US Session Forex Brief, Apr 5 – Nerves Calm as US NFP Turns Higher Again After the Dip Last Month

The US NFP came back to the normal range after the sot number last month, but earnings disappointed once again

The market sentiment has been quite positive this week and stock markets have enjoyed some jolly times, surging higher. Although, US President Donald Trump threatened Mexico yesterday with auto tariffs if Mexico didn’t help in curbing immigration and drug smuggling into the US. That turned the sentiment neutral and stock markets and forex have been trading in a tight range in the last few sessions.

Another reason for the slow price action in the last two days has been the employment report which was expected to be released today from the US. The report released last month showed a dip in non-farm payrolls (NFP) to just 20k after having increased by more than 300k in the previous two months, which raised some concerns among economists and hurt the USD. So, markets were concerned for the NFP results today, hence the slow price action in financial markets in the last few sessions.

If today’s NFP number was soft again, concerns would grow that the global economic slowdown might be affecting the US economy, but the payrolls grew by 196k in March, beating expectations of 172k and coming a long way above the 20k we saw last month. But, the earnings were a drag again as growth fell to 0.1% for March, which is a disappointment after the 0.4% growth in February that raised hopes for higher earnings, since they have been the slowest growing component in the US economy during the economic expansion of the last few years. So, nothing new from this report; back to where we were before before February.

European Session

- German Industrial Production – Industrial production reports have shown a decline in the four months in Germany in the period from October to January. Although, January’s report was revised higher today from -0.8% to 0.0%. Today’s report which is for February was expected to show a reversal and a 0.6% in production for that month, but the actual number came a bit higher at 0.7%. This is positive news for the Eurozone economy, but most of the increase in industrial production came from construction, otherwise this would have been yet another negative reading at -0.4%, so the German economy is not yet out of the swamp.

- French Trade Balance – Trade deficit has been declining in France since it peaked at more than -6 billion Euros back then. In January, the deficit fell to -4.2 billion but it was expected to pick up again in February to -4.87 billion. Although, it beat expectations shrinking further to -4 billion Euros for that month, as today’s report showed.

- France’s Le Maire Concerned About German Economy – French Finance Minister Bruno Le Maire was commenting earlier today and he sounded concerned about Germany’s economic growth slowdown and the recession in Italy. He added that the Eurozone future is at stake if we do not reduce divergences between Euro countries. It is time to decide on Eurozone budget to favour convergence among EU states

- UK Halifax HPI – The Italian government will target GDP growth of 0.3% to 0.4% for 2019. Economists see a 0.1% GDP growth this year. Italy is said to see wider budget deficit at 2.3% to 2.4% (2.1% is the official promise) in 2019. Halifax House Price Index has shown some volatility in recent months, with house prices increasing and decreasing from month to month. This indicator showed a 2.% decline in house prices in January but it bounced back in February increasing by 5.9% that month. Today we were expecting this indicator to turn negative again and decline by 2.5%. It did turn negative but the decline was smaller than expected, with house prices falling 1.6%.

The US Session

- US Unemployment Rate – The unemployment rate remained unchanged at 3.8% in the US as previously. Although, the participation rate declines to 63.0% vs 63.2% prior, That’s a negative thing since it means that unemployment would have increased by 2 points if the participation rate would have stayed unchanged.

- US Average Earnings – Average hourly earnings increased by only 0.1% in March against 0.3% expected. Earnings jumped 0.4% higher in February which gave analysts the idea that earnings are starting to pick up, since they have been growing pretty slowly. But now, growth in earnings falls back to the normal range of the last few years. That means the FED will stay on hold for now.

- US Average Earnings – Average hourly earnings jumped 0.4% higher in February which gave analysts the idea that earnings are starting to pick up, since they have been growing pretty slowly. But now, growth in earnings falls back to the normal range of the last few years at just 0.1% in March against 0.3% expected. Average hourly earnings YoY also missed expectations coming at 3.2% against 3.4% expected

- Canadian Unemployment Rate – The unemployment rate in Canada has been fluctuating between 5.6% and 5.8% for quite some time. We saw a jump to 5.8% in January from 5.6% in December. In February unemployment remained unchanged at 5.8% and today’s number which is for March was expected to remain the same. It came at 5.8%, so no change there.

- Canadian Employment Change – The employment change in Canada for March came at -7.2k today against 3.0k expected. This is the first decline in employment since last September. The fall in employment for March comes after two strong months when employment grew by more than 50k. The CAD lost around 50 pips after the employment report on declining jobs numbers, but the decline stopped soon. After all, it is just a small dip in a growing trend.

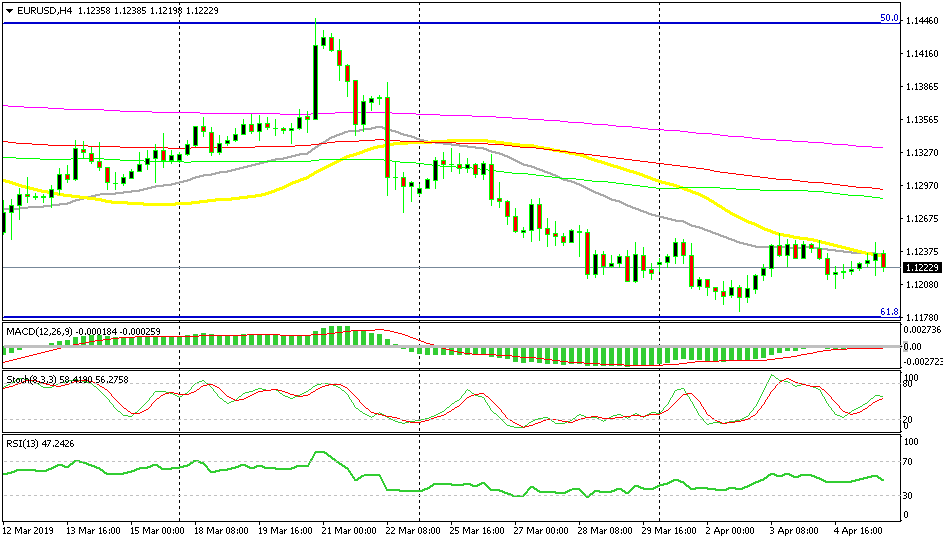

Short EUR/USD Again

- The main trend is still bearish

- The pullback higher is complete

- The 50 SMA and now the 20 SMA provided solid resistance

- The buyers couldn’t reverse the trend

The 20 SMA joined the 50 SMA today in providing resistance

We are short on EUR/USD since Wednesday, as this pair retraced higher on the positive Eurozone services data. Although, the retrace retrace stopped when this pair met the 50 SMA (yellow). This moving average proved to be a very strong resistance indicator as it held for a few sessions. The stochastic indicator became overbought and it is heading down now as this pair also turns bearish. After all, fundamentals and the main trend are still bearish. Today, the 20 SMA (grey) has also joined the 50 SMA and together they are reversing EUR/USD lower.

In Conclusion

The US employment report is finally out and markets seem more relaxed now that non-farm employment change didn’t post another soft number which would have raised more questions about the US economy and the strength of the employment sector. But, earnings fell back to their normal growth rate at 0.1% which balanced out the positive effect from the NFP. At least, markets are a bit more relaxed now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account