Forex Signals Brief for July 25: Will the ECB Get More Dovish?

Today in Europe all the attention turns onto Mario Draghi and the ECB to hear what exactly they propose to do to try and lift the struggling

Today in Europe all the attention turns onto Mario Draghi and the ECB to hear what exactly they propose to do to try and lift the struggling Eurozone economy.

While it is broadly expected that the ECB will leave rates unchanged, there is some chance the deposit rate could be cut. If nothing else, the guidance the bank provides will likely be the determining factor in how the EUR/USD responds. Draghi is expected to outline his case for a rate cut which could be even as soon as September as well as talking about the resumption of the ECB’s asset-buying program.

Yesterday, a less than impressive German manufacturing print, really sunk the EUR and it was likely only saved by the fact we had the ECB coming up today.

Prior to the ECB, we do get more German data out, by way of business climate numbers, but I wouldn’t expect that to be market moving, given what we have in store.

Later in the US, we have core durable goods orders which is the key data point in what is an otherwise quiet session. Earnings are still the main focus for the SPX at the moment.

Forex Signal Update

Both of our signals ended up in the red yesterday in what was a relatively quiet session. There should be some better action in the next 24 hours.

USD/JPY – Active Signal

The USD/JPY is really just treading water at the moment, largely due to markets waiting on the FOMC next week. We have made a bit of a lower high which is a positive for this signal and as you can see there are plenty of wicks above, which is a sign of selling.

EUR/USD – Active Signal

The EUR/USD sold off sharply yesterday as some weak data and a looming ECB keeps traders nervous about the state of the economy. Clearly, the dovish sentiment will weigh on price and we are short, hoping Draghi comes out swinging.

Cryptocurrency Update

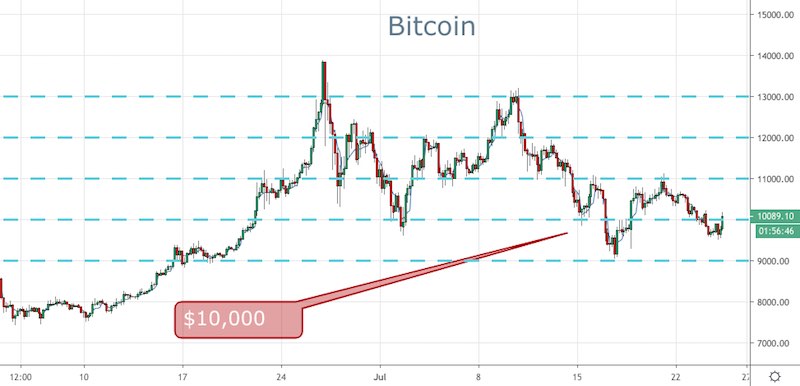

BTC has reclaimed the $10,000 level in Asian trade in what is the test that we have been waiting for.

As I’ve been saying, this is an important level, because if price cannot hold, then it will likely sell off another 1000 points to $9,000.

However, if price holds, then we will likely continue to consolidate above that point and then try and make a leg higher when we get a fresh catalyst.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account