Forex Signals US Session Brief, August 9 – The Pullback in USD Continues

The sentiment in financial markets has been negative in recent weeks, turning the risk sentiment off. Safe havens have been surging during this time while the risk assets such as Crude Oil and commodity Dollars have been tumbling lower. Yesterday WTI Crude Oil fell pretty close to the $50 level again, but that support zone survived once again and today we are seeing a pullback higher. Commodity Dollars are retracing higher again against the USD as well today, while safe havens are continuing their march, with USD/JPY trying to make new lows. So, it seems that it’s just the USD that is slipping lower.

We also had some important economic reports come out of UK and Canada today. The UK GDP report for Q2 showed a contraction in the previous quarter, as did manufacturing construction output, industrial production and the business investment. As a result, the GBP turned bearish again and now we are heading for 1.20 again. The employment report from Canada was also pretty horrible, with the unemployment rate increasing two points while the participation rate declined, which should have had a positive impact on unemployment. Building permits also posted another decline, so this sector is back into contraction and the CAD is back to bearish.

The European Session

- ECB Economic Bulletin – The ECB released the monthly economic bulletin after last Thursday’s meeting. Here are some of the main comments: Prolonged uncertainty is dampening economic sentiment, notably in the manufacturing sector. The drop in Q2 global services output PMI raises risk of more broad-based deterioration in the global growth outlook. Data and survey information point to somewhat weaker Eurozone growth in the coming quarters, so the ECB is examining future policy options via reinforcing the forward guidance, rate tiering and potential restart of QE.

- China is Fighting its Battle – China’s foreign ministry spokeswoman Hua Chunying made some comments earlier today after CNBC reported that Trump is to ban government agencies from purchasing from Huawei. She said that China opposes unfair treatment of Chinese firms by the US.

- Saudis Try to Look Optimistic as Oil Dives – Reuters reported earlier, citing a Saudi Oil official, that recent concerns about oil demand growth are “overplayed”. Recent concerns reflect poor macroeconomic environment. Oil market fundamentals are good, especially on supply side due to strong commitment of OPEC+ with supply cuts. Key OPEC+ countries are committed to do whatever it takes to keep oil market balanced next year.

The US Session

- Italian PM and President Speak on the Political Situation – The political situation is a bit tense at the moment and we might see new elections take place soon but for now, the government is holding on to power. The Italian premier, Giuseppe Conte, had a meeting earlier with president Sergio Mattarella and rumours point to some minister resigning.

- US Unemployment Claims – The jobless claims have been in the range of 200k to 220k in recent several weeks. They fell to 209k in the first week of July, increased to 216k in the second, fell back to 206k in the third week and in the last week they increased to 215k again. Today’s report is expected to show unemployment claims remain the same as last week at 215k.

- US Final Wholesale Inventories – The wholesale inventories were slashed in half from 0.8% in April to 0.4% in May as the final reading showed. The first reading for June which was released earlier showed than inventories were slashed in half again to just 0.2% for that month, which is expected to remain unchanged today in the final reading of this economic data.

Trades in Sight

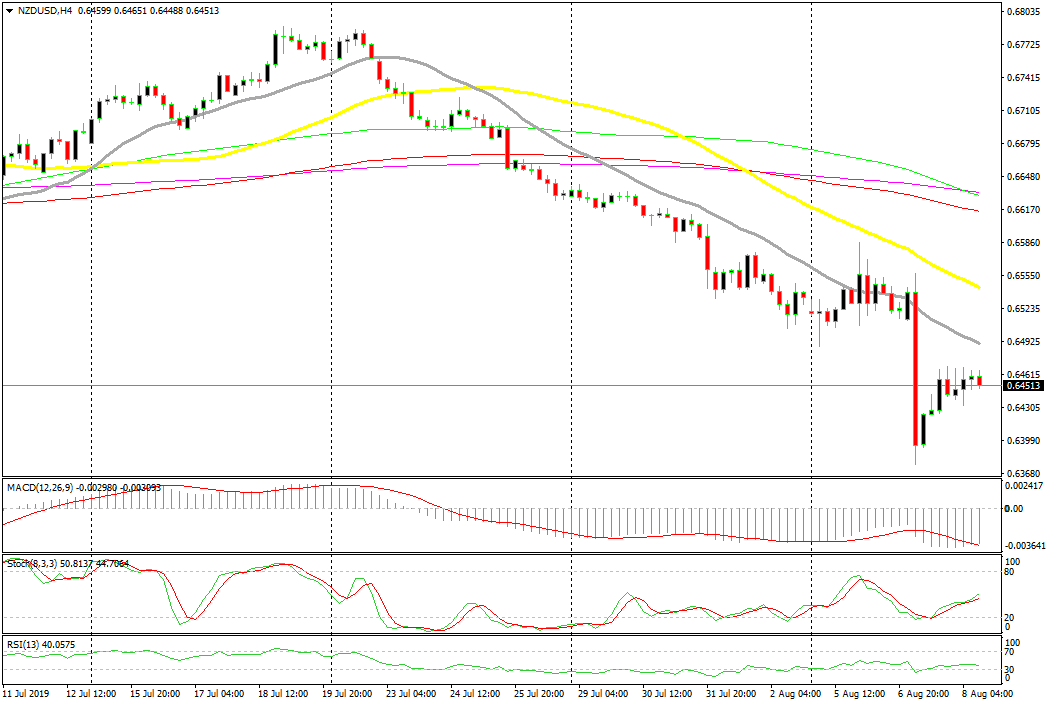

Bearish NZD/USD

- The trend is pretty bearish and it picked pace further yesterday

- The pullback is complete on the H4 chart

- 20 SMA is catching up

- The last few candlesticks point to a bearish reversal

The downtrend will likely resume once the 20 SMA catches up

NZD/USD turned really bearish about three weeks ago together with the Aussie as the sentiment deteriorated in financial markets. This pair has lost more than 400 pips during this time and the downtrend picked further pace yesterday after the RBNZ cut interest rates by 0.50%. The RBNZ left the door open for more easing in the coming months, so fundamentals are pretty bearish for the Kiwi, as the trade war escalates further. This pair has retraced higher but the retrace seems almost complete now on the H4 chart. Buyers are not making new highs and the recent candlesticks point to a bearish reversal. We went short on this pair but the reversal will likely come when the 20 SMA (grey) catches up with the price.

In Conclusion

Markets continue to remain quiet with GOLD slipping below $1,500 slowly. Although, EUR/USD has lost around 35 pips in the last couple of hours, probably due to the ECB economic bulletin. But as I mentioned above, the big decline will commence once the ECB announces a date for the start of the next stimulus package.