US Session Forex Brief, March 1 – Sentiment Turns Positive, Indices Resume the Bullish Trend

The manufacturing data from the Eurozone this morning shows that this sector remains in difficulty, and that's without the US auto tariffs

Today we had a few positive developments on the geopolitical front, quite the opposite of what we saw yesterday. Yesterday, geopolitics hurt the market sentiment thus keeping stock markets subdued during the European session. Today, Pakistan decided to release the captured Indian pilot and Donald Trump tweeted a while ago that the relationship with Kim Jong Un is very good. We still don’t know how this issue will end, but it’s a positive sign for the time being and that’s what the market is concerned about right now. Here’s his tweet:

As a result, the safe havens are getting beaten up as USD/JPY climbs 70 pips while GOLD losses nearly $10 from top to bottom. Stock markets have made a bullish reversal and they are resuming the uptrend which started two months ago. Risk currencies have also moved higher in the last few hours with commodity Dollars leading the way, but that is also due in part to the Caixin manufacturing PMI from China which beat expectations early in the Asian session, although it still remains below the 50 level.

Speaking of manufacturing, this sector remains in contraction in the Eurozone with Spanish manufacturing falling below the 50 level as well in February, joining the Italians and Germans on that front. Besides that, core inflation ticked lower to 1.0% in the Eurozone. Headline inflation ticked higher, but core inflation is more important since it removes the volatile energy prices. The ECB is betting that sustainable inflation will pick up but core CPI, which is as sustainable as it gets, is moving lower.

European Session

- German Manufacturing PMI and Retail Sales – Manufacturing sector fell into contraction in January in Germany, as the PMI indicator declined below the 50 level. Today it was expected at 47.6 points and it came exactly as expected, so it remains in contraction. Although, the employment sector remains strong as the unemployment claims come negative once gain at -21k against -5k expected. Retail sales also posted some nice numbers as they grew by 3.3% in January against 1.9% expected.

- French Manufacturing – The French manufacturing sector is the only one that is not contracting in the Eurozone. Final manufacturing PMI was expected to remain unchanged at 51.4 points but ticked higher to 51.5 points. Not much, but shifting away from contraction at least. The government budget balance deficit also declined considerably from -76.1 billion Euros, to -17.3 billion which is a good thing as well.

- Italian Manufacturing and Unemployment Rate – The manufacturing sector in Italy fell into contraction since October last year and it remains in contraction as well. The PMI indicator was expected to slip lower today to 47.1 points from 47.8 in January, but it came at 47.7 points, which is still a decline. The unemployment rate declined to 10.3% in December but that was revised higher to 10.4% today. The report for January showed that unemployment increased to 10.5%, so soft numbers from Italy as well.

- Spanish Manufacturing – Manufacturing has been holding up in Spain above the 51 level just like in France, but it finally caught up with the rest of the Eurozone in February as today’s report showed. The PMI indicator was expected to decline to 51.8 points from 52.4 previously, but it fell to 49.9 points for February, which means contraction.

- UK Manufacturing PMI – The British manufacturing activity has also been declining in recent months. Today the manufacturing PMI indicator from January was revised lower from 52.8 points to 52.6 points. February’s number was expected to decline to 52.0 points and it came as expected. At least, net lending to individuals came higher at £4.8 billion against £4.7 billion expected.

- Eurozone Inflation and Unemployment Rate – Headline inflation ticked higher in the Eurozone today coming at 1.5% as expected, against 1.4% previously. But the core CPI which is more important ticked lower to 1.0% against 1.1% expected. At least, the unemployment rate fell to 7.9% from 8.0%.

The US Session

- Canadian GDP – The GDP report from Canada today was expected to show a stagnation of the economy in December. But, the actual number showed a decline once again, which is the third contraction in four months as the actual GDP number came at -0.1%. The annualized GDP comes at 1.1% against 1.4% expected. This is the slowest pace of growth since Q2 2016. Economic growth for H1 2018 was also revised lower to 2% from 2.3% previously, the annualized residential investment comes at -14.7% for Q4, and the Annualized non-residential capital spending came at -10.9% in Q4. Bad numbers once again and the CAD lost 80 pips immediately after the release.

- US Personal Spending – The personal spending for December was expected to turn negative for the first time in many months. Spending was expected to decline by 0.2% that month but it declined by 0.5% instead. I suppose the government shutdown has had a negative impact on the US consumer.

- US Personal Income – Today we had the personal income report for January and December being released at the same time since it was held up during the government shutdown. Personal income declined by 0.1% in January, but that came after a strong increase of 1.0% in December.

- FED’s Dudley Speaks – The ex New York Fed president was commenting to Bloomberg a while ago that the FED might start hiking in the second half of the year. Inflation is the story of the ‘dog that didn’t bite’ according to Dudley. This is both bullish and bearish for the USD at the same time.

- US Manufacturing PMI – In December the manufacturing PMI made a big decline as it fell from 59.3 points to 54.1 points. Although it increased to 56.6 points in January, it is expected to have declined again in February as the number is expected at 55.6 points.

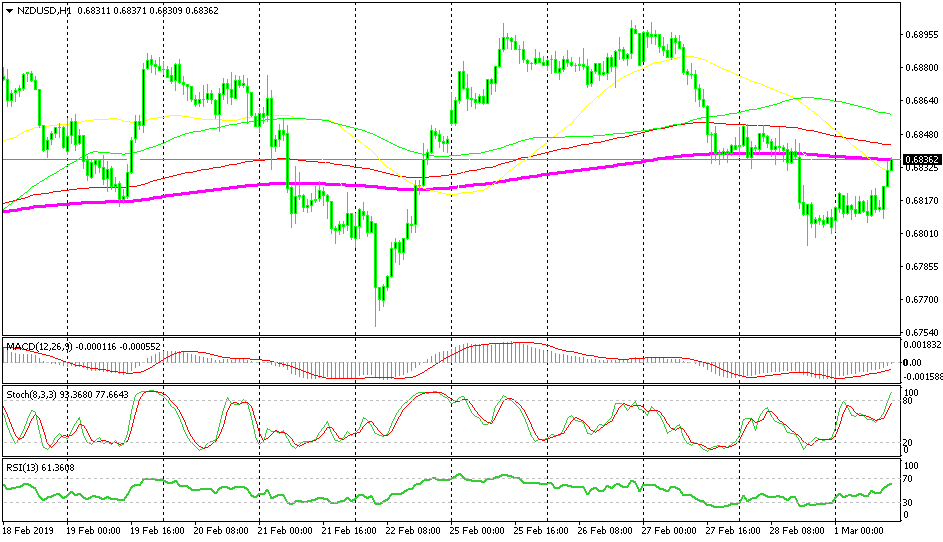

Bearish NZD/USD

- The trend has turned bearish this week

- The retrace up is complete

- The 200 SMA provided resistance

The 200 SMA provided solid resistance for NZD/USD

The 200 SMA provided solid resistance for NZD/USD

NZD/USD turned bearish earlier this week as the sentiment deteriorated in financial markets. As a result, risk currencies such as commodity Dollars suffered. The trend is still bearish but during the European session we saw a 30 pip jump higher which is a retrace of the bigger downtrend, so we decided to sell this pair. The retrace ended at the 200 SMA (purple) and now a bearish reversal has began.

In Conclusion

The manufacturing figures from Europe were quite soft again today. Although, the Euro is still retracing higher against the USD. The US manufacturing report will be released soon which will show where this sector stands in America. Although, I am pretty sure that manufacturing will once again be in a much better shape in the US than in the rest of the developed world.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

The 200 SMA provided solid resistance for NZD/USD

The 200 SMA provided solid resistance for NZD/USD