Forex Signals US Session Brief, August 29 – Risk Assets Find Some Bids After China Trade Comments

China's positive comments on trade improved the sentiment today and sent risk assets higher, but it is fading again now

The market sentiment has been driving markets around during this year and the sentiment has been driven by the trade war and the rhetoric that surrounds it. The sentiment has been mostly negative with the trade war escalating further and the last occasion we saw such a scenario was during the G7 summit over the weekend which sent safe havens such as GOLD and the JPY surging higher after Donald Trump announced an increase of 5% in tariffs on China.

But, Trump softened tones this week and left it to the Chinese to continue trade talks which improved the sentiment a bit this week, hence the reversal higher in USD/JPY and the retreat in Gold after opening with a big bullish gap on Monday. Today, China responded with some positive comments on trade which raised hopes that the meeting in September will not be abolished. That improved the sentiment further today and risk assets such as Commodity Dollars rallied higher during the European session, as did stock markets. Although, the trade war is still on and these comments alone aren’t going to shift the situation, so I expect the sentiment to turn negative again soon.

The European Session

- China Softens the Tones – China reiterated this morning that it opposes escalation of a trade war. China’s commerce ministry said that it hopes the US will show sincerity and concrete action and that US will meet China halfway on trade issues. China is willing to resolve the issue via a calm attitude, both sides have been in touch, and are in effective contact. They are still discussing about US visit next month. Important thing is both sides continue negotiations and create conditions for that. If Chinese officials do go to the US next month, both sides should create conditions for progress in negotiations.

- French Consumer Spending and GDP – The consumer spending turned negative in June after two positive months, declining by 0.1% which was revised lower to 0.2% today. Although, in July spending turned positive again in France and increased by 0.4% as expected, which is a positive thing. The GDP for Q2 was also released this morning and it was expected to increase by 0.2%, but it increased further by 0.3%.

- German CPI Inflation – The German economy is in a difficult spot with manufacturing in deep contraction, which is now spilling to the rest of the economy. Inflation was expected to turn negative in July and decline by 0.1%, but it came out at -0.2%.

- The New Government Is Official in Italy – The old government was dismantled last week and hopes were for a coalition between two other parties to form a new government. The press secretary said this morning that Conte has accepted Mattarella’s mandate without reservations to lead the coalition government between the Five Star Movement and Democratic Party. So there you go, although we will see how long it will last.

The US Session

- US Prelim GDP Q2 – The US GDP for Q2 report was released earlier and it was revised a tick lower as expected. The initial reading came at 2.1% but this time it was revised lower to 2.0%. Although the GDP rose by 2.3% YoY. A tick lower in the second reading, but for Q2 this is a good reading compared to other major economies. GDP price index also remained unchanged at 2.4% against 2.4% in the first reading, prior GDP price index stood at 1.1%, while the core price index ticked lower to 1.7% against 1.8% initially.

- US Personal Consumption – Personal consumption increased by 4.7% against 4.3% expected. Consumer spending on durable goods ticked higher to 13.0% against 12.9% initially. But business investment came at -0.6% against -0.6% initially which is the first contraction since 2016. Exports came at -5.8% against -5.2% initially, imports remained unchanged at 0.1% vs 0.1% initially.

- US Pending Home Sales – Pending home sales have been volatile this year, although we saw a big jump of 2.8% in June as the report released last month showed. In July, pending home sales were expected to increase by 0.1%, but they beat expectations showing a 2.5% decline.

Trades in Sight

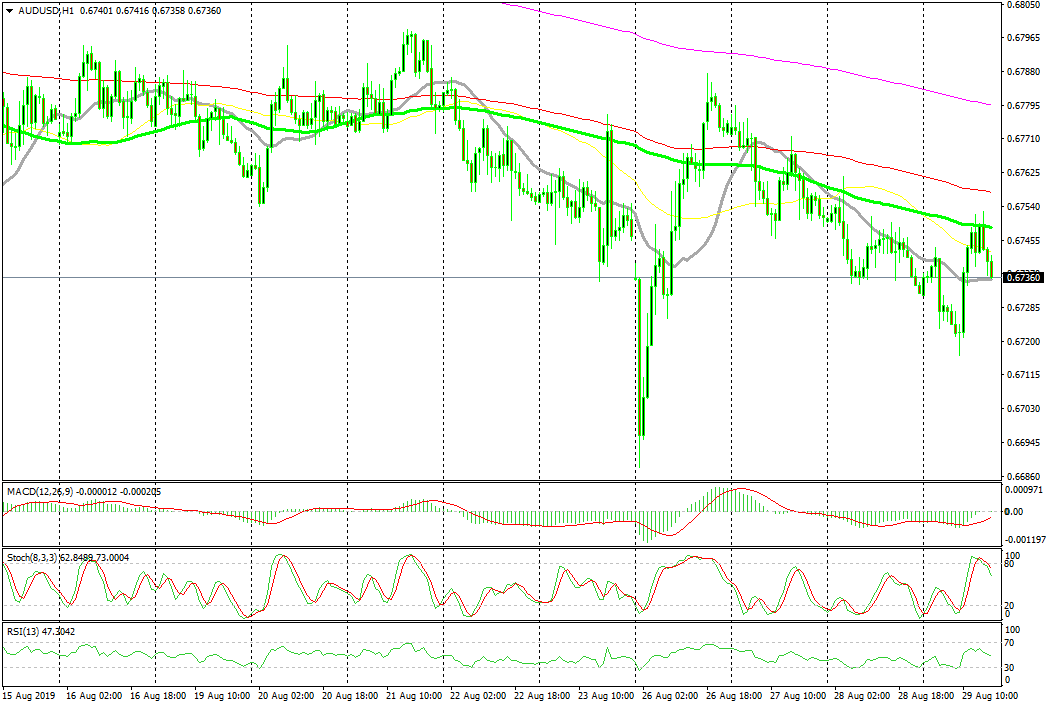

Bearish AUD/USD again

- The main trend is bearish

- The pullback higher is complete on the H1 chart

- The 100 SMA provided resistance

- Fundamentals are bearish

All retraces have ended at MAs for AUD/USD

AUD/USD has been on a bearish trend for a long time. We have used this trend in our favour, selling pullbacks higher such as yesterday when we opened a sell signal which closed during the night after the disappointing construction report from Australia. So, fundamentals are getting worse for the Aussie as today’s private capital expenditure and new home sales posted some negative numbers. We saw a retrace higher in the European session but the retrace has ended at the 100 SMA and now this pair has resumed the bearish trend again.

In Conclusion

The sentiment improved after comments from China this morning but it seems now that the optimism has faded. The USD is also gaining some momentum now as it is pushing higher against all major currencies after the US GDP and personal spending reports which were sort of positive.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account