Forex Signals US Session Brief, Sep 2 – Euro and the GBP Extend the Decline Further Amid Quiet Markets

markets have been quiet today with US still on holiday, but the Euro and the GBP keep declining

Last Friday we saw a decisive move in Euro pairs towards the end of the day. The USD turned bullish across the board in the US session and EUR/USD headed for 1.10, which was the ultimate support level for this pair. The day and the week were coming to a close and whatever buyers were left in this pair panicked and turned into sellers, piling on the downside for this pair. As a result, the big round level at 1.10 was finally broken. That level turned into resistance this week and the bearish move resumed again after the 20 SMA caught up with the price on the H1 chart, which in turn, shows that the pressure is pretty strong on the downside.

The GBP has also turned pretty bearish today. The political tensions are growing in Britain; Prime Minister Boris Johnson is pushing for a no-deal Brexit to put pressure on the EU in order to get a better deal. but the opposition parties in the UK and some dissidents from the Conservative party are getting pretty vocal with regards to new general elections. They lack time and votes to force Johnson into asking another extension of the Brexit deadline since the UK Parliament will be closed soon, but you never know how things will turn out. As a result, the certainty surrounding the GBP has increased and GBP/USD is heading towards 1.20 again. The other currencies and trading assets have been pretty quiet today.

The European Session

- Manufacturing Remains in Contraction in the Eurozone – The manufacturing sector has fallen into deep recession in he Eurozone, especially in Germany. This morning, the manufacturing reports from the Eurozone weren’t expected to show any meaningful change and they came out as expected, more or less. Spanish and Italian manufacturing activity improved a bit in August but remain in contraction, Eurozone manufacturing remained unchanged at 47 points while German manufacturing fell deeper into recession. Only in France is this sector above contraction.

- UK Manufacturing Contracts Further – UK manufacturing PMI report was released this morning and this indicator declined further during August, from 48.0 to 47.4, against a stagnation expected at 48.0 points. Manufacturing declines again and now this sector is in a really bad shape, following European and especially German manufacturing. The headline number now falls to the lowest level since 2012. Looking into the details of this report, the future manufacturing output component and business confidence both fell to its weakest levels on record.

- China Still Tries to be Constructive, Verbally – The Chinese foreign ministry made some comments early this morning which sounded positive and helped improve the sentiment. They said that creating conditions for talks with US should be the focus.

- UK Opposition Wants General Elections – Labour party leader, Jeremy Corbyn, was speaking in Manchester earlier today saying that Labour will finalize a plan to stop no-deal Brexit today. He said that the opposition wants general election before Brexit. Vote of no-confidence is also an option on the table. Will get a fair idea of what is being proposed in parliament on no-deal Brexit in about 28 hours from now.

The US Session

- Vote Against Brexit Would mean New Elections – Apart from the opposition in the UK, a number of Tory party members also oppose Boris Johnson. ITV’s Paul Brand tweeted a while ago, citing a senior government source. Below is the tweet:

- China is taking Things to WTO – China lodges formal complaint at World Trade Organisation over US tariffs. China’s Commerce Ministry said that their actions are not a surprise. US tariff actions seriously violate consensus reached by leaders of China and the US in Osaka, Japan in the G7 summit.

Trades in Sight

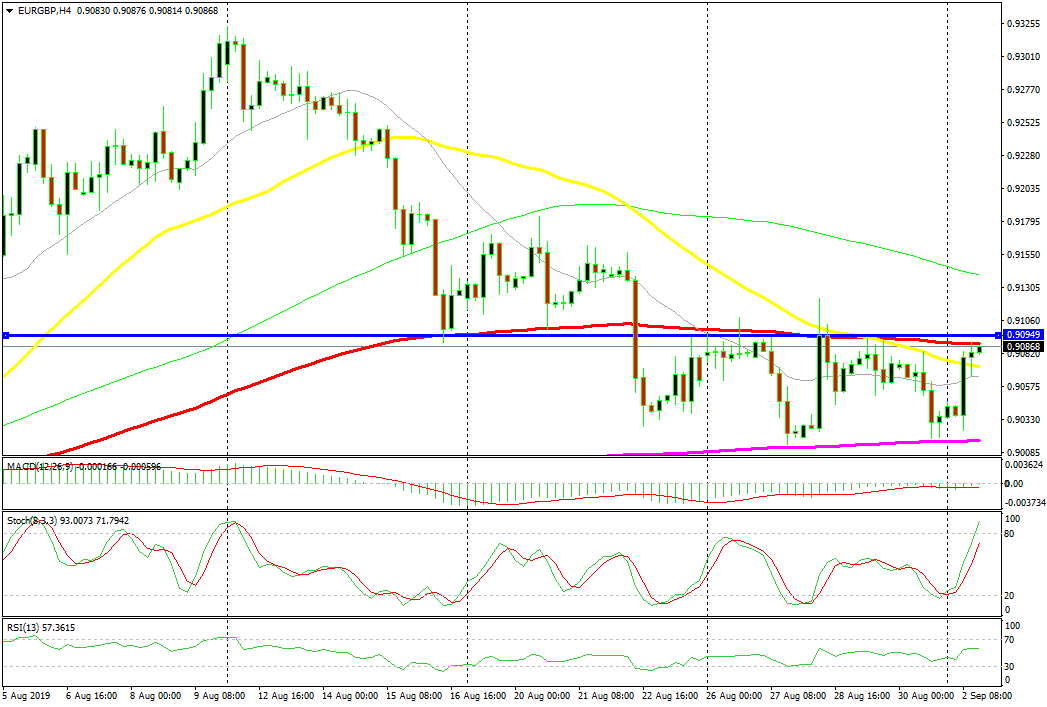

Bearish EUR/GBP again

- The trend has turned bearish

- The pullback higher is complete on the H4 chart

- The 100 SMA is providing resistance

- 0.91 has turned into resistance as well

Range trading continues for EUR/GBP

EUR/GBP turned bearish by the middle of last month after being bullish for more than three months. For more than a week though, the trend has stalled and this pair has traded in a range between the 100 SMA (red) at the top and the 200 SMA (purple) at the bottom. Right now, the price is near the top where we decided to go short. Stochastic is overbought now which means that the climb is complete, while the previous H4 candlestick closed as a doji, which is a reversing signal.

In Conclusion

Financial markets have been pretty quiet today, apart for Euro and the GBP which have been declining. Although, I expect these two currencies to calm down now as we head towards the end of European session. The US and Canda are off today for Labour Day.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account