Forex Signals US Session Brief, August 20 – Risk Sentiment Improves, What’s Next?

The sentiment in financial markets has improved, however, the overall trading has been choppy due to summer holidays. Although financial institutions and forex brokers are operating, trading volume typically drops during August.

On Tuesday, there have been a series of updates from global markets, but none of them managed to drive volatility in the market.

The European Session

Trump-BoJo Addresses Free Trade, Sterling Supports

During the European session, the POTUS (President of United States) Donald Trump and the British PM Boris Johnson held telephonic conversations on Brexit and a potential free trade agreement between both nations after Britain’s exit from the European Union.

Despite the positive news, Sterling failed to gain support and fell further by 70 pips throughout the day. The two world leaders are due to meet at the upcoming G7 summit at France during this weekend.

German PPI m/m

As per the Destatis report, the German index of producer prices for July 2019 in industrial products increased by 1.1% versus the corresponding month of the preceding year.

In June 2019 the yearly percentage of change all over had moved +1.2%, as published by the Federal Statistical Office. Compared with the preceding month of June 2019, the overall index increased slightly by 0.1% in July 2019 (-0.4% in June 2019).

CBI Industrial Order Expectations

As per the Confederation of British Industry report, the manufacturing output stabilized in the three months to August, after exhibiting a decline in July. The survey of 286 manufacturing companies showed that both total order books and export order books were recorded as lesser than normal, but to a softer extent than in July.

Economists were expecting a slowdown in the orders -25 vs. -34 previously, however, July’s figure improved to -13 which is better than the previous figure and the forecast one.

The US Session

During the US session, investors need to focus on a few low impact economic events and trade setups.

CAD – Manufacturing Sales m/m – 12:30 GMT

Statistics Canada will release retail sales with a forecast of -1.8% drop vs. 1.6% surge in the previous month. The figure reports a change in the total value of sales made by manufacturers.

The Canadian dollar is also likely to feel a bearish pressure ahead of this news release amid sentiments.

USD – FOMC Member Quarles Speaks – 22:00 GMT

The Federal Reserve Governor Randal Quarles is due to speak about community development at the Utah Center for Neighborhood Stabilization, in Salt Lake City. Since it’s not directly related to monetary policy, we may see a muted impact of the event on the US dollar. Yet, we should keep an eye on it to capture any surprising remarks regarding upcoming interest rates.

GOLD – XAU/USD – Double Bottom Extends Support

During the London session, the precious metal gold has traded mostly in line with our forecast above 1,495 support level. On the 4-hour chart, gold has formed a triple bottom pattern which extends support at 1,495 while the RSI and Stochastics are holding in the selling zone.

Our forex trading signal to stay bullish above 1,499 with a stop loss below 1,496 and take profit of around 1,505 has already closed at take profit. For now, I will be looking to stay bearish below 1,508 and bullish above 1,495 during the New York session.

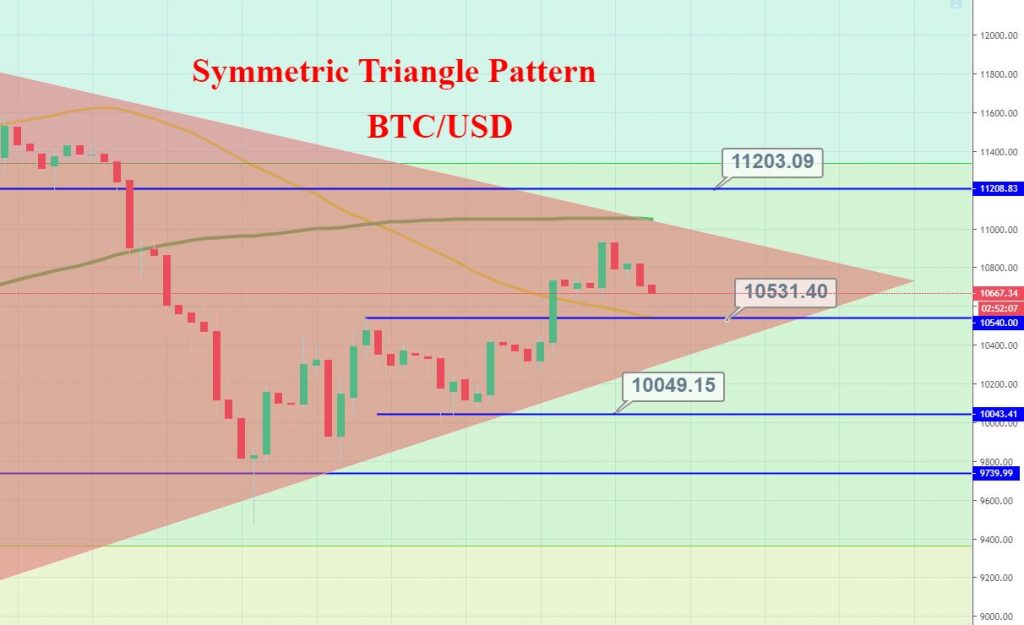

BTC/USD is also experiencing a lack of volatility, which is why it’s stuck in the symmetric triangle pattern. As anticipated, bullish power dominated to push BTC/USD towards 10,900 and even higher near 11,000 resistance area.

For now, immediate support stays around 10,700, and below this BTC/USD may drop towards 10600 zones. Below this, 10,440 will be a level of support.

Good luck and have a profitable US Session!