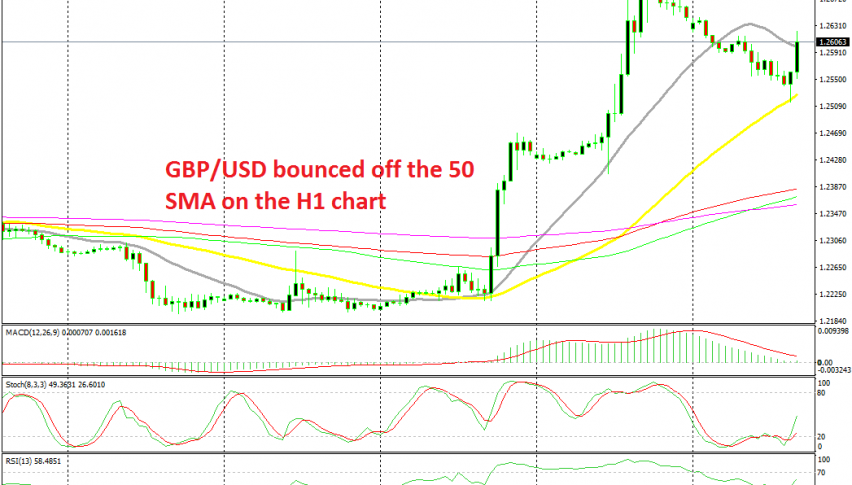

GBP/USD Bounces off the 50 SMA After BOE’s Cunliffe Remarks

BOE's Cunliffe made some dovish comments, but the GBP has turned bullish again after bouncing off the 50 hourly SMA

The Bank of England has been holding on the sidelines recently, while the rest of the major central banks have turned really bearish, cutting interest rates quite a few times in the last few months. Although, it’s not like they can do much, due to Brexit. Although, they lean on the dovish side since several sectors of the economy have been in contraction for months. BOE member Cunliffe made some comments on the monetary policy just a while ago:

- Low level of interest rates a structural trend

- Monetary policy is not powerless, but expect more tools will be needed to stimulate demand in a downturn

- Higher levels that may be more sustainable in”low for longer” world (I assume he means low rates).

- It is too early to say that we need more coordination between monetary and fiscal policy

- Need to approach any fundamental re-engineering of relationship between BOE and treasury very cautiously

- Lower market interest rates probably reflect over pessimism about long term growth

- Cunliffe expects increase pressure on banks to hunt for yield, take more risk

- As not yet seen banks take significantly more risk, regulation and memory of crisis may be restraining this, but this could be changing

- Tension US reported last month were surprised

- Repo tension may tell us something about fragility of sentiment

- Brexit uncertainty generally weighing on investment

- Global economy is weaker, trade disruption hurting investment globally

- Economic outlook weaker than expected a year ago, reiterates rates can move in either direction after no deal Brexit

- When told by audience member that people did not believe BOE would ever raise rates after a no deal Brexit, he said that people expectations aren’t always right

- When asked about negative Bank of England rates, he answered that there should be a very big shift to world as people know itfor that to happen

- The Bank of England has other tools that would be more effective than negative rates

- Personally, I would not want negative rates and UK

Although, the GBP is not caring much right now as it turns bullish once again. GBP/USD turned bullish towards the end of last week, after a joint statement from UK Prime Minister and the Irish counterpart. The EU also released some positive comments which sent GBP/USD surging more than 500 pips higher in two days. Today this pair retraced lower, but the 50 SMA held as support and the price has bounced more than 130 pips higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account