Buying Pullbacks in USD/JPY, Again

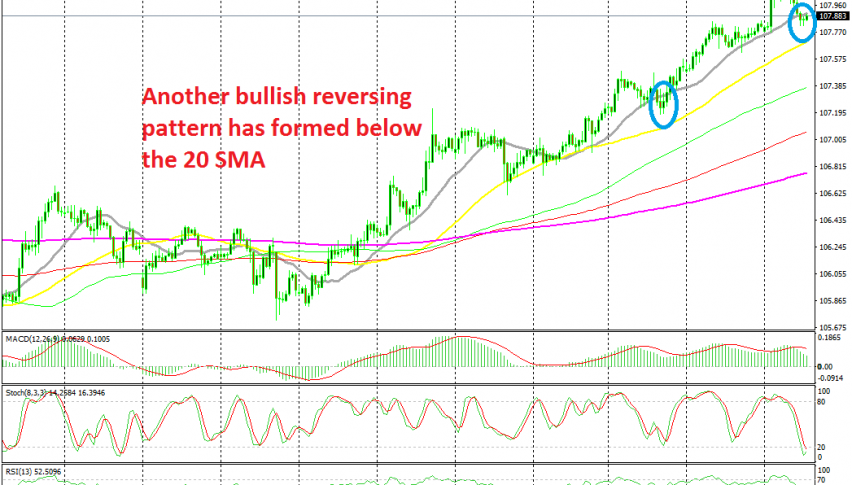

USD/JPY has retraced lower today, but it seems that the retrace is ending below the 20 SMA once again

On Tuesday, we opened a buy signal in USD/JPY when this pair was retracing lower. USD/JPY has been on a bearish trend in recent months, but at the middle of last week it reversed to bullish, as the sentiment improved in financial markets.

The 50 SMA (yellow) has helped in providing support when the trend hasn’t been too strong, while the 20 SMA (grey) has taken its place when the trend has picked up pace. On Tuesday, this pair retraced lower to the 20 SMA where we decided to go long.

USD/JPY broke below the 20 SMA that day, just like it did earlier today. But the price reversed up and continued the uptrend. Yesterday the price reached the take profit target. Today’s chart pattern looks pretty similar. The price retraced lower and it broke below the 20 SMA again, but it didn’t ran too far away from it.

The previous candlestick closed as a doji which is a bullish reversing signal after the pullback, so we decided to go long on this pair. Stochastic is already oversold on the H1 time-frame chart, so the pullback is complete. Now let’s wait for the bullish trend to resume again.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account