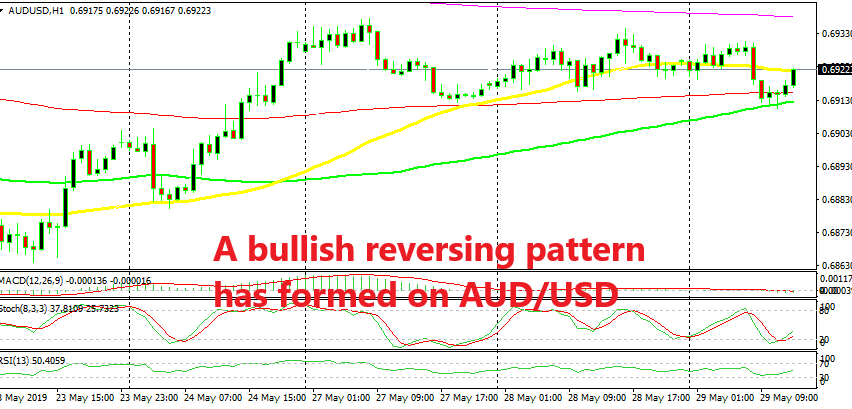

Buying the Pullback in AUD/USD

AUD/USD retraced lower this morning but the retrace is complete and we decided to go long because of that

[[AUD/USD]] turned bullish towards the end of last week after some really weak data from the US. AUD/USD has been on a bearish trend in the last two months as sentiment keep deteriorating on the escalating trade war which, in turn, hurts risk assets such as the Aussie.

The US economy has been holding up well as major/developed economies around the globe have weakened considerably, so the USD has been the safest currency to buy during this time. But last Thursday, the manufacturing and the services reports showed that these two sectors fell close to stagnation this month. That puts into question the shape of the US economy, hence the bullish reversal in AUD/USD at the end of last week.

In the last two days this pair has been trading in a range and today we saw a retrace lower. But the retrace ended at the 100 SMA (green) which provided support earlier today. The price formed a pin candlestick right above that moving average, which is a reversing signal and stochastic became overbought on the H1 chart so we decided to use this opportunity and go long on AUD/USD. Now the price is already starting to reverse.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account