Forex Signals US Session Brief, Oct 9 – GBP Moves Up and Down On Brexit Promise and Denial

Today the sentiment in financial markets turned positive after China said to be ready to a partial deal with the US, despite the recent blacklisting of Chinese tech companies from the US. The blacklisting of the recent days put trade talks and the outcome back into question, but China is playing nice today. They said to be ready for a partial deal with the US and promised to buy more agricultural products from the US, but that’s still not one of the core issues for the US, so markets are still being careful.

Today, we also heard rumours from EU officials that the EU would make concessions to the UK on the Irish backstop. A report from The Times says that the EU is prepared to provide a mechanism for Northern Ireland to leave the Irish backstop after a set number of years. GBP/USD surged nearly 100 pips higher, but again, the stop would be removed after some year, which is not what the UK wants. The DUP Party of Northern Ireland shot the deal dead right away, so the GBP retreated back lower.

The European Session

- ECB’s De Guindos Doesn’t Sound Too Pessimistic on Inflation – ECB vice president Luis de Guindos spoke this morning, saying that inflation expectations are not de-anchoring, but there is a potential risk that they could do so. Have not discussed groundwork for further rate cuts. -0.50% is the correct level at present. Side effects of monetary policy are becoming more and more evident, tangible. The ECB still has headroom to ease further. If trade tensions escalate and no-deal Brexit materializes, the growth outlook will deteriorate further.

- The EU Might Give Concession to the UK – As mentioned above, areport comes from The Times here and says that the EU is prepared to provide a mechanism for Northern Ireland to leave the Irish backstop after a set number of years. This is a Northern Ireland-only backstop but with a time limit, something which was basically near unimaginable over the past few months.

- Bank of England Financial Policy Committee Meeting Summary – The main comment of the meeting summary was that the core of UK financial system is prepared for worst-case Brexit. Entrenched Brexit uncertainties weighing on UK economy. Further price volatility to be expected in a disorderly Brexit. US-China trade war poses biggest near-term risk to global economy.

- DUP Party Doesn’t Like the EU Offer – Not long after the offer from the EU, Sammy Wilson, DUP Brexit spokesman said that it will go nowhere. The government in Westminster will not accept it, we will not accept it. I don’t think anyone who looks at it with any kind of objectivity at all will say it’s an improved offer. DUP’s Donaldson added that we would clearly oppose reported EU compromise offer. The reported offer is a Northern Ireland-only backstop reheated and it does not represent a real compromise.

- China Playing nice Ahead of Trade Talks – According to the Financial Times, Chiese officials have promised to propose increased agricultural purchases to ease the trade war. This is an effort from China to seek a partial agreement in exchange for the US to put off the new rounds of tariffs which are due on 15 October and then again in December. But, this is not the main concern for the US, so we’ll see how it goes.

The US Session

- US MBA Mortgage Applications – US MBA mortgage applications for the weekending in October 4, came in at 5.2% ,form 8.1% in the previous week. The purchase index declined to 252.2 points against 263.8 prior. Market index increased to 574.5 points from 553.8 prior, the refinancing index also increased to 2,418.1 points form 2,202.6 prior,while the 30-year mortgage rate fell to 3.90% vs 3.99% prior.

- Ireland’s Vadarkar Doesn’t Approve the EU Concession – The Irish prime minister, Leo Varadkar, commented a while ago,saying that there’s no change to EU position on Brexit. We are open to workable proposals on consent for Northern Ireland.

- FED Meeting Minutes – The Federal Reserve increased interest rates in December, which was the fourth rate hike that year, and again in March this year, while the global economy was slowing. Donald Trump kept cursing at them for doing so and it seems like he was right. The US economy has slowed considerably recently and the FED has turned dovish now, cutting rates twice in the last two meetings. But, the focus now is to see if they aim to keep cutting interest rates in the coming months or if they have stopped for now. If there are hints in these minutes from the last meeting, then the USD is likely to turn bearish for some time. Please follow this event live on our economic calendar.

Trades in Sight

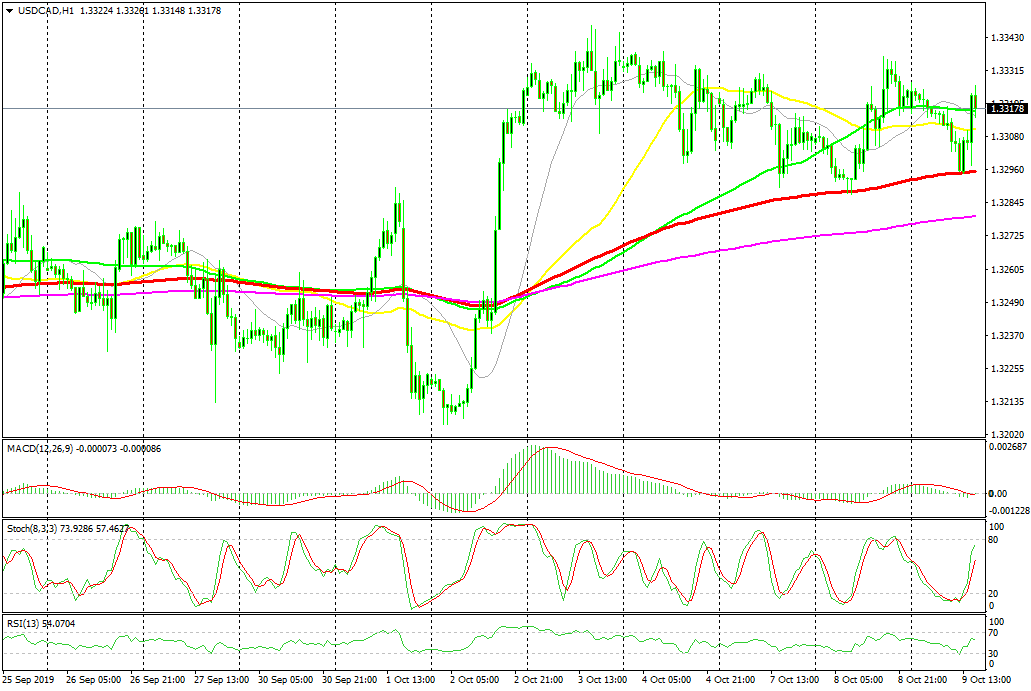

Bullish USD/CAD

- USD/CAD is trading sideways

- The 100 SMA is working as support

- The climb in Oil is over

The 100 SMA is doing a good job as support

Earlier on, we went long on USD/CAD. This pair has been trading sideways this week but recently the 100 SMA (red) has caught up with the price and has turned into support for this pair. Yesterday the price bounced off of this moving average,which we missed, so today we decided to take the opportunity when USD/CAD slipped to the 100 SMA again. Now the price has bounced higher again from the 100 SMA, so our trade is in profit.

In Conclusion

China has offered to buy more agricultural products from the US, which improved the sentiment somewhat in financial markets and Chinese officials said that they are ready for a partial deal. But, I don’t Think Donald Trump wants a partial deal, so it’s really unclear how the trade talks will go.