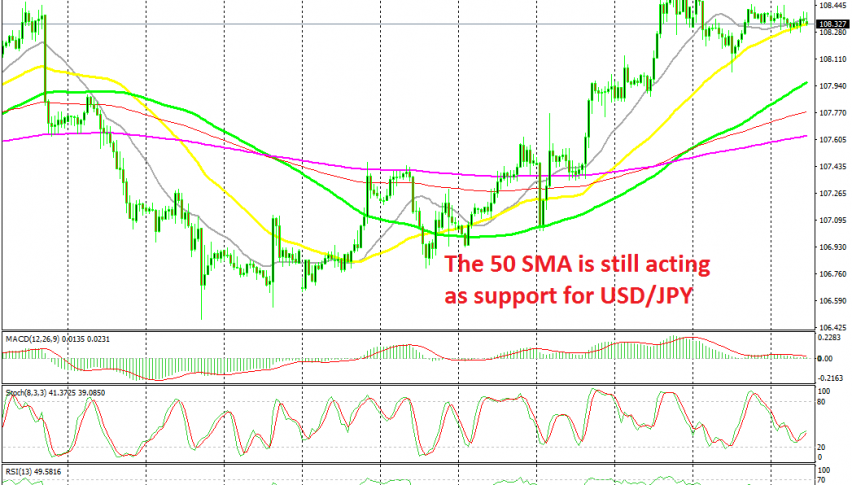

Moving Averages Keep USD/JPY Well Supported

USD/JPY turned pretty bullish last week as sentiment improved and moving averages are pushing it higher

[[USD/JPY]] turned pretty bearish two weeks ago, after the US ISM manufacturing and non-manufacturing reports came pretty weak. That increased fears that the US economy is heading towards a stagnation, which hurt the sentiment in financial markets, sending safe havens higher and USD/JPY lower.

But, the sentiment improved last week after positive comments regarding US-China negotiations and Brexit. That reversed the situation for USD/JPY and this pair climbed around 200 pips. So, the pressure has been to the upside for this pair since Monday last week.

Although, we saw a pullback lower yesterday after comments from China that they need more time to negotiate with the US,which hurt the sentiment a bit. But, the 50 SMA (yellow) held the decline, turning into support. We decided to buy down there and the price bounced higher.

But, it has been trading sideways in the last couple of sessions, although the 20 SMA (green) and the 50 SMA (yellow) are supporting this pair. So, let’s hope that these moving averages induce another bounce for USD/JPY.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account