US Session Forex Brief, June 18 – The Euro Tumbles On Draghi’s Comments About Rate Cuts

The economic data from most developed/major countries around the globe has been getting weaker in recent months as the global economy has taken another leap to the downside after the short-lived improvement in Q1 of this year. Today we saw house prices fall by 3.0% in Australia in Q1, which is the fifth consecutive quarterly decline. The monetary policy minutes were also released last night, which I didn’t check, but I assume they were dovish since the RBA cut interest rates in that meeting. AUD/USD was lower this morning which confirms the dovish bias from the RBA.

European Session

- Eurozone ZEW Economic Sentiment – The economic sentiment was on a deteriorating trend during last year, bottoming at -22 points in November, but it started improving since then and in April the sentiment turned positive again. But that didn’t last long as the sentiment turned negative again last month, falling to -1.6 points. This month it was expected to get worse and fall to -3.6 points, but after the big decline to -21.1 points of the German ZEW economic sentiment which was published earlier, the market was prepared for another big decline in the Eurozone number. That’s what happened and the Eurozone ZEW economic sentiment fell to -20.2 points, so Mario Draghi was right to be worried.

- Eurozone Final CPI Inflation – Inflation has also been on a weakening trend in the Eurozone as in the rest of the globe, but we saw a jump in April, although that wasn’t real because prices were heavily affected by the Easter weekend that month. In May, inflation turned weak again and the headline CPI (consumer price index) fell to 1.2% from 1.7% while core CPI declined to 0.8% from 1.3% in April. The final reading was published this morning and it showed no change from the prelim reading, so inflation is heading down indeed in Europe.

- Draghi Mentions Brings Back Rate Cuts – Draghi’s speech in Sintra was published this morning with the headline comment that more rate cuts are part of the central bank’s toolkit. QE still has considerable headroom, QE limits are specific to contingencies faced by the ECB. If outlook doesn’t improve, additional stimulus is needed, negative rates have proven to be a very important tool and indicators for the coming quarters point to lingering softness. The ECB is able to enhance forward guidance by adjusting its bias and conditionality to account for variations in adjustment path of inflation. In the coming weeks, we will deliberate how our instruments can be adapted commensurate to the severity of the risk to price stability.

- Ifo Cuts GDP Growth for Germany – The Ifo cut Germany 2020 GDP growth forecast again today to 1.7% from 1.8% previously. The GDP forecast for 2019 remained unchanged though at 0.6% which is pretty low. They also mentioned the weakness in industrial sector spilling over into labour market, domestic economy, so tough times ahead for Germany.

US Session

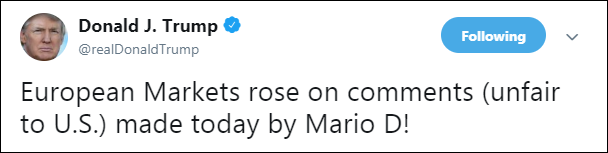

- Trump Takes A Jab at the ECB, but Aims at the FED – US President Donald Trump tweeted as soon as he got up after seeing []EUR/USD]] much lower after Draghi’s comments this morning. Here is the tweet “Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others”. And another tweet right after that:

- Merkel Threatens Iran if Iran Doesn’t Uphold the Nuclear Pact – German Chancellor Angela Merkel commented today on Iran saying that there will be consequences if Iran doesn’t uphold nuclear pact. We must do everything we can to solve the situation peacefully. The US has increased the military presence in the region, so things are escalating here as well.

- Canadian Manufacturing Sales – Manufacturing sales have been negative in three out of the last five months in Canada, but the report released last month showed a decent jump of 2.1% in March, which was revised higher today to 2.6%. Today’s report was expected to show another increase of 0.6% in April, but sales missed expectations falling by 0.6% instead. New orders also came negative for that month at -1.4% against +2.5% prior, which were revised higher from +1.5%.

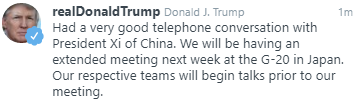

- Trump Tweeting Again, This Time About China – There was some worry that the meeting wouldn’t take place at all. The hope is that trade talks restart on the way to a deal. But Trump posted quite a positive tweet on the matter, so here it goes:

Bearish EUR/USD

- The trend has turned bearish again

- Fundamentals are dovish

- The ECB turned even more dovish today

- MAs are pushing the price down

The 50 and the 20 SMAs are pushing the price down

EUR/USD was quite bullish in the previous two weeks as the USD turned bearish on softer economic data in recent months from the US. But the larger bearish trend resumed again for this pair and fundamentals keep deteriorating for the Euro, such as the big decline in the ZEW economic sentiment we saw this morning from Germany and the Eurozone. The ECB also turned even more dovish today, implying a coming rate cut this year and this pair lost around 60 pips. It has been putting up a small retrace higher which is a good opportunity to sell as the moving averages are approaching fast.

In Conclusion

Donald Trump started the day early today, taking a hit at the ECB for turning dovish which sent the Euro down and European stock markets higher. Trump hates that the FED has been on a rate tightening cycle, so today’s tweets are aimed at the FED which will meet tomorrow, more than the ECB. So, I expect the FED to sound sort of dovish too, but I’m not sure about the July rate cut.