AUD/USD Tumbled on Falling Iron Ore Prices and Revives Again

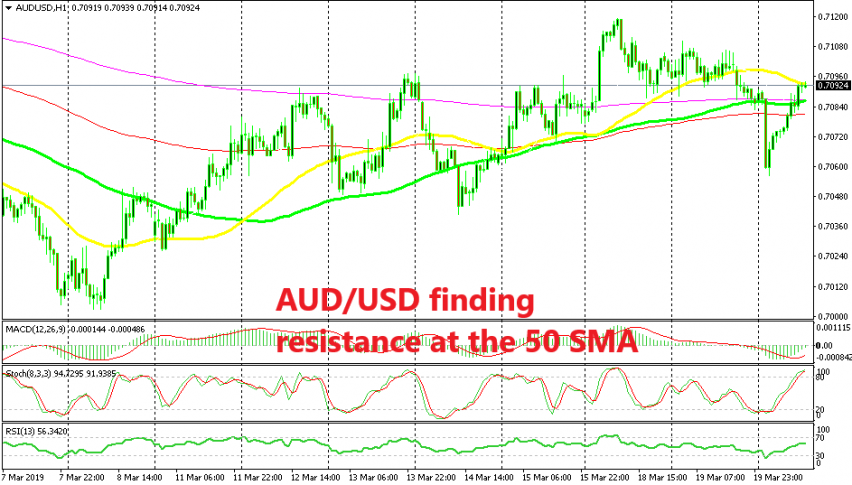

AUD/USD has made a round trip lower during the night on falling Iron prices but it is finding resistance at the 50 SMA now

The commodity dollars made a sharp decline early in the Asian session today. There wasn’t anything on the economic calendar, so that decline looked a bit strange in the morning, but after having a look around, I saw that iron ore prices had fallen by more than $30 during the night.

Iron ore formed an uptrend from the last days of December until early February, but in the last two months, the price has traded sideways in a range and today’s decline brings us to the bottom of the range which, if broken, will open the way for a bearish trend in the weeks/months to come.

Australian is a big exporter of raw materials and this decline in iron ore was what hurt the Aussie last night. That comes on top of China making it difficult for Australian coal exports to enter the country. So, we should keep these two things in mind because they will catch up with the AUD like they did today.

But, the price reversed and has recuperated all losses since then. Although, AUD/USD has run into the 50 SMA now which is providing resistance. Stochastic is overbought on the H1 chart and the previous candlestick closed as a doji which is a reversing signal, so we decided to sell this pair just now. Iron ore continues to decline, by the way.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account