US Session Forex Brief, Feb 19 – GBP, Gold and Cryptocurrencies Extend Their Bullish Run

The GBP and Gold continue to climb higher today despite a bullish momentum in the USD.

The major currencies made a bullish reversal against the USD last Friday, but today we see that only the GBP is keeping that momentum going as the rest of majors have turned bearish today. Commodity Dollars turned bearish yesterday and the meeting minutes from the Reserve Bank of Australia gave AUD/USD and the Kiwi another reason to push lower. Now the scenarios between a rate hike and a rate cut are balanced, as opposed to the RBA leaning towards the hawkish side until a couple of weeks ago.

The Euro also turned bearish today after the Vice President of the European Central Bank also sounded sort of dovish. He commented earlier this morning that the ECB won’t take any decision before thorough analysis and the policy will stay accommodative for a long while yet. That means no rate hikes this year and judging by the shape of the Eurozone economy in recent months, we can agree that it doesn’t support a rate hike.

The ZEW economic sentiment from Germany and the Eurozone improved compared to last month, but it still remains negative. That’s a positive sign, but it still couldn’t help the Euro, and I expect it to deteriorate further when the US tariffs on European cars come.

The GBP extended the bullish run today despite comments from the EU that the Brexit agreement and the Irish backstop issue won’t be reopened. Cryptos are also extending their bullish run with Bitcoin heading towards the resistance area around $4,000 and so is Gold, which has finally broken last month’s high at $1,325 and now trading above $1,330.

- Altmaier Thinks Trump Will Forget About Car Tariffs – The German Minister of Economy Pete Altmaier commented earlier that Trump and Juncker agreed that no tariff measures will be taken. As long as negotiations are ongoing, no unilateral tariff measures will be taken. The argument of national security for tariffs is not sustainable and I am convinced Trump will listen to his advisors in the end. Yeah right, let’s see you bet your house on that Altmaier.

- Eurozone Current Account – The Eurozone current account, which is the difference between all imported and exported goods, services, income flows and unilateral transfers, used to range around the €20B range. Although, the numbers for November were revised higher from €20.2B to €22.6B. The report for December was expected to fall closer to the range at €21.4B but came at €16.2B. It’s still positive, right?

- UK Average Earnings Index – The average earnings index 3M/Y grew by 3.4% in November, which is the fastest pace of growth since June 2010. Today’s report which is for December was expected to show a 3.5% growth rate but it remained unchanged at 3.4%. That’s still pretty good despite a weakening economy.

- UK Employment Report – The claimant count change, which displays the number of unemployed people filing for benefits, has missed expectations and it has been increasing in the last several months. It missed expectations once again today but it declined from 20.2k in December to 14.2k in January. The unemployment rate remained unchanged at 4.0% last month as expected, after it declined from 4.1% in the previous month.

- Eurozone and German ZEW Economic Sentiment – The economic sentiment has been deteriorating in the Eurozone as the economy has softened considerably. The sentiment is negative, although it has been improving a little in the last two months. Today, the Eurozone ZEW economic sentiment increased from -20.9 points to -16.6 points, beating expectations. The German ZEW sentiment also beat expectations as it went from -15.0 points to -13.4 points.

- UK Parliament will take Control if May Cannot Pass a Deal – These were the opening words from UK’s Junior Business Minister, Richard Harrington. He added that he does not believe there will be a no-deal Brexit, but if so, emergency action would be needed, including BOE stimulus.

The US Session

- May-Juncker Meeting Tomorrow is Significant – Comments from the PM spokesman James Slack. May will seek legally-binding changes to backstop in the meeting with Juncker. The government is still working on alternative arrangements for backstop. The UK is still looking to reopen the withdrawal agreement, but the Cabinet has discussed no-deal Brexit planning. Well, the EU repeated again today for the millionth time that they won’t reopen the deal, but let’s wait and watch.

- FED’s Mester Still Sounds Hawkish on Rate Hikes – FED member Mester expects Fed funds may move ‘a bit higher’ if the economy performs as she expects. The most likely scenario is that economic growth will slow this year, job growth will slow, and inflation will stay near 2%, The Fed is not far behind or ahead of the curve and can gather information on economy before adjusting rate policy. Although, the reduction in balance sheet is likely putting pressure on longer-term interest rates

- GDT Price Index – It’s that time of the month again when the global dairy auction takes place. Dairy prices have been increasing in the last several auctions after declining for many months prior to that. There are no expectations for it since it is an auction, but keep an eye on it if you are trading the NZD.

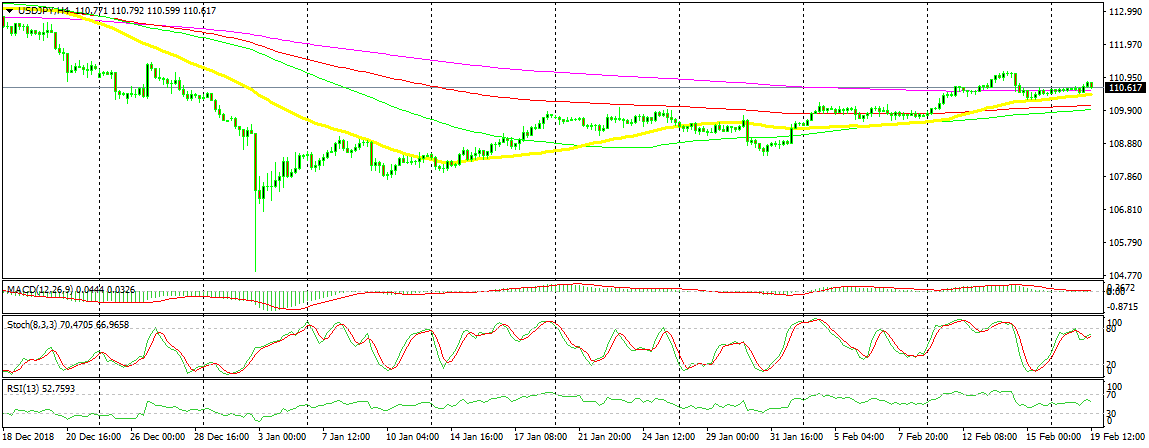

Bearish USD/JPY

- The trend has been bullish for two months

- Fundamentals point up

- The 50 SMA is providing support on the H1 chart

The 50 SMA is holding the uptrend in place for USD/JPY

USD/JPY has shifted to a bullish trend this year after declining for around 10 cents late in 2018. The price has broken all moving averages on the H4 chart and the 50 SMA (yellow) has been providing support to this pair and pushing the trend higher. Now this pair is in the middle of a bullish move, but it I am thinking of going long on it if I see a retrace lower to the 50 SMA.

In Conclusion

The US Dollar was climbing higher earlier today during the European session, but it has now retraced lower in the last couple of hours. This looks like a good opportunity to go long on the USD, probably against the Euro, the AUD and the JPY, but I will wait until the pullback is complete before pulling the trigger.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account