Crude Oil Prices at a Standstill – Eyes on G20, OPEC Meetings

Crude oil is still trading below 59.70 resistance area. Since May 2019, the market has tested this level four times but failed to violate...

As expected, the market isn’t moving much due to uncertainty from G20 and OPEC meeting. Likewise, crude oil prices are also trading sideways in a tight trading range of $59.80 – $58.40 for two main reasons:

- Expectations of the supply cut meetings between Saudi Arabia Crown Prince Mohammed bin Salman Chinese Leader Xi Jinping, Russia President Vladimir Putin of Russia with the US President Donald Trump at the G20 meeting.

- Expectations of Output cut from OPEC & OPEC+ members on July 1 and 2.

Both meetings have the opposite agenda. One can trigger bullish bias while the other can bring bearish bias.

On the other hand, Trump has been sending out different signals on the expected result of the talks between Xi and Trump tomorrow.

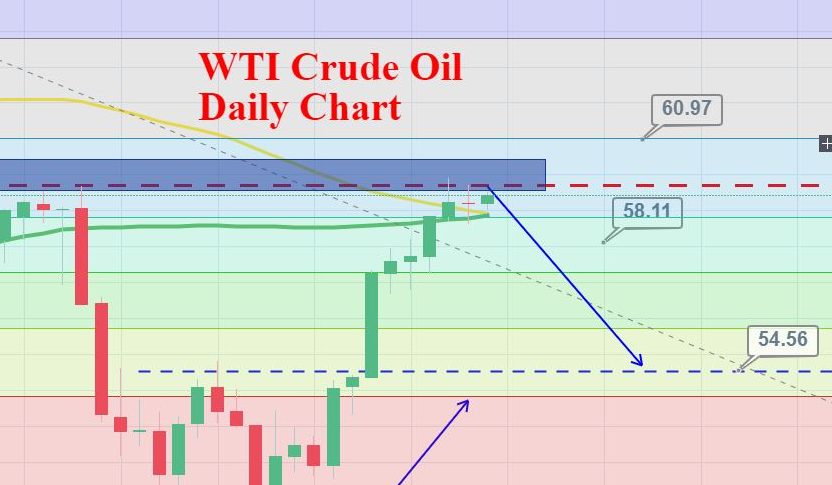

Technical Analysis – WTI Crude Oil

On the technical front, crude oil is still trading below 59.70 resistance area. Since May 2019, the market has tested this level four times but has failed to violate this. In fact, investors aren’t taking any risks ahead of G20 and OPEC meetings.

Two Things to Consider

- On the upper side, the bullish breakout of 59.70 may extend the buying trend until 61

- On the lower side, crude oil has the potential to stay bearish until 58.12 and 57.20.

Consider staying bearish below 59.60 with an initial target of 58. Elsewhere, buying is suggested near 57.40 until we have further updates.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account