US Session Forex Brief, March 22 – Stocks Tumble Further, Safe Havens Benefit As Eurozone Data Deteriorates

The sentiment has turned massively bearish on financial markets today as the global economy continues to weaken further

Forex traders, economists, central bankers and politicians keep hoping that the global economy improves and ends this weak period, but things keep getting worse, especially in the Eurozone and in Canada. The FED was the last of the major central banks to turn dovish on Wednesday after the European Central Bank turned dovish two weeks ago, which the Reserve Bank of Australia and the Bank of Canada did so even earlier. That hurt the market sentiment which was starting to improve, but the round of economic data from the Eurozone today was quite terrible which hurt the sentiment in financial markets further

The Eurozone manufacturing PMI had fallen into contraction in February but it was expected to improve slightly today. That didn’t happen. Instead, the manufacturing PMI indicator dived further, but what was more terrible is the size of the decline in German Manufacturing figures which contracted nearly three points. That hurt the sentiment further sending stock markets diving around 200 pips lower.

And considering that the US tariffs on European cars haven’t come into the play yet. US President Donald Trump said earlier today that if European automakers build plants in US, then there won’t be tariffs. he wants European manufacturers to open plants in the US, but even if that was to happen, it would take years, so I guess he is going forward with tariffs on cars. That comes at the worst time for German manufacturing, which means that things will likely get worse before they get better. The retail sales report from Canada which was released about two hours ago was pretty weak as well, so it’s been a negative day for markets today.

European Session

- French PMI Data – The French services sector fell into contraction in December, January and February although February was revised slightly above contraction. This month, French services PMI was expected to improve further to 50.6 points, but it missed expectations coming at 48.7 points, which mean contraction again this month. Manufacturing PMI indicator briefly dipped below the 50 level in December but this sector expanded again in the previous two months. Although, it dived back into negative territory today falling to 49.8 points.

- German PMI Data – The services sector in Germany remains in decent shape at 54.9 points for this month, despite cooling off a bit. But, that’s not the most important sector in Germany. Manufacturing is and it is showing a terrible trend. Manufacturing fell into contraction in January, it worsened in February and today’s report was expected to show a slight improvement, but it deteriorated further, falling from 47.6 points to 44.7 points. That is pretty bad and the car tariffs are on the way.

- Eurozone PMI Data – Just like in Germany, the service sector remains safe from contraction now after getting pretty close to it in January. But the manufacturing sector continues to suffer. Manufacturing PMI was expected to improve this month after falling in contraction in February, but missed expectations falling deeper into negative territory coming at 47.6 points.

- Draghi Doesn’t See Recession Risk – Reuters reported earlier, citing unnamed sources saying that the ECB president Mario Draghi told EU leaders that risks of recession are low. ECB sees protracted weakness and uncertainty in the economy. International trade is the main reason for the slowdown. In this situation, substantial degree of monetary policy accommodation is needed. I suppose he didn’t see that manufacturing report this morning, but accommodation should be bearish for the Euro. ECB’s Mersch also said earlier that the monetary policy should be prudent, forward-looking.

- Donald Trump Speaking – Trump was speaking on Fox Business earlier today. He sounded confident on trade talks with China and urged the FED again to not to tighten monetary policy. But, it seems like the car tariffs are coming soon because Trump said that European car manufacturers should build plants in the US which takes at least a few years. So, situation is expected to get worse for European manufacturers.

The US Session

- Canadian CPI Inflation – Headline inflation has been sort of volatile in Canada on a monthly basis. Although, it was expected to jump higher by 0.6% in February. The actual number came at 0.7% as did the core CPI (consumer price index). But trimmed mean and median CPI YoY remained unchanged at 1.9% and 1.8% respectively, while but common CPI ticked lower at 1.8% from 1.9% previously.

- Canadian Retail Sales – Retail sales disappoint once again in Canada. Core sales increase by only 0.1%, missing expectations of 0.2% in January. The previous number was revised lower to -0.8% for December from -0.5%. Headline retail sales came even worse as the data showed a 0.3% decline for January . This number for December was revised lower as well to -0.3% from -0.1%. The CAD lost 50 pips on these numbers.

- US Flash Manufacturing – US manufacturing is also weakening but unlike in the Eurozone, it remains positive. Last month’s number was revised lower to 53 points against 53.7 previously, but it was expected to improve this month and come at 53.5 points. Although, we saw another miss as this month’s number declined to 52.5 points.

- US Flash Services – The service PMI indicator has been on a weakening trend as well, but it jumped two points higher last month from 54.2 to 56.2 points. This month, the services PMI indicator was expected to cool off a bit to 55.7 points, but it missed expectations coming at 54.8 points.

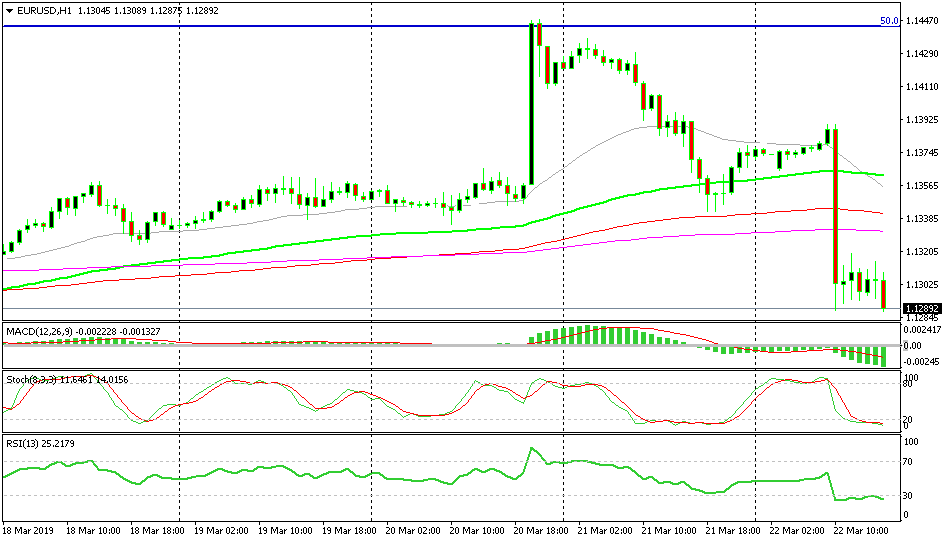

Bearish EUR/USD

- The trend has turned bearish this week

- Fundamentals are pointing down for the Euro

- All moving averages have been broken

Now the MAs look like a good place to sell this pair

The situation has turned upside-down for EUR/USD. On Wednesday it rallied more than 100 pips, now it has lost 160 pips already from the top. Fundamentals point down for the Euro as the ECB has turned dovish and different sectors of the Eurozone economy are in contraction and getting worse as we saw this morning. EUR/USD has broken all indicators to the down side, and now we’re waiting for a retrace higher in order to go short, probably at the lower MAs.

In Conclusion

The situation for the Eurozone is going from bad to worse and the global economy is heading in the same direction. Trump is still pushing for auto tariffs on European cars, so it is expected to get even worse for European manufacturing industry. The setniment is massively bearish now as the decline in stocks continues while safe havens keep climbing higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account