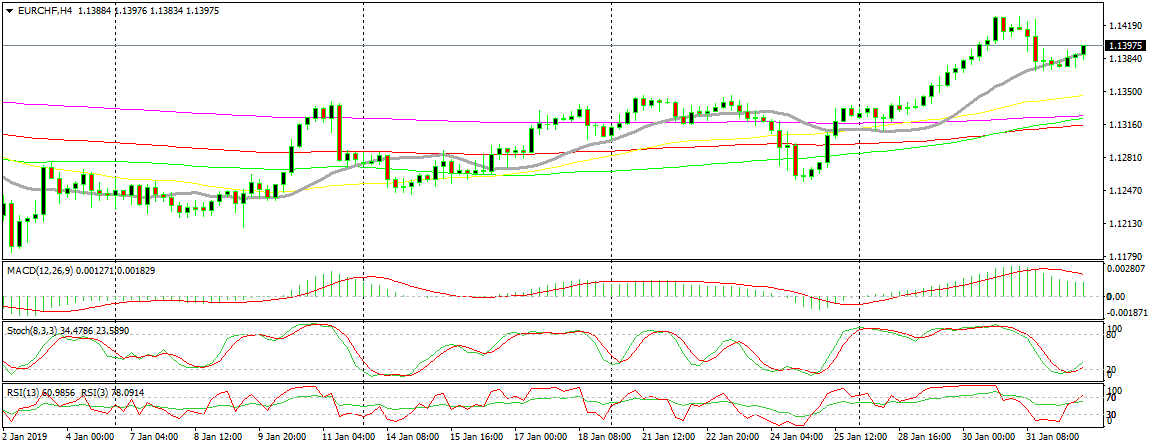

Bullish EUR/CHF

- The trend has been bullish for a few weeks

- The retrace lower was complete

- The 20 SMA provided support

EUR/CHF resumes the bullish trend after refreshing lower

EUR/CHF has been on a bullish trend for a few weeks as we pointed it out yesterday. Although, it decided to retrace lower in the last two days and today the retrace seemed complete on the H4 chart. The stochastic indicator was oversold and it is now turning higher, while the 20 SMA (grey) was providing support. We also saw a couple of H4 doji candlesticks which are a reversing signal and now this pair is reversing back up.

In Conclusion

The market is waiting on the employment and earnings report from the US which will be released in a minute. Last month. we saw a major surprise from the new jobs report and the average hourly earnings, which was followed by increased volatility in the USD, so get ready for some more action today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account