Buying the Pullback in EUR/CHF Again at the Same Level Today

EUR/CHF turned bullish yesterday, but it has returned back where it was during the night, so we decided to buy it once again.

If you follow our forex signals you would have noticed the buy signal in EUR/CHF. We bought this pair about a week ago and after bouncing up and down for about a week, this pair finally made a bullish move yesterday as EUR/USD decided to break its own range and head to 1.14.

But, the sentiment deteriorated during the Asian session as Pakistan shot two Indian military aircrafts down last night, increasing demand for safe havens and sending EUR/CHF lower. Now, this pair is back where it was when we opened the first signal, so we decided to try the upside again from here.

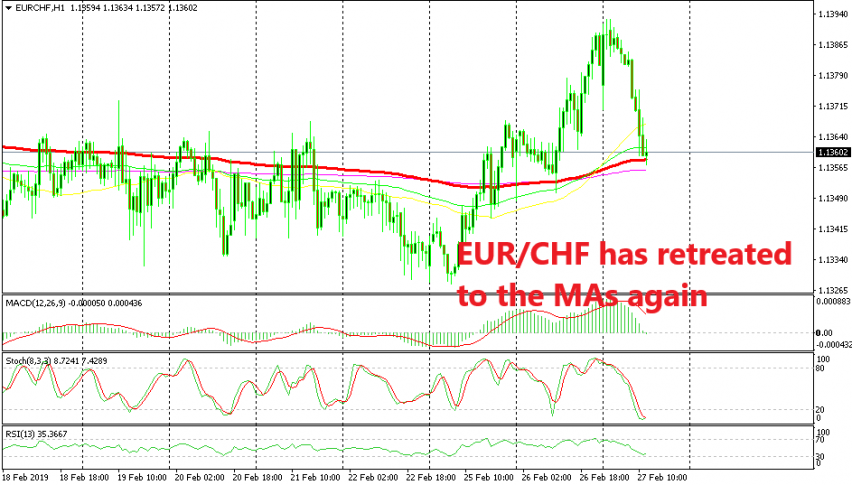

You could ask why we didn’t wait longer and buy at the bottom of the previous range at around 1.1330s. But, that range has now been broken and the top of it, which was at 1.1360-70, should turn into support now. EUR/CHF is already oversold on the H1 time-frame, as you can see from the chart above. Besides that, the moving averages are all standing around here now and they should provide some support to this pair.

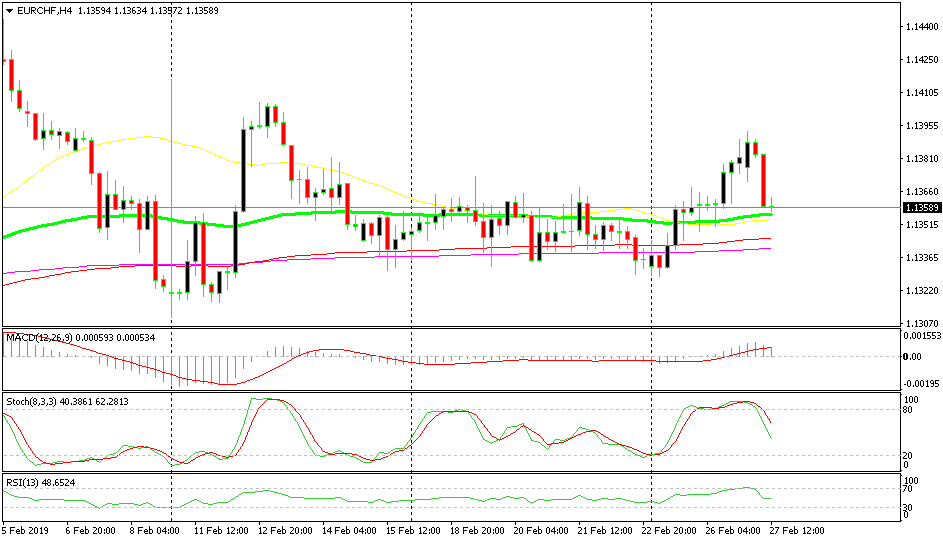

The 50 and 100 SMAs are providing support on the H4 chart

Shifting to the H4 time-frame, we see that the 50 SMA (yellow) and the 100 SMA (green) are providing support on this chart. The stochastic indicator is not oversold yet, but the run for safe havens has stopped now, so a reverse might be underway soon if there are no more plane shootings.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account