DAX Slips Lower as Risk Sentiment Turns Off Again Amid Protests in Hong Kong

Stock markets opened with a bullish gap this morning, but they are resuming the bearish trend again now

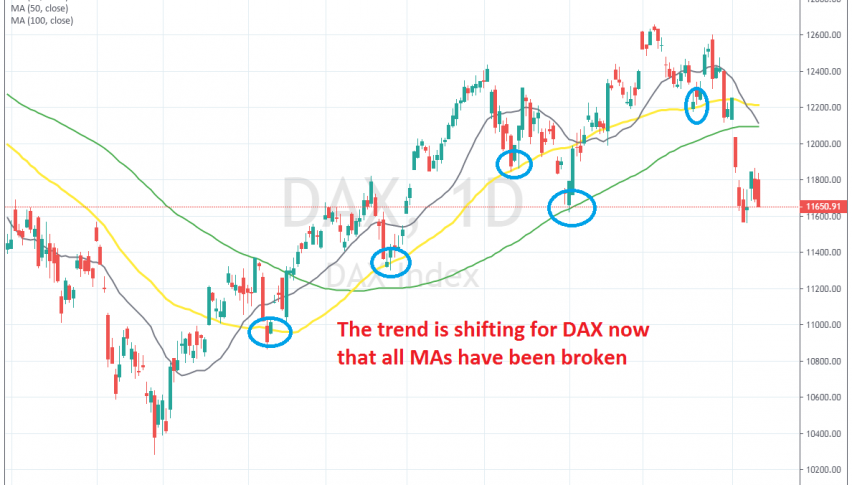

Stock markets have been on a bullish trend since the beginning of this year when they reversed higher, following the big decline in Q4 of 2018. Although, in the last few weeks we have seen stock markets slide lower in what seems to be a trend reversal.

Looking at the daily chart of the main German index DAX 30, we see that there have been decent pullbacks lower during the 7-month uptrend. But, moving averages have killed the retraces and the uptrend has resumed after finding support at these MAs. First it was the 50 SMA (yellow) which provided support on the daily chart, then the 100 SMA (green) took its turn.

Now, things seem a bit different since the price has slipped below all moving averages on the daily chart. This morning DAX opened with a gap higher, but the ongoing protests in Hong Kong are damping the sentiment, which can also observed by the climb in safe havens.

The 20 SMA provided resistance for the second time today

China is gathering the military in a city bordering Hong Kong, so things look a bit scary. This will likely keep stock markets on the decline in the coming sessions, so the pullbacks higher should be seen as good opportunity to sell main stock indexes. The 20 SMA (grey) on the H4 chart looks like a good place to short DAX since it has been providing resistance in the last two days.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account