US Session Forex Brief, June 24 – Main Assets Crawl Higher As USD Weakness Still Prevails the Markets

The USD Dollar has been on a bullish trend form more than a year, but it started turning bearish in recent weeks as the US economy turned soft as well, joining the rest of major economies of the globe. The Buck took a moment to breathe in the second week of this month, but it turned even more bearish after last Wednesday’s FED meeting, which showed that the FED turned pretty bearish. Odds of a rate hike increased further to nearly 100%, so the USD has been heavily sold off last week and that price action is spilling into this week as well, with the USD slipping lower today during the European session.

That has helped major assets climb higher today, such as GOLD which has made some gains and trading above $1,400, while the Euro is also grinding higher, despite the weak German Ifo business climate which has fallen to the lowest since 2014. Major market participants are pricing in rate cuts from the European Central Bank now, with HSBC predicting to 10bps rate cuts until the end of the year. Crude Oil is also benefiting from a weaker Dollar, but the main reason for last week’s rally continues to be the tensions between the US and Iran. The sentiment continues to remain negative in financial markets, which benefits safe havens such as the JPY and the CHF.

European Session

- German Ifo Business Climate – The Ifo business climate from Germany was published this morning and it showed yet another weak figure for this month. German Ifo Business climate fell to 97.4 points as expected from 97.9 points in May. Business climate expectations also fell to 94.2 points against 94.6 expected, from 95.3 points previously. Current assessment came at 100.8 points against 100.3 expected, up from 100.6 in May. The headline reading stands at its lowest reading since November 2014. Surveying firm Ifo says that German business morale has fallen in June with the economy “heading for the doldrums”.

- Jeremy Hunt Feels Optimistic About the Backstop – Jeremy Hunt who is still running for the leader of the UK Conservatives said early this morning that the UK can get a better deal on the backstop. He added that Brexit must be delivered, one cannot be prime minister without answering questions and it is disrespectful for Boris Johnson not to take part in debates.

- Contradictory Comments From China – China’s officials confirmed President Xi’s travel plan this week to travel to Japan on 27-29 June for the G20 Summit where he and Donald Trump will meet. But later on, China’s foreign ministry said that FedEx should explain errors related to Huawei packages. Although, no comment on whether or not FedEx will be on ‘unreliable list’.

- Russia Confirms Its Position on Iran’s Side – Russia’s deputy Foreign Minister commented earlier saying that it will counteract US sanctions on Iran. The US is deliberately raising tensions around Iran and US would rather impose new sanctions instead of seeking dialogue.

- Market Participants Expect Rate Cuts From the ECB – HSBC weighs in with their thoughts on the ECB’s next monetary policy steps and they don’t see an ‘imminent’ restart of QE by the ECB. They don’t expect the central bank to bring the deposit rate below -0.60%, which means they expect two cuts of 10bps. Reuters poll also offers an 80% chance of a rate cut soon from the ECB.

US Session

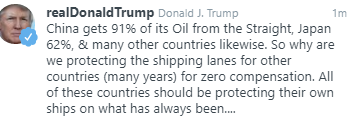

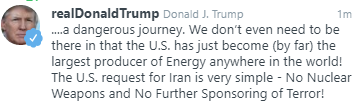

- Donald Trump Tweeting on Oil Shipping Lanes – US President Donald Trump started tweeting as soon as he got up this morning. Here are some tweets on the Oil shipping lanes from the Persian Gulf to China and Japan, referring to the Straight of Hormuz:

- Pompeo Also Tweeting on the Issue – US Secretary f State Mike Pompeo also tweeted today on this issue:

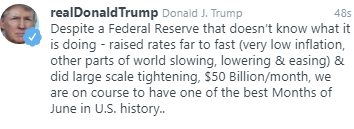

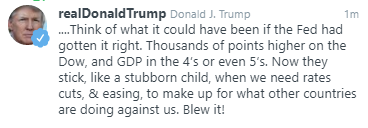

- Trump Tweeting Again, This Time on the FED – US President Donald Trump tweeted again about the FED. He should be happy that the FED will cut interest rates soon, but that’s not a sure thing, so I assume he is pushing the FED:

- Belgian NBB Business Climate – Another indicator showing the business climate from the Eurozone was released just now and it was another weak reading again after the weak number we saw from the German Ifo business climate indicator this morning. This indicator has been on a declining trend since the end of last year and this year it fell into negative territory. Last month, it stood at -3.6 points but was expected to improve slightly to -2.2 points, which it didn’t. It missed expectations falling to -4.2 points for June.

Bearish EUR/USD

- The pressure is on the upside

- Fundamentals are bearish for the USD

- The 20 SMA is providing support

The price is leaning at the 20 SMA on the H1 chart

EUR/USD has been bearish for a long time, but it has formed a bottom above 1.11 and it is bouncing off that level as we saw last week after the FED meeting. The situation has turned bearish for the USD since markets are pricing in a 100% chance of a rate cut next month. As a result, EUR/USD has climbed more than 200 pips higher in the last few days and it is finding support at the 20 SMA (grey) which is pushing the price higher.

In Conclusion

Donald Trump is doing all he can to persuade the FED to cut interest rates next month. The FED have been out of touch with the situation though, hiking rates when inflation wasn’t showing any signs of improving and he wages were stagnant to for many years. But they can’t predict the trade war either. Anyway, let’s wait and see.