Bitcoin Trying to Decide Whether to Turn Bearish or Remain Bullish After Bitfinex Coin Loss

Bitcoin broke back below the 200 SMA after lost coins, but the selling momentum ha already faded

Cryptocurrencies have had a tough year in 2018, losing between 70% and 90% from the top at the end of 2017 to the bottom in December 2018. Although, the tough times ended when this year started and the start so far seems pretty good for Bitcoin formed a bottom in December around $3,100 according to my broker’s feed and the sellers haven’t been able to make new lows in the first two months when the pressure was still pretty much on the downside.

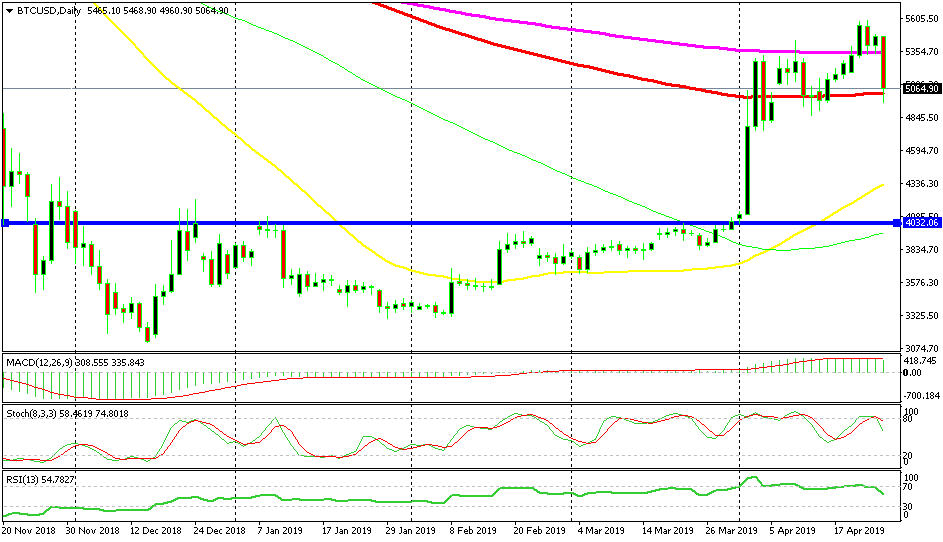

Bitcoin found resistance at the 50 SMA (yellow) on the daily chart for some time during the first half of February but then the price moved above it, which was a sign that the downtrend of the previous year was over. After all, the downside had been exhausted after aggressive selling for more than a year.

The 100 SMA held after the $500 decline Bitcoin

Once broken, this moving average turned into support as seen on the daily chart above which is another sign that the downside momentum was over, otherwise, the sellers would have broken back below this moving average without much hassle. The next target for Bitcoin buyers who were gaining confidence now became the zone around the $4,000 level, which provided resistance for several weeks, until the break at the beginning of this month.

That break and the surge to $4,300 in the next few days was another sign that the pressure might now turn to the upside. But I wouldn’t bee too eager going long still because the larger time-frame charts such as the weekly and the monthly were still pretty bearish. Another reason for not being too optimistic in the cryptocurrency rally was the fact that the 200 SMA (purple) was providing resistance for Bitcoin and held the price below it for most of this month. That moving average comes at around $5,350 on my platform.

But this week, we saw buyers give Bitcoin another push higher and they finally managed to break the 200 SMA. The daily candlestick closed above it and the price reached $5,600. The 200 SA now turned into support form resistance. This was the sign that the buyers were now finally in control because that’s what the outcome is when the price moves higher and resistance levels and indicators such as moving averages turn into support.

But the news that Bitfinex wasn’t able to recover the lost coins sent shivers through the digital currency market. This crypto exchange lost a considerable amount of coins last year which was a sign that the safety of this market is still very questionable. Although, there were hopes that they would resurrect all the lost coins, but that’s not the case and it seems that they gave up. This news hit the wires on Thursday night and on Friday cryptocurrencies turned bearish.

Bitcoin fell back down below the 200 SMA which had been providing support all week and had the biggest bearish day from top to bottom since last November. So, the question on every crypto trader now is whether the trend in altcoins was killed right there or if this was just a pullback before the next bullish move higher.

I did think that the trend might reverse after such news. But the 100 SMA (red) on Bitcoin’s daily chart which has been offering a support zone for Bitcoin, held the ground again. If the sentiment was to change and the trend to shift, previous support should not be such strong obstacles. In fact, the price bounced off this moving average today and it is right now trading back up at $5,350-60.This shows that the buyers saw that $500 decline yesterday as a good opportunity to go long at a better entry level, which is the 100 SMA (red).

The price is now trading around the 200 SMA, so this moving average is still being an obstacle for buyers. Although, if they manage to push back above the 200 SMA and keep Bitcoin above it, then that would be a strong signal that the uptrend is official and the buyers will keep pushing higher again soon. If such news from coin loss doesn’t turn cryptos down, then there is only one way to go, up. The next target will be this week’s high at $5,600 and then to $6,000 which will be the real test for Bitcoin buyers.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account