US Session Forex Brief, March 21 – Stocks Tumble, Safe Havens Climb as Sentiment Continues to Remain Negative

The market sentiment has been hurt by central banks turning dovish but it is improving right now

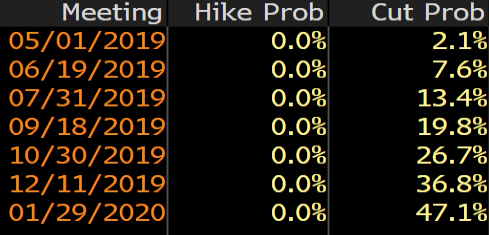

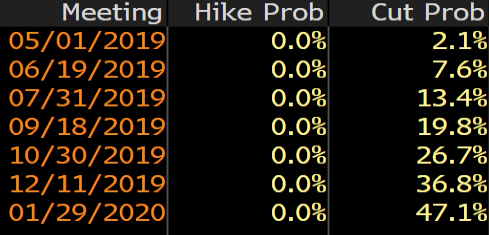

Yesterday was the FED meeting in the evening. The US economy has improved somewhat in the last couple of months after seeing some soft signs in the winter period, so if anything, the FED would sound a bit more hawkish than in the previous meeting. But we got a surprise as the FED turned more dovish and now markets expect an interest rate cut next year more than a rate hike. Here are rate move expectations compared on tables from this meeting and the previous one:

After the meeting

Before the meeting

Now, markets are pricing in a rate cut in January next year. Chairman Powell was pretty dovish on China and the Eurozone but I thought that he would be more hawkish/less dovish regarding the US economy which has shown signs of improvement in recent weeks. But, he said that conditions favour a more accommodative approach and the FED lowered GDP growth expectations to 2.1% for 2019 vs 2.3% in December and to 1.9% vs 2.0% in December.

As a result, the USD lost around 100 pips and the sentiment turned negative, which has hurt stock markets and helped safe havens. Today we had two more central bank meetings from the Swiss National Bank and the Bank of England. But, they repeated the same things we have heard before, so they didn’t have any impact on the markets.

European Session

- SNB Libor Rate Decision and Monetary Policy – The Swiss National Bank left interest rates unchanged at -0.75% as expected. The statement said that the CHF remains highly valued, the situation of FX market continues to be fragile and the SNB is prepared to intervene in markets if needed. They lowered inflation expectations to 0.3% this year, down from 0.5% in December and to 0.6% in 2020, down from 1.0% in December. Yet, the CHF is stronger now and it keeps running higher.

- ECB Economic Bulletin –The European Central Bank released its economic bulletin which said that the March decisions were aimed at lifting inflation towards goal. Remember that they turned dovish in the last meeting two weeks ago. The data points to sizable moderation in growth momentum and underlying inflation in the Eurozone continues to be muted. Pretty much a repeat of the last statement.

- UK Retail Sales – Retail sales were expected to turn negative again in February after being negative in 3 out of the last 5 months, coming from a 1.0% increase in January, which was revised lower to 0.9% today. But, sales increased by 0.4% instead in February and by 4.0% YoY against 3.3% expected. Core retail sales which exclude autos and fuel increased by 0.2% versus -0.4% expected MoM, while the YoY sales came at 3.8% versus 3.5% expected.

- EU’s Malmstrom Warns US Against ‘Pulling the Plug’ on WTO – EU trade commissioner, Cecilia Malmstrom commented this morning that the US should renew global order with WTO reform. US needs to stop blocking the appointment of arbitrators and find the space between ‘pulling the punches and pulling the plug’. Many in Europe are offended that US would consider EU to be a security threat, according to her. I’m not.

- BOE Interest Rate Decision and Monetary Policy Summary – The Bank of England kept interest rates unchanged at 0.75% as expected with a 0-0-9 unanimous vote. The summary had comments such as underlying inflation broadly on track with forecast, the employment growth could now moderate significantly. Brexit could prompt policy moves in either direction. Gradual, limited tightening is still probably needed. The monetary response to Brexit is not automatic and could be in either direction and Brexit uncertainties continue to weigh on confidence, short-term economic activity.

The US Session

- US Unemployment Claims – The unemployment claims have been in the 220k-230k region for the last four weeks after increasing to the 240k-250k in January. Today, unemployment claims were expected to come at 225k, but beat expectations coming at 221k for last week, keeping the range of recent weeks.

- Philly FED Manufacturing Index – The Philly FED manufacturing index has been softening for months and in February it fell into negative territory, coming at -4.1 points. This indicator was expected to make a reversal this month and grow to 4.6 points, but it beat expectations coming at 13.7 points. This is quite a positive thing and it appears to have improved the market sentiment as the decline in USD/JPY has reversed.

- Canadian Wholesale Sales – Wholesale sales have been pretty volatile in Canada in the last several months, increasing and declining one month to the next. In December they posted a 0.3% increase coming from a major decline of 1.0% in the previous month. Today, wholesale sales were expected to show another increase for January of 0.5% and they increased indeed by 0.6%, beating expectations.

- US CB Leading Index – This index which shows the change in the level of a composite index based on 10 economic indicators turned negative in January declining by 0.1%. Today’s report which is for March was expected to show a 0.1% increase, but it came higher at 0.2%.

Bullish GBP/USD

- The trend has turned bearish this week

- Fundamentals point down

- The 200 SMA has now turned into resistance

The 100 SMA is providing resistance on top

GBP/USD has turned bearish this week as Brexit is heading towards another extension. Although the situation is not clear as Theresa May wants an extension until June 30, while the EU only offers two options, the end of May or the end of this year. This has increased the uncertainty and GBP/USD has been declining. Although, we saw a retrace higher in the previous two hours but the 200 SMA (purple) which used to provide support yesterday has now turned into resistance. The price is turning down again now so we have a bearish bias for this pair.

In Conclusion

The market sentiment has been pretty negative in the last few trading session but it seems to be improving now. The decline in stock markets has ended and they are reversing higher, as is USD/JPY. The strong reversal in the Philly FED manufacturing index which suggests a big improvement in this sector this month is helping as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account