US Session Forex Brief, March 4 – The USD Continues the Uptrend Despite Trump’s Complaints

The USD Opened with a bearish gap lower last night on Trump's comments but it has resumed the uptrend again now

The USD was under pressure during the second half of February but towards the end of last week, the situation changed and the Buck reversed higher. EUR/USD turned bearish after failing to hang on above the 1.14 level. It fell into the 1.13 region where it has been trading for most of the time since late October. US President Donald Trump doesn’t like a strong Dollar since it would hurt exports and he repeated it over the weekend; that’s why markets opened with a bearish gap for the USD last night. But it seems that there is nothing else to turn to right now, so the market has been leaning on the USD which is getting stronger today, love it or hate it.

The sentiment has improved as well today as comments about a US-China deal concluding soon keep coming out. Stock markets opened with a bullish gap higher last night as a result. Safe havens have continued to slide lower with Gold back below the $1,290 level while USD/JPY is trading just below the 112 level.

Cryptocurrencies have started moving again with Bitcoin breaking out of the range and heading lower. The economic data was pretty light today with the investor confidence improving somewhat in the Eurozone but still in negative territory, while the construction sector fell into contraction in Britain.

European Session

- UK Construction PMI – The construction PMI indicator has been declining in the last several months but it was holding above the 50 level. It got pretty close to contraction in January as this indicator fell to 50.6 points. Today’s report was expected to come at 50.5 points, but it fell to 49.5 points, meaning contraction for the second time since last March.

- Spanish Unemployment Change – In January we saw a massive 83.5k increase in the employment change which came after a big decline in December. Today’s report was expected to come at 5k, but it missed expectations slightly coming at 3.3k. That won’t affect the unemployment rate in Spain, I suppose.

- Eurozone Sentix Investor Confidence – The investor confidence has been declining in the Eurozone falling into negative territory in November and deteriorating further since then. Although, we saw a slight improvement today to -2.2 points which is better than the -3.1 points expected. Let’s hope it improves further and turns positive soon.

- Eurozone PPI Inflation – The declining Oil prices turned the producer price index negative in November and December. But, Oil prices made a bullish reversal in January and today’s PPI report from the Eurozone for that month was expected to show a 0.4% increase in PPI. The actual number came as expected at 0.4%, so let’s hope that this spills into the main CPI inflation figures later on.

- China to Cut VAT Tax for Manufacturers – Bloomberg reported early today that China is planning to cut the value-added tax rate that covers the manufacturing sector by 3% as part of measures to support the slowing economy. That means a $90 billion cut, which could help increase the GDP by 0.6%. Although, the Aussie will be the biggest winner if that’s to take place.

- UK Government Still Pursuing Legally Binding Changes to Irish Backstop – Comments made by the PM spokesman James Slack. He added that we’re at a critical stage in negotiations currently. Have been making progress but more work needs to be done. We understand that lawmakers will want to scrutinize any changes that are secured

The US Session

- Comments on US-China Negotiations – The main White House adviser, Kevin Hassett, commented earlier saying that US-China deal may be finished sometime soon. This reinforces the other comments on this issue such as the story by the Wall Street Journal earlier today. Great for the market sentiment and for stocks.

- US Construction Spending – The construction spending declined in November but it made a turnaround in December growing by a respectable 0.8% that month. Today, the report for January is expected to show another increase of 0.2%, which is not great but it will be positive at least.

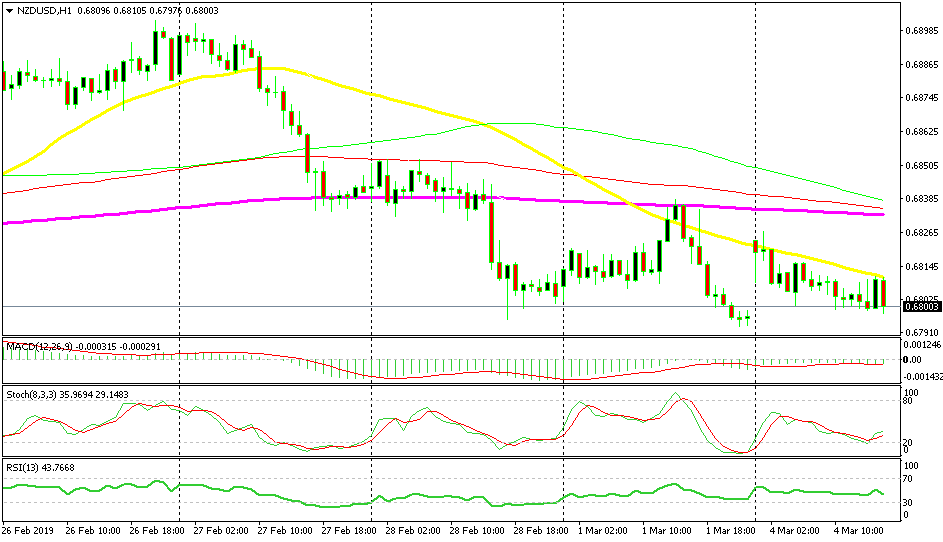

Bearish NZD/USD

- The trend turned bearish last week

- The retrace up is complete

- The 50 SMA is pushing the price lower

The 200 SMA provided solid resistance for NZD/USD

NZD/USD turned bearish last week and we had a couple of winning signals selling the retraces higher. Last night though, this pair opened with a bullish gap higher after Donald Trump complained again about the strong Dollar. But, the 50 SMA (yellow) provided resistance and it has been pushing the price lower since then. So, this indicator is a good place to look for shorts once a retrace higher is completed.

In Conclusion

The UK construction sector fell into contraction today, following the other sectors of the economy. The GBP continues the bearish move lower although it started earlier last week, so this report didn’t have much impact on the GBP. But, you’d expect that with Brexit going as it is going.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account