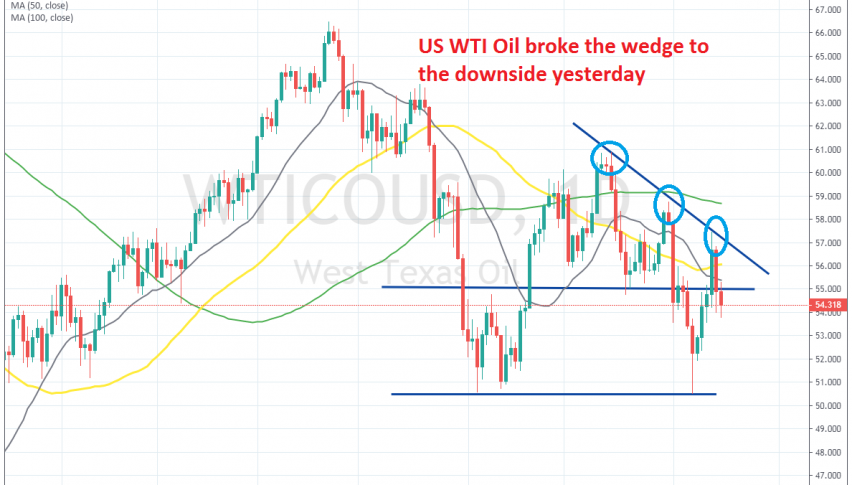

US Crude Oil Fails at the Descending Trendline and Falls Below the First Support Again

US crude Oil bounced off the support zone above $50 last week, but it reversed yesterday at the descending trend line

Crude Oil turned bearish at the end of April as trade talks between US and China fell apart back then, which hurt the sentiment in the financial markets. The price fell pretty close to the $50 level which turned into a support zone as it has been holding declines three times by now.

The price retraced higher in June as the sentiment improved, while OPEC+ announced an extension to the production quotas, both of which helped crude Oil. But, WTI turned bearish again in July as he global economy weakened further but the $50 level held once again.

Although, looking at the daily chart, I assume that the strong support area above $50 is likely to be broken soon because the highs are getting lower and lows are also getting lower. A trend line has formed in crude Oil and WTI failed to push above it on Tuesday. The support level at $55 was broken and now US crude is heading fro $50 again. I think that this will be the time that the support zone above that level will finally be broken.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account