Forex Signals US Session Brief, August 6 – The Sentiment Improves After Positive Economic Figures Today

The sentiment turned pretty negative last Thursday after Donald Trump tweeted about extra tariffs on Chinese imports. China has argued that it has kept promises on buying US agricultural products, but we know there was a fallout in trade talks last week which took place in China, so the trade war is on again. The sentiment in financial markets deteriorated after those tweets, which has sent risk assets tumbling lower, while safe havens have been absolutely surging in the last few days. Gold made 6-year highs while USD/JPY tumbled 400 pips lower.

Although today the sentiment seems to have improved somewhat as commodity dollars continue the retrace higher which they started yesterday, while safe havens are retreating, with USD/JPY retracing more than 150 pips higher this morning during the Asian session. The reason for this has been the economic data coming out of Asia and Germany early today. The employment report from New Zealand was impressive with the unemployment rate losing 3 points while the earnings index rose by 0.8% in Q2. The German factory orders posted a nice jump for June, but the main data came form Japan with average earnings and household spending came out much better than expected. That improved the sentiment and markets are trying to decide right now whether to stay on positive mode or turn negative again.

The European Session

- European Services PMI – While manufacturing is in a really difficult position in Europe, services are holding up better. Today’s Eurozone services PMI report showed that this sector remained unchanged in July more or less. In Germany and Spain where services have been the strongest weakened a bit last month, but in France and Italy this sector improved, leaving the Eurozone number where it was last month at 53.2 points.

- PBOC Swears it Is Not Manipulating the Yuan – The People’s Bank of China which is the central bank said in a comment early this morning that it opposes accusations from the US that it is manipulating the currency. Accusation is related to unilateralism and protectionism which severely harm global rules. The Yuan exchange rate is decided by market supply and demand and China won’t engage in competitive devaluation. There is no issue of currency manipulation in China and we will not use the yuan as a tool to deal with trade disputes. USD/CNY jumped above the 7 mark yesterday. PBOC deputy governor, Chen Yulu added that China has never used its currency as a tool for competition. He hopes that US will resolve the trade spat in a rational manner.

- FED’s Daly Is Against Aggressive Rate Cuts – San Francisco Fed president, Mary Daly commented this morning, saying that aggressive rate cuts not warranted without evidence of a stronger economic downturn. Global growth headwinds justified last week’s rate cut. Trade uncertainty has amplified, which could chill business investment. She doesn’t see the economy heading into a recession but sees continued headwinds from trade, lower policy rates from other central banks could justify lower rates.

- Some Positive Brexit Comments form the EU – The European Commission made some comments on Brexit today. They said that the EU is open to talk if UK wants to clarify its position on Brexit. The commission remains available for Brexit discussions in the coming weeks, while the EU is prepared for no-deal Brexit but says it is not the preferred option

- UK Replies to the EU – UK’s Michael Gove said earlier today that they remain ready and willing to negotiate the Brexit deal. We can negotiate a new deal, but he is saddened by the EU’s refusal to negotiate one.

The US Session

- Trump Tweeting on Trade – The US President Donald trump tweeted about trade and US farmers a while ago:“As they have learned in the last two years, our great American Farmers know that China will not be able to hurt them in that their President has stood with them and done what no other president would do – And I’ll do it again next year if necessary!”

“Massive amounts of money from China and other parts of the world is pouring into the United States for reasons of safety, investment, and interest rates! We are in a very strong position. Companies are also coming to the U.S. in big numbers. A beautiful thing to watch!”

- FED’s Bullard Speaking – Federal Reserve’s Bullard told the AFP that US interest rates are “in right neighbourhood” and we will watch the data. He added that the FED should not react to “tit-for-tat trade war”. Some positive comments form the most dovish FED member.

- JOLTS Job Openings – JOLTS job openings have been in the 7.30M-7.40M in the last few months. In June, new jobs came at 7.45M but were revised lower to 7.37M. Last month they came at 7.32 million, missing expectations of 7.50M. Today they are expected to come at 7.34M.

Trades in Sight

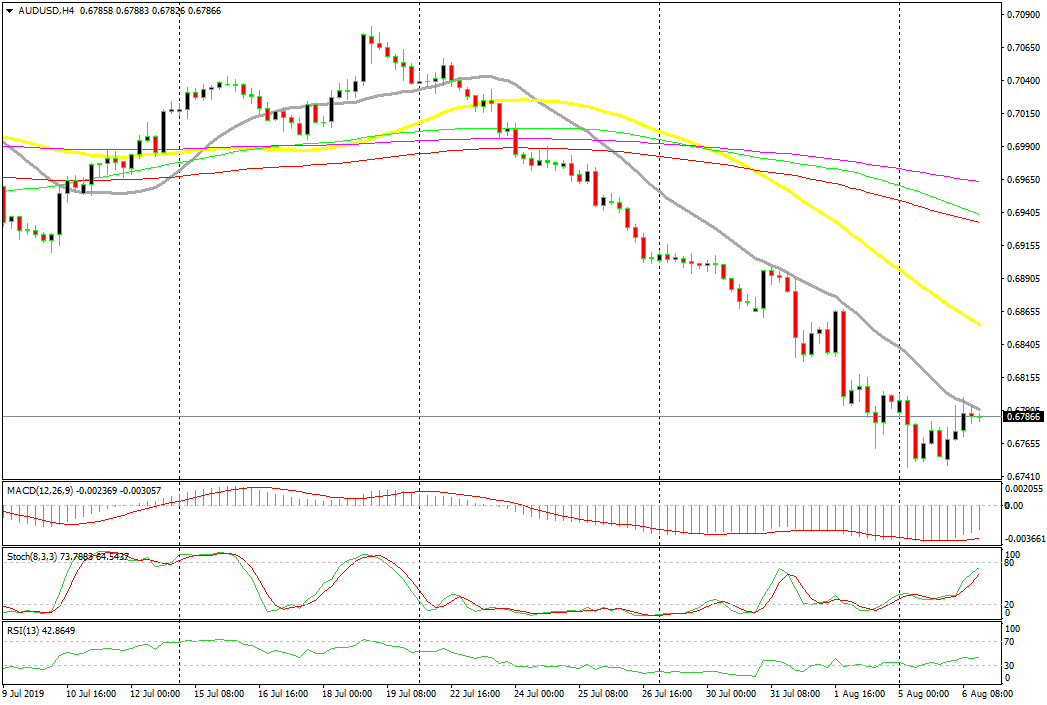

Bullish AUD/USD Again

- The trend is still pretty bearish

- The pullback is complete

- 20 SMA is providing resistance again

- Fundamentals are bearish for the Aussie

The 20 SMA is reversing this pair down again

AUD/USD turned bearish two weeks ago as the USD buyers returned and the trend has been pretty strong since then. the trend picked up further pace last week and yesterday it made new lows. But in the last few sessions the decline has stopped and we have seen a retrace higher take place as the USD weakens on the escalating trade war. But, the retrace is complete now with stochastic almost overbought and the 20 SMA (grey) providing resistance again. The previous H4 candlestick closed as a doji which is a reversing signal. We are already short on this pair from earlier on but if you missed that trade, this is a great opportunity to go short.

In Conclusion

The factory orders made a jump in Germany in June and that’s a positive sign for the manufacturing sector in Germany and the Eurozone since this sector is in great trouble. Perhaps this will be the reversing point, but it’s still too early to tell since it’s just one good month. We should wait for the manufacturing data to come out this month from Europe.