Forex Signals US Session Brief, July 15 – Markets Remain Puzzled Despite Positive Figures From China

traders went against the USD last week after Powell, but now they are not so sure, so the price action has been pretty quiet today

Last week was quite important for the USD and global markets in general. The FED turned really dovish in the last meeting, so markets were pricing in really high chances for a rate cut at the end of this month during the July FED meeting. But we saw some positive economic figures from the US in the last few weeks, which put the rate cut for this month in doubt. Although, Powell didn’t leave much room for interpretation regarding that last week during his testimony at the US Congress. He let markets know that a rate hike this month is a done deal, hence the bearish reversal in the USD by the middle of last week.

But, the markets are still uncertain whether the FED will cut interest rates just once this month or if they will enter an easing cycle, which would make them look quite immature after hiking rates so many times in the last three years. So, after the USD sell-off on Wednesday and Thursday, traders took the sidelines on Friday, uncertain whether to stay bearish on the USD or start buying the Buck, since the US economy is still in the best place among major developed economies.

That sort of sentiment has been prevailing in financial markets today as well, with most assets trading in tight ranges. The economic data from China leaned on the positive side today, despite the slowdown in GDP growth in Q2. The fixed asset investment beat expectations and increased compared to Q1, while YoY industrial production and retail sales made a considerable jump. But, that hasn’t improved the sentiment in financial markets, which continue to be quiet.

The European Session

- Trump Keeps Pressuring the FED to Cut Rates – The US President Donald Trump has been taking digs at the FED for a long time, trying to persuade them to stop rate hikes in the past years. Now that the US economy has weakened, it has become obvious that he was right and he wants the FED to cut interest rates. He took another dig today: “We are doing great Economically as a Country, Number One, despite the Fed’s antiquated policy on rates and tightening. Much room to grow!”.

- China Keeps Making Things Difficult – The US and China seem to be on the right path to strike a trade deal, but besides the conflict on trade, other issues keep adding to the tensions. The US sold a batch of arms to Taiwan, which China doesn’t like. China’s foreign ministry commented this morning on this matter, saying that it will sanction US firms involved in Taiwan arms sales. Let’s hope this doesn’t break the trade deal.

- Swiss PPI Inflation – The producer price index (PPI) turned negative in Switzerland at the end of last year as Oil prices kept declining. The PPI prices started increasing again in the first two months of this year, but they fell flat in April and June. For June, PPI was expected to increase by 0.1%, but instead it declined by 0.5%, which will likely affect CPI inflation in the coming months.

The US Session

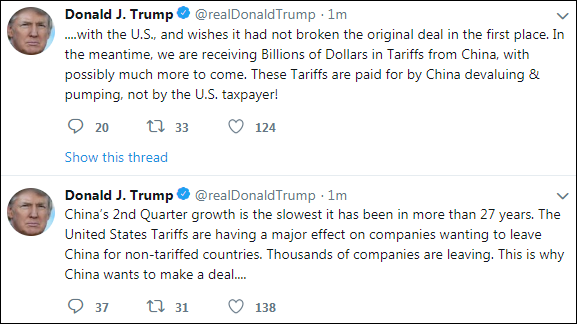

- Trump Keeps Pushing for A Deal With China – The Chinese data today was mostly positive, with fixed asset investment, industrial production and retail sales coming above expectations, although the QoY GDP growth slowed to 6.2% from 6.4% in Q1. Trump was quick to tweet after that. Here are the tweets:

- US Empire State Manufacturing Index – The manufacturing index made a reversal and grew in April and May after softening in Q1, but in June, this index fell in negative territory at -8.6 points. Today, this report was expected to turn positive again and come at 1.6 point, but actually it beat expectations coming at 4.3 points, which is a positive sign.

- FED’s Williams Speaking – The FED member Williams was speaking earlier on Libor briefing, saying that the industry can’t wait on Libor shift. No comments on the outlook for monetary policy though. He doesn’t always sense urgency from market participants to shift language in contracts away from USD Libor. Libor is a leading risk to financial stability. We are now at a critical point in the timeline. Consumer products are a critical area where industry needs to focus because it’s going to be challenging, but the biggest challenge is a willingness on the part of the market to stop using Libor.

Trades in Sight

Bearish EUR/CHF

- The main trend is bearish

- The ascending channel has been broken

- The 200 SMA provided solid resistance

EUR/CHF couldn’t break above the 200 SMA

EUR/CHF turned really bearish in April as the sentiment turned negative in financial markets, after the trade war escalation. The bearish trend continued in May as well, although in June we saw a pullback higher, which turned out to be just a retrace before the downtrend resumed again. This pair followed an ascending channel, but it couldn’t break the 200 SMA (purple) on the H4 chart, which provided strong resistance and eventually reversed the price down. Now this pair is back to bearish and we will be waiting for a retrace up to the MAs before going short on it.

In Conclusion

Markets continue to be quiet now and the economic calendar is light today, so there won’t be any help from the calendar if you want volatility. Although, the USD is starting to crawl higher, perhaps on Trump’s comments about China, but the situation still remains unclear. Perhaps, Powell will give us some direction tomorrow.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account