US Session Forex Brief, Apr 17 – Inflation Reports From Europe Didn’t Move Forex, While Indices Stretch the Uptrend Further

UK and Eurozone inflation remained soft this morning, while Canadian inflation made a reversal higher during March

Stock markets turned bullish last week after a dip at the beginning of the week on Donald Trump’s tweet about tariffs on $11 billion worth of European goods. The threat still stands and the EU has threatened retaliation which would open another war front in this global trade war. Yesterday we heard the EU Trade Commissioner Cecilia Malmstrom say that the EU will publish a list of US goods targeted for retaliation if Trump goes ahead with tariffs. But for now, the sentiment is still positive and stock markets are benefiting from it, crawling higher and threatening record highs.

The forex market though seems as undecided as yesterday. In fact, the forex market has been undecided all week as most major pairs have traded in tight ranges and with good reason. The global economy has slowed considerably during the past year and major central banks have now shifted to bearish, so there’s no reason to buy any major currency right now. The final inflation report from the Eurozone for March confirmed the softness as headline CPI remained unchanged at 1.4% and so did core CPI at 0.8%. In UK inflation softened as well, but it still remains at a decent level. But all GBP traders are worried about right now is Brexit.

European Session

- Eurozone Current Account – The current account which shows the difference in value between imported and exported goods, services, income flows, and unilateral transfers was on a declining trend from October to December last year. But the report released last month which was for January showed a jump which was more than double the previous month. Today, January’s number was revised higher to €37.1 billion from €36.8 billion previously. Today’s report for February missed expectations of €33.2 billion and instead came at €26.8 billion.

- UK CPI Inflation Report – Inflation has cooled off in Britain from 2.7% in August last year, to 1.9% YoY in February. Core consumer price index also cooled off from 2.1% to 1.8% during the same period. Today, headline CPI YoY was expected to tick higher to 2.0% but it remained unchanged at 1.9% while core CPI YoY was expected to tick higher as well to 1.9% but also remained unchanged at 1.8%. The MoM CPI for March increased by 0.2% as expected. The RPI (retail price index) was expected to increase from 2.5% to 2.6%, but missed expectations too and instead, it declined to 2.4%. The HPI (house price index) made quite a reversal down and fell to 0.6% YoY from 1.7% previously. HPI stood at 2.5% in January, fell to 1.7% in February and now it declined to 0.6% in March. The reaction in the GBP has been muted as with all other data releases.

- Eurozone Final CPI Inflation Report – Inflation has been declining pretty fast in the Eurozone, falling from 2.2% in October last year to 1.4% in March as the prelim report showed two weeks ago. Core CPI YoY, which the ECB is more worried about, has also weakened from 1.1% to 0.8%. Today, Eurostat released the final reading for March and the yearly inflation figures remained unchanged at the same levels, as the prelim reading. But, CPI MoM increased by 1.0% last month as expected against 0.3% in February.

- Italian Trade Balance and CPI Inflation Reports – The trade balance has been on an increasing trend in Italy since it bottomed at around €1.27 billion at the end of last year. Since then, we have seen an increase but last month’s report which was for January missed again falling to €0.33 billion. Today’s report for February was expected to show a reversal and increase to €2.62 billion, but beat expectations coming at €3.27 billion. Final CPI remained unchanged at 1.0% as the prelim reading but HICP YoY ticked higher to 1.1% against 1.0% prelim.

- Eurozone Trade Balance – The trade balance has been on an increasing trend in the Eurozone since it bottomed at around €12.5 billion at the end of last year. Last month’s report which was for January was revised higher today from €17.0 billion to €17.4 billion. Today’s report for February was expected to show a small decline to €16.8 billion but it beat expectations increasing further to €19.6 billion.

- ECB’s Hanson Looks Confident for H2 of 2019 – The European Central Bank governing council member, Ardo Hansson, was commenting earlier today about the economic slowdown in Europe. He said that there’s no reason to doubt that growth will pick up in H2 2019. Yesterday we heard a number of ECB members sound dovish regarding economic growth in H2, but now Hanson is going against the pack, although I don’t see where he finds the confidence because the Eurozone economy is still slowing.

The US Session

- Canadian Inflation – Inflation was declining at the end of last year as we saw four negative numbers during the last five months of 2018. Although, last month’s report which was for February showed a surprising jump of 0.7% MoM during that month. Today’s report is expected to show another 0.7% increase in CPI inflation for March. Common CPI and median CPI YoY are expected to remain unchanged at 1.8% but trimmed CPI is expected to tick lower from 1.9% to 1.8%.

- Canadian Trade Balance – The trade balance has turned positive for a moment in August last year when it came at $0.5 billion. But it turned negative again in the following month and since then the deficit has been increasing, peaking at -$4.6 billion in January. In February we saw a small decline in the deficit to -$4.2 billion and today’s report for March is expected to show another decline to -$3.5 billion.

- US Trade Balance – The trade balance has been holding steady in the US at around -$50 billion, but we saw a jump in the deficit in December to nearly -$60 billion. It turned back to the normal range in January falling to -$51.1 billion, but today’s report which is for February is expected to show another increase in the deficit to -$53.5 billion.

- US Final Wholesale Inventories – Wholesale inventories have been increasing in the US from around 0.3% in December last year to 1.1% in February. The increase is shown in red since it means that firms will slow purchases as their inventories grow, but at the same time, growing inventories help increase the GDP. Today’s report is expected to show a slowdown in inventories buildup to 0.4% in February from 1.2% in January.

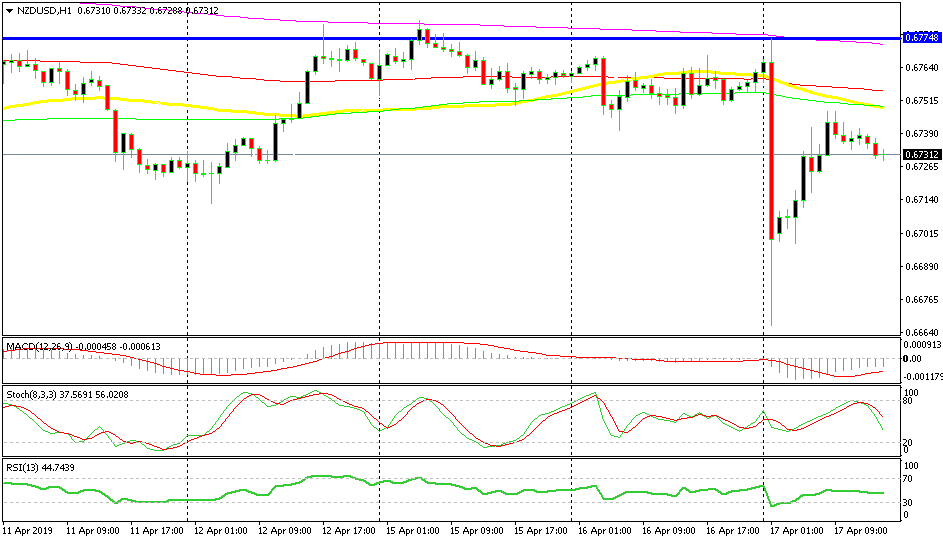

Bullish NZD/USD

- The trend has shifted to bearish

- NZD has bee the weakest of commodity Dollars recently

- Fundamentals turned more bearish

- The retrace higher is complete

The 50 SMA has now turned into support for AUD/USD

Earlier, we went short on NZD/USD as this pair was retracing higher after the 110 pip crash during the night as the Q1 CPI inflation report missed expectations of 0.3% and only showed a 0.1% increase. The Kiwi has been sort of soft compared to AUD/USD which continues to be on an uptrend and now the situation has reversed to bearish for NZD/USD after the inflation report. We saw a retrace higher during the Asian session but the retrace is complete now and moving averages are providing resistance above, so I think that we will be safe with this trade.

In Conclusion

This morning’s inflation reports from the Eurozone and the UK couldn’t move markets or their respective currencies. But now the Canadian inflation report is out and it showed a nice jump of 0.7% MoM once again for March and the YoY trimmed and median CPI moved two points higher, which has turned the CAD bullish. USD/CAD lost around 60 pips after the release.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account