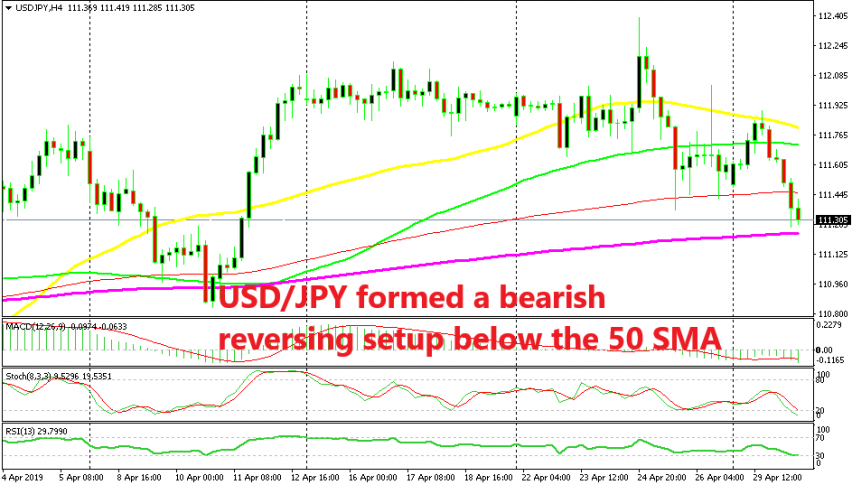

USD/JPY Turns Bearish at the 50 SMA, Now Faces the 200 SMA

USD/JPY has been consolidating n the last two weeks, but the Chinese data last night has turned it bearish now

[[USD/JPY]] has been consolidating and trading sideways in the last couple of weeks, although the pressure has been on the downside during this time. The range has been slowly moving lower while the jump to 112.40 last week reversed pretty quickly, showing that buyers couldn’t hold on to gains.

Yesterday was a pretty bullish day for this pair as the sentiment in financial markets was positive, which meant that safe havens such as Gold and the JPY were sold off. But, today we are seeing a bearish reversal on the H4 chart. The bullish move ended at the 50 SMA (yellow) for USD/JPY, so it seems like this moving average has turned into resistance now.

The price formed a spinning top candlestick, which is similar to the hammer and thus it is a reversing signal. That was the confirmation the buyers needed and the reverse started in the last US session. Although, the miss in the Chinese manufacturing and services PMI overnight gave this pair the strong push down. Now the picture for USD/JPY has turned bearish as the sentiment has turned negative and traders are leaning on safe havens.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account