Weekly Outlook, July 1-5: OPEC Meeting, G20 Summit, RBA & NFP in Focus

This week is likely to bring new trends in the market as investors will be reacting towards G20 summit outcome, OPEC meeting, RBA rate cut...

G20 Summit – US China Key Highlights

G20 summit concluded on Saturday where the prolonged trade war between China and the United States was at the top of the agenda. Unfortunately it hasn’t delivered a clear stand on the US-China trade talks, which is why the coming week may open with a risk-on sentiment.

The US and China have consented to continue trade talks, relaxing a long row that has added to the global economic slowdown. US President Donald Trump and China’s President Xi Jinping entered an agreement at the G20 Summit in Japan.

President Donald Trump announced that the United States will hold off boosting tariffs on more than $300bn worth of Chinese products while discussions to settle the trade war within the two countries continues. Trump also allowed US companies to resume selling to the Chinese tech giant Huawei, which is being seen as a notable concession.

Watchlist – Key Economic Events This Week

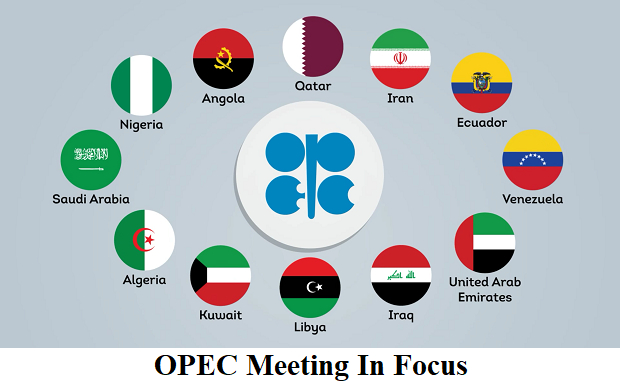

OPEC Meetings

The G20 meeting is over and now all of the focus shifts to OPEC and OPEC+ meeting scheduled on 1st and 2nd of July. Although the OPEC ministers meet on Monday, this weekend’s G20 Summit could hold more influence on oil rates as the US-China hold a truce and the US agreed to continue trade talks and not hike tariffs to $300 billion worth products. This can extend support to oil prices on Monday.

OPEC countries represent around 40% of the world’s oil supply and are unified in their oil output levels. With so much authority over oil’s supply-side, shifts in their production levels can have a significant impact on oil prices.

OPEC meetings are typically held in Vienna and are attended by delegates from 15 oil-rich countries. They address a variety of concerns concerning energy markets and, most importantly, members agree on how much oil they will produce. The meetings are closed to the press, but officials usually talk with reporters throughout the day, and a formal statement covering policy shifts and meeting objectives is released after the meetings have concluded.

On Monday and Tuesday, OPEC, Russia and other producers are broadly assumed to continue with an agreement for a 1.2 million barrels a day output cut, initially agreed upon last year. Crude oil prices come under reiterated pressure from surging US supplies and a slowing global economy.

The Saudi energy minister, Khalid al-Falih, announced on Sunday that the agreement would most likely be extended by nine months and no further reductions were necessitated. If this happens, we may see a bearish impact on crude oil prices as most of the supply cut extension is already priced in, and investors were expecting additional supply cuts to curb oil prices.

The Australian Dollar came under selling pressure as the latest local jobs report resulted in lackluster outcomes. In May, Australia’s unemployment rate held steady at 5.2%, while economists were calling for a downtick to 5.1%. While the nation added more jobs (42.3k versus 16.0k expected), most of those gains were derived from part-time positions (39.8k).

RBA Monetary Policy Decision – Tuesday

Cash Rate At 4:30 GMT, the RBA (Reserve Bank of Australia) will be releasing the interest rate. Australian economic events are suffering over slower economic growth, especially inflation and wages.

Reserve Bank of Australia’s Governor Philip Lowe stated it was impractical to assume that the one 0.25% rate cut in June would be sufficient to fuel wage growth, CPI inflation, and the economy to the desired level.

What to expect from RBA?

I think the stronger Aussie would be a headwind to inflation and growth. Besides, the threat of tariff on Chinese markets are keeping Australian businesses uncertain about the future. Therefore, a dovish policy seems to be on the cards. All things considered, Lowe and co are likely to go for an interest rate cut by 25 base points in July’s meeting.

However, the rate cut may not hurt Aussie a lot as most of the interest rate cut is already priced in. We may see a dip in Aussie as an initial response to the rate cut, but investors may jump in to capture an oversold Australian Dollar, driving exchange rates higher.

Since we are already expecting a dovish tone, this isn’t going to be a massive surprise for the market. We will see selling bias of investors for the Aussie.

US Nonfarm Payroll & Unemployment Report – Friday

Labor Market Report – Today at 12:30 GMT, the Bureau of Labor Statistics will be releasing the nonfarm employment change. The US economy disappointed and added just 75K jobs last month. While this month’s figures are expected to jump to 164K jobs.

The unemployment rate is expected to remain stable at 3.6% vs. 3.6% in May.

Average Hourly Earnings m/m – Despite the importance of NFP, we can’t overlook the average hourly earnings, which are also releasing at 12:30 GMT.

How is it going to help us?

In the case of muted nonfarm data, investors usually turn their attention to average hourly earnings reports. This month, the earnings are expected to release 0.3% increase up from a 0.2% rise in June.

Summing up – This week is likely to bring new trends in the market as investors will be reacting towards G20 summit outcome, OPEC meeting, RBA rate cut, and the US nonfarm payroll data.

So, good luck and stay tuned to FX Leaders for daily updates and forex trading signals!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account