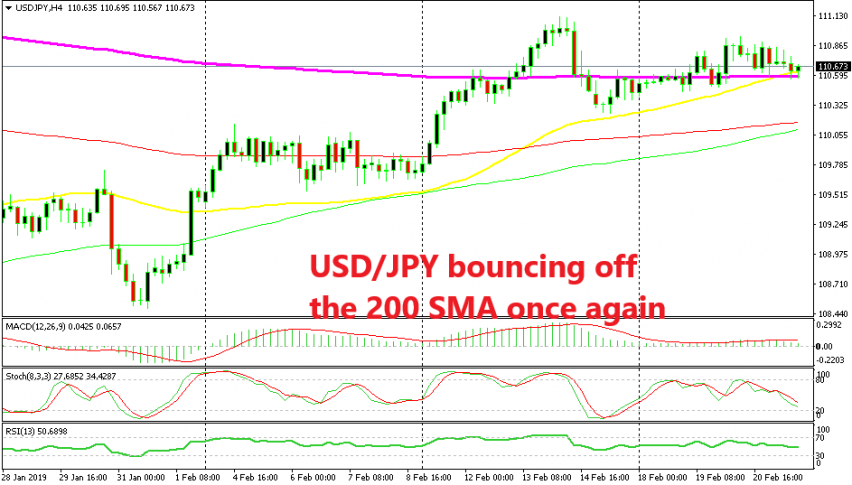

USD/JPY Still Finding Solid Support at the 200 SMA

USD/JPY has been on an uptrend since January 2 and it seems that this trend will resume again soon after a consolidation

[[USD/JPY]] has been on a bullish trend since the first trading day of this year when it crashed nearly 5 cents lower an extremely thin liquidity. The uptrend has been very consistent during this period as the price pushes higher, refreshes lower for a session or two and then resumes the uptrend.

The 200 SMA (purple) provided some resistance last week and again at the beginning of this week as the price dipped back below it. Although, it seems like this moving average has turned into solid support now since it has been holding the declines during most of this week.

We decided to go long on USD/JPY above this moving average earlier today. The stochastic indicator is nearly oversold on the H4 time-frame, which means that the retrace lower is almost complete. The 50 SMA (yellow) has caught up with the price now and that’s supposed to add some more strength to this support area, so it seems that the uptrend is about to resume again soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account