US Session Forex Brief, April 3 – Markets Turn Higher as Sentiment Improves on Services Data

The Eurozone and Chinese services reports today were quite upbeat and that's what risk assets wanted to run higher

Today we had some positive fundamentals coming out which have affected financial markets positively. In the Asian session, the Chinese Caixin services PMI indicator jumped more than three full points higher, beating expectations. That comes after the bullish reversal in Chinese manufacturing data we saw on Sunday and earlier this week, which suggests that the slowdown in the Chinese economy might be coming to an end. After all, manufacturing turned into expansion in March after contracting during the previous three months, and services showed a considerable expansion as well. Besides that, we heard rumours from Financial Times today that China and the US are getting very close to a final trade agreement. These events helped the sentiment turn positive today.

But that wasn’t all. The services report from the Eurozone also showed a turnaround in March. The manufacturing sector is deep in contraction in Europe and the services sector was headed there as well in the recent months. But today, we saw a jump in services PMI in all major European countries. This is another sign that the global economic slowdown might be coming to an end. At least, the global economy is not slowing down as fast as it was until last month. The UK services PMI dived in UK, but Britain is a special case now with Brexit and everything.

European Session

- Spanish Services PMI – The Spanish economy has held up pretty well compared to other major Eurozone countries, particularly the service sector. The service PMI indicator stood at 54.5 points for February and today’s report which is for March was expected to show a slight increase to 55 points, but beat expectations as it came at 56.8 points. Composite PMI also came higher at 55.4 points against 53.8 expected.

- Italian Services PMI – The service sector fell into contraction in the previous two months in Italy as the economy remains in recession officially. Although, this morning we saw a three point jump in the PMI indicator, showing that services have moved away from contraction in March and expanded nicely that month. The composite PMI also beat expectations coming at 51.5 points against 49.8 expected.

- French Final Services PMI – The French service sector has been the weakest in the Eurozone as the yellow vests protests affected the economy negatively. Although, we saw a jump here too as the service PMI indicator moved higher to 49.1 points from 48.7 in February. The composite PMI ticked higher as well to 48.9 vs 48.7 prelim, but this sector still remains in contraction in France.

- German Final Services PMI – The manufacturing sector has dived deep into contraction in Germany but the service sector continues to hold up well. It dipped close to contraction in December last year but it has been expanding nicely since then. Today, the PMI indicator increased from 54.9 to 55.4 points which is a pretty decent place to be.

- Eurozone Services PMI – As with major Eurozone countries, the whole of the Eurozone services PMI has been increasing in the last few months after dipping in December and January. The prelim reading for March stood at 52.7 points two weeks ago and the final reading today was expected to remain unchanged. But it beat expectations coming at 53.3 points.

- UK Services PMI – In Britain, the service sector has been flirting with stagnation levels but has just about held up above that. Today’s report though, showed a contraction for March as the PMI indicator fell to 48.9 points from 51.1 previously, but Brexit uncertainty is affecting the economy.

- Eurozone Retail Sales – Retail sales posted a big decline of 1.6% in December last year but in January we saw a reversal as sales jumped 1.3% higher. Although, that month was revised lower to 0.9% today. Today’s retail sales report which is for February was expected to show a 0.2% increase that month but sales increased by 0.4% in February. So, another positive number from the Eurozone today.

The US Session

- US ADP Non-Farm Employment Change – ADP non-farm employment change has been sort of volatile recently but they have held up above 180k. In February, this indicator showed a 183k increase in new jobs which was revised higher to 197k today. Although, in March the ADP employment declined to 129k, missing expectations of 184k.

- US Final Services PMI – The service sector has been pretty stable in the US holding in the 54-55 point region in the last several months. Although, the final reading jumped to 56 points in February. Today’s final reading for March is expected at 54.8 points, unchanged from the prelim reading two weeks ago, but we might get a positive surprise here as well.

- US ISM Non-Manufacturing PMI – The non-manufacturing sectors of the economy have been performing really well in the US. This indicator started to dip in December and January with the lowest print at 56.7 points, which is still a very decent level of expansion. But we saw a jump to 59.7 points in February. Today’s report is expected to show a cool off in March to 58.1 points but that would still be a really decent place for US non-manufacturing.

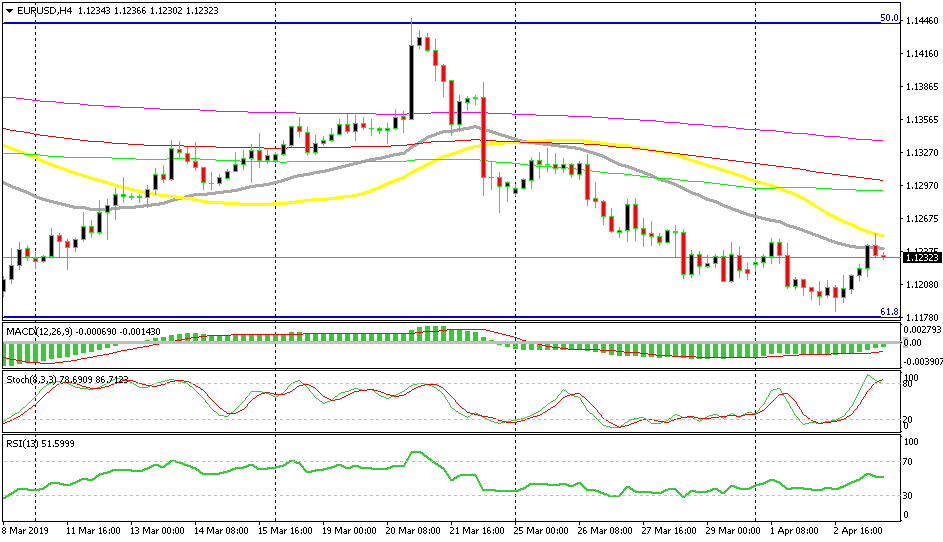

Short EUR/USD

- The trend has been bearish for two weeks

- The pullback higher is complete

- Moving averages are providing resistance

- The previous candlestick points down

The 100 SMA held the surge in bitcoin

Earlier on we went short on EUR/USD as this pair was retracing higher on positive Eurozone services data. Although, the retrace continued higher to 1.1255 where it met the 50 SMA (yellow). The H4 candlestick closed below the 20 SMA (grey) which has provided support and resistance before so both moving averages are providing resistance. Stochastic is also overbought and the previous candlestick closed as an upside-down hammer which is a strong reversing signal. Besides, the trend is still bearish.

In Conclusion

The sentiment has turned quite positive today as the economic data from around the globe is showing that the global economy expanded in March after slowing down for about a year. That has stock markets running higher today and risk currencies are also on a bullish move, especially the Aussie. But, don’t get too excited and nurse your trades if you are long, because this week’s positive reports are just a one off and we might see more negative fundamentals in the days to come.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account