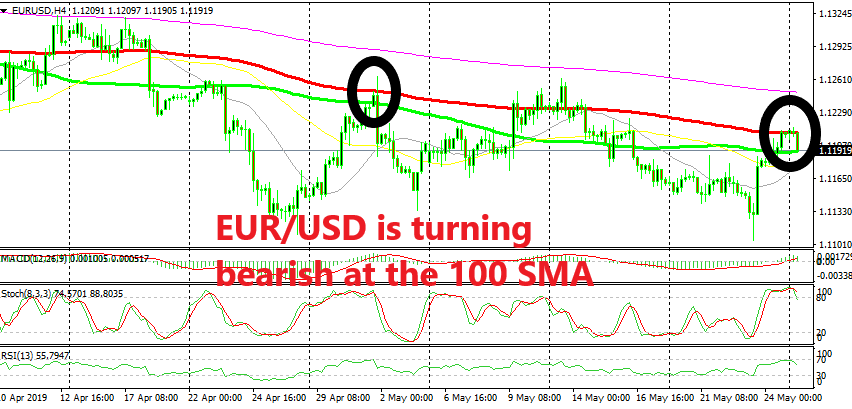

Seems Like EUR/USD Has Run its Course After Finding Resistance at the 100 SMA

EUR/USD has been pretty bearish recently but last week we saw a pullback higher which now seems complete

The USD has been pretty bullish in the last few weeks as the global economy slows down again over growing trade concerns. The major global economies are in difficulty, so there’s no reason to buy any major currency, hence the bullish momentum in the USD. But last week, the US manufacturing and services sectors posted some really soft numbers which raise questions about the shape of the US economy.

As a result, the USD turned pretty bearish in the last two days. EUR/USD reversed at the support area above 1.11 and then climbed more than 100 pips higher in the following sessions after forming a doji candlestick on the H4 chart which is a reversing signal. So, last week closed on a pretty bearish footing for the USD.

But the USD is still the best place to run to, since the other developed economies are in a worse shape and the USD is turning back up now. EUR/USD ran into the 100 SMA (red) last Friday which together with the 200 SMA (purple) have been providing resistance for this pair, pushing it down since last October.

The price is only 20 pips lower this morning, but on the H4 chart the picture paints a bearish picture since the price has always reversed either at the 100 SMA or the 200 SMA. So, the retrace higher seems complete on this time-frame and the bigger bearish trend is about to resume. This looks like a good opportunity to go short on EUR/USD with a stop above the 200 SMA and a profit target above the support at 1.1110-20.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account