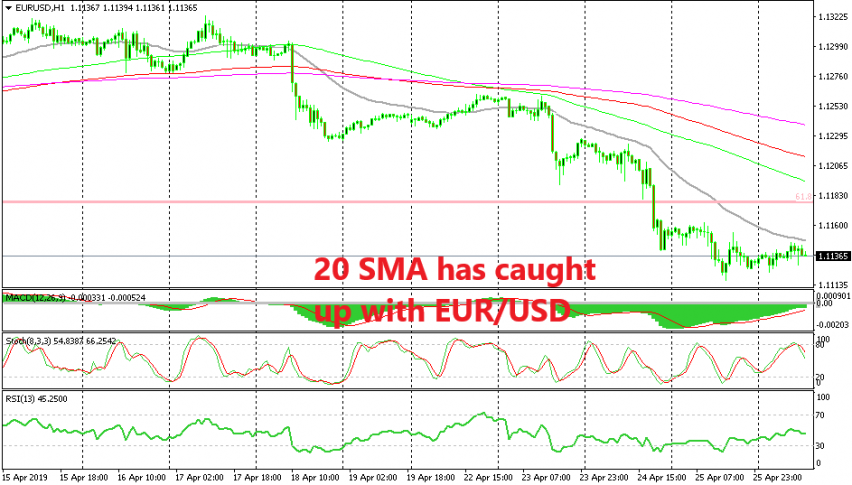

The 20 SMA Catches Up With EUR/USD, the Downtrend Should Resume

The downtrend in EUR/USD has stalled in the last two sessions but the 20 SMA should force this pair to resume the bearish trend

[[EUR/USD]] turned bearish last Thursday after the confirmation that the Eurozone manufacturing is in deep contraction during the European session that day and after the impressive retail sales in the US session. So, this pair had two reasons to turn bearish and the bearish momentum has continued since then.

There was a pause on Friday last week and Monday this week due to low volatility during the Easter weekend, but the downtrend resumed on Tuesday again and we saw this pair make new lows every day in the last three days. In fact, EUR/USD broke this year’s lows yesterday, so the bears are in total control right now.

Although, in the last two sessions the downtrend has paused again. But now we see that the 20 SMA (grey) has caught up with the price, which should give the sellers more confidence. The pullback higher is complete as well as stochastic shows. By the way, the trend is pretty strong since the smallest moving average is doing the resistance job now. So, we are good with our sell signal here which we opened yesterday as this pair was retracing higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account