US Session Forex Brief, March 27 – Risk Sentiment Sours and Turns Positive Again in European Session

The sentiment has bee shifting back and forth today and markets are following the sentiment, hence the volatility in stock markets

During the second half of last week the sentiment turned really negative in financial markets and stock markets declined considerably while safe haven assets such as Gold and the JPY rallied. Although, this week the sentiment started to improve and despite being cautious, markets reversed back up again, albeit slowly. But, today we saw another shift in the market sentiment during the European session. Stock markets dipped more than 100 pips lower because of that and USD/JPY declined nearly 50 pips. There was nothing which could have sparked this shift but that’s what markets do when they are agitated. You don’t need anything to spark panic.

However, the sentiment shifted again and indices recuperated pretty well in the last few hours. So, things are back where we left them yesterday. The economic data has been pretty light today, although we had Mario Draghi and a couple of other ECB members make comments, repeating the dovish shift in the ECB monetary policy earlier this month. Draghi did sound sort of confident on the domestic economy and inflation, but with the numbers we have seen from the Eurozone recently, I wouldn’t be. The Euro jumped 20 pips but it is now back down. The Brexit saga continues with a number of Conservative MPs and the DUP Party still opposing Theresa May’s deal.

European Session

- ECB President Draghi Speaks – The President of the European Central Bank Mario Draghi was speaking in Frankfurt earlier today saying that risks to the outlook remain tilted to the downside but the ECB is not short of instruments to deliver on mandate. The effects of exchange rate appreciation have now reversed and the soft patch doesn’t necessarily foreshadow a serious slump. The domestic economy has remained relatively resilient and he remains confident that sustained convergence of inflation to target has been delayed rather than derailed. Mostly dovish with some positive tones.

- More ECB Members Speaking – The ECB chief economist, Peter Praet, who is leaving soon, was also speaking in Frankfurt this morning saying that there’s only so much the monetary policy can do. The ECB is alert to downside risks and prepared for contingencies that can possibly come about. All instruments remain available following return to rate guidance as main policy tool. He is more blunt but he is leaving the ECB so he doesn’t have to wrap it up nicely like Draghi did. De Guindos also said that the Eurozone is not immune to spillover from other regions, but insists that there are only limited spillovers from Fed monetary policy to Eurozone inflation and output.

- CBI Realized Sales – The CBI sales indicator turned negative in December declining to -13 points as the sentiment deteriorated that month due to the failing Brexit deal. In January and February this indicator remained at 0 points. For March, this indicator was expected to increase to 5 points but it came at -13 points which shows the negative trends in the retail and wholesale sector of the UK economy.

- US MBA Mortgage Applications – US MBA mortgage applications increased by 8.9% in the week which ended on the 22nd, against 1.6% previously. The purchase index increased to 267.5 points against 251.5 previously, market index also grew to 424.6 points from 390.0 in the previous week while the refinancing index fell to 1,289.5 points from 1,146.8.

The US Session

- US Trade Balance – In December, the US trade deficit posted a sudden decline which is a positive thing, but the increase in January was double that of December and the deficit grew to -$59.8 billion. Today’s report which is for February was expected to show a small decline but the actual number came much lower at -$51.1 billion against -$57.2 billion expected. That should satisfy Donald Trump to some degree.

- Canadian Trade Balance – In Canada the trade deficit has been growing in the last several months. In January it jumped to -$4.6 billion which was revised lower to -$4.8 billion. Today’s report was expected to show a small decline in the deficit for February to -$3.5 billion, but the actual number for that month came at -$4.2 billion, so a decline from the previous month but a miss in expectations.

- US Current Account – The US current account report which shows the difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter has been declining from around -$100 billion at the end of 2017 to -$125 billion in Q3 of last year, which was revised lower to -$127 billion today. In Q4 2018 the current account deficit was expected to increase to -$130 billion but it missed expectations and grew further to -$134 billion. I suppose Trump’s joy from the falling trade deficit didn’t last long.

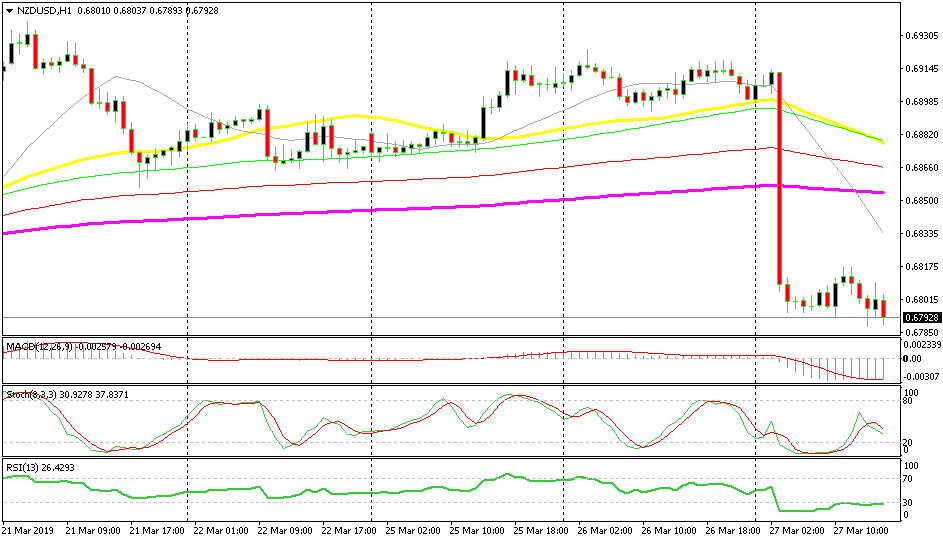

Bullish [[NZD/USD]]

- The trend has turned bearish

- The RBNZ turned dovish last night

- Risk assets are under pressure

NZD/USD lo st more than 120 pips last night

st more than 120 pips last night

While risk assets turned bearish since the middle of last week, NZD/USD has been holding up quite well and still grinding higher until last night when the Reserve Bank of New Zealand finally killed any hopes that the buyers had. They turned dovish following other major central banks, which now stand at 5, and the NZD lost around 120 pips. Now the picture looks pretty bearish for NZD/USD and we are trying to go short on this pair, but we will wait on a retrace higher, probably when the 20 SMA (grey) catches up with the price.

In Conclusion

Alright, the sentiment has turned sort of negative again as I was writing this forex brief and stock markets have reversed back down again while safe haven currencies are climbing. Although, markets still seem uncertain today with the sentiment shifting back and forth so take care when trading out there because markets keep changing their bias.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

st more than 120 pips last night

st more than 120 pips last night