US Session Forex Brief, Feb 22 – Traders Preparing for Next Week as this Week Heads Towards the Close

The European session has been pretty quiet despite some important data releases, but watch the US session as central bankers speak

The financial markets have been pretty quiet once again today, trading in a tight range. The stock markets are sort of bullish as they crawl higher, but only slightly. The uptrend continues in indices and they have made some new highs for the year today with S&P500 leading the way. This morning we had the Ifo and ECB’s Ewald Nowotny repeat that the German economy is expected to remain weak and growth will likely be revised down after the the decline in the business climate in Germany. But, that didn’t hurt stock markets which keep creeping higher. Donald Trump is loving this as he measures the success of his administration on stock markets.

We had a number of economic releases this morning from the Eurozone, with the German Ifo business climate indicator declining for another month and missing expectations. The GDP for Q4 remained flat as well in Germany which is not a good signal after the 0.2% contraction we saw in Q3. Inflation remained unchanged in the Eurozone at 1.4%, while core CPI (consumer price index) remained at 1.1%. Although, inflation declined by 1.0% in January. The mess continues in Britain as more MPs threaten to leave the two major parties which increases the uncertainty for the GBP, hence the decline today.

- German Final GDP QoQ – The German final reading for the Q4 GDP of 2018 was expected to remain flat and it came at 0.0% as expected. At least, it’s better than the Q3 GDP which shrank by 0.2%. Non-adjusted YoY GDP came at 0.9%, while GDP adjusted to working hours came at 0.6%. Although, capital investment grew by 0.9% in Q4 against 0.7% expected and private consumption came at 0.2% against 0.1% expected, so this report is not that bad after all.

- German Ifo Business Climate – The business climate has been worsening in Germany as well as in the whole of the Eurozone after it peaked at around 117 points at the end of last year and in the beginning of this one. In January, the business climate indicator fell below the 100 level for the first time in a long period and today, it was expected to decline again to 99 points, although it missed expectations coming at 98.5 points.

- CPI Eurozone Inflation – Inflation has been softening in Europe after it peaked at 2.2% in October as Oil prices were still climbing back then. But, it slipped to 1.4% in November and December, but the declining trend stopped in January as today’s report showed. The headline YoY CPI came at 1.4% as expected and so did core CPI coming at 1.1%. Although, monthly inflation for January declined by 1.0%.

- More British MPs Leaving the Establishment Parties – Ian Austin is the latest lawmaker to quit the Labour Party, bringing the number to 9 so far from Labour and 3 from the Conservatives. Right now these numbers don’t affect the Brexit vote if there is one soon, but the ITV reported that more MPs are to follow, which could break the UK political scene for good.

- ECB’s Nowotny Speaks – Ewald Nowotny was speaking again earlier today saying that German growth expectations are likely to be revised down. He added later that the ECB will not necessarily resume the asset purchase program. If lending weakens, special measures could make sense. ECB should consider how far to stray away from expectations, said Nowotny, since he sees discrepancy between central bank guidance and market expectations.

- Irish Foreign Minister Speaking – Ireland’s Simon Coveney commented a while ago saying that the EU is working with UK to give reassurance on backstop. The assurance is that if the backstop is used, it would only be temporary. That’s as much assurance as the EU is going to give to the UK, no legal assurances in written.

The US Session

- Canadian Retail Sales – Core retail sales for December came as expected, declining by 0.5%, which is the third decline in the last five months. The other two months when core sales didn’t decline also missed expectations coming at 0.0% and 0.1%, so it feels more like five months in a row with falling sales. Headline retail sales were expected to remain flat in December after declining by 0.9% in November, but they missed expectations for another month, coming at -0.1%. Previous core retail sales which exclude autos was revised lower to -0.7% from -0.6% previously. Retail sales at electronics and appliance stores decreased by 4.0% in December following a 2.1% gain in November. It seems that Black Friday had some positive impact on electronics sales, but that has reversed in December and we are seeing a 4% decline which is huge.

- EU Threatens Retaliation if US Impose Tariffs on Autos – Bloomberg reported a while ago that the EU officials are planning to retaliate if the US administration hits the EU with car tariffs. The first three names proposed are Caterpillar, Xerox and Samsonite. The USD lost around 20 pips immediately after the news hit the wires.

- Belgian NBB Business Climate – The NBB business climate indicator for Belgium as well as for the rest of the Eurozone has been declining in the last several months, turning negative and today it is expected to decline further today. This indicator is expected to fall to -2.0 points against -1.5 points previously. It beat expectations but it still declined to -1.7 points.

- ECB President Draghi Speaks – The ECB President Mario Draghi is due to speak as he accepts an honorary degree from the University of Bologna. I don’t know what his prepared speech will be, but I suppose there will be questions from the audience, so it will be worth watching.

- FED Speakers to Fill US Session – Today we have a number of FED members holding speeches later in the afternoon. It starts with the Federal Reserve Bank of New York President John Williams speaking in a while, followed by Clarida, Bullard and Quarles, and for Williams to finish it off as he speaks again in the evening.

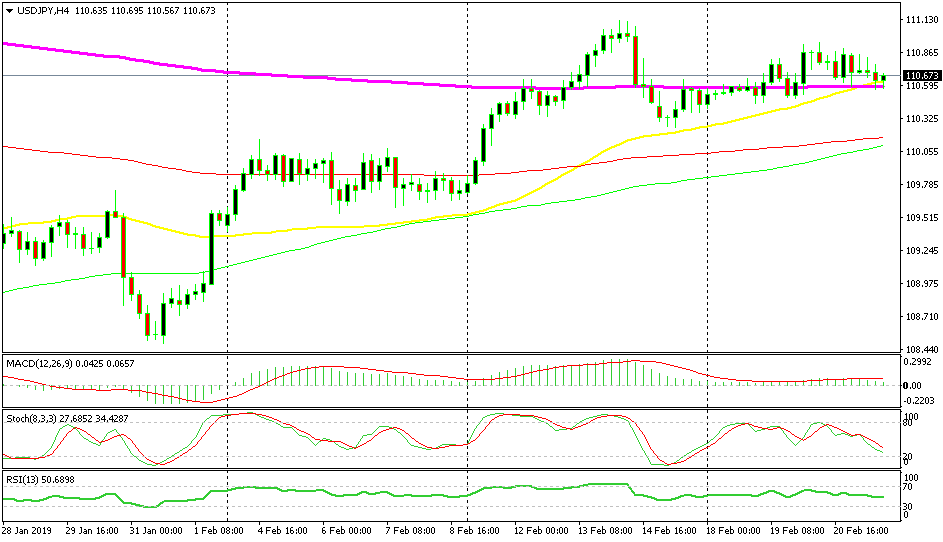

Bullish USD/JPY

- The trend has been bullish for two months

- We’re seeing another pullback today

- The 200 SMA has providing support on the H4 chart

The 200 SMA is holding well in USD/JPY

Just a while ago we closed our buy forex signal in USD/JPY as this pair bounced off the 200 SMA (purple) on the H4 chart. This moving average has been providing solid support during the second part of this week and the 50 SMA (yellow) has caught up as well and it is adding strength to the support. But, the USD lost around 20 pips after the Bloomberg announced a numbr of US companies to be targeted for retaliation on US Auto tariffs which has brought the price back down here again. I am thinking of going long again if the price touches the 200 SMA soon.

In Conclusion

The inflation report from the Eurozone and the retail sales from Canada didn’t have much impact today on the respective currencies and the markets have been trading in tight ranges. But, we have a number of central bankers speaking in the afternoon with ECB’s Mario Draghi coming up in about an hour and four FED members also holding speeches, so keep an eye on them. Although, we will cover Mario Draghi’s speech live and the others’ on our economic calendar.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account