Forex Signals US Session Brief, Oct 17 – Another Brexit Deal is Reached, But Only in Paper

The sentiment has turned quite positive in the last week or so. US and China were converging towards a trade deal, which they have reached. It was a partial deal which was called Phase One, but as Chinese officials commented today, both sides are discussing the next phase of the deal, with the intention to end the trade war. The trade war is going to last for some time until China tackles most of its wrongdoings, but the partial deal is enough for now for traders.

The other reason for the improvement in the risk sentiment is the Brexit deal. Boris Johnson, Irish officials and the EU were seen to converge on their statements by the end of last week and this week they were hinting at a Brexit deal. Today, the deal was finally reached, which was confirmed by all sides. That sent GBP/USD around 250 pips higher immediately and improved the sentiment further in financial markets, pulling risk assets higher.

But, the DUP Party of Northern Ireland, refused the deal and other actors of UK politics joined, such as the opposition, the Brexit Party of Nigel Farage and the Scottish National Party SNP. As a result, the climb in risk assets and in the GBP has stopped. After all, we’re back to where we were at the start of this year when Theresa May had a deal but UK politicians kept refusing it. So, the deal is good only in paper, because I still see it as very difficult to pass the British parliament.

The European Session

- Chinese Officials Comment on Trade Talks – The Chinese commerce ministry commented on the matter this morning, saying that US trade talks were constructive and there was substantial progress. The goal is to stop the trade war and remove all tariffs. Hopes that China can make progress with the US in removing tariffs. Currently working on text with the US and wish both sides can reach an agreement as early as possible and make progress on cancelling tariffs. They are working on text for “Phase One” deal, discussing “Phase Two” talks.

- UK Retail Sales Report – UK retail sales for September beat expectations of -0.1%, coming in flat at 0.0%. August stood at -0.2% initially but was revised to -0.3%. Retail sales YoY remained unchanged at 3.1% against 3.1% expected. Prior reading stood at 2.7%, but was revised lower to 2.6%. Core retail sales for September, which exclude autos and fuel beat estimates, increasing by 0.2% vs -0.1% expected. Core retail sales YoY (ex autos and fuel) also ticked higher to 3.0% against 2.9% expected.

- Eurozone Construction Output – The construction output for August was expected to remain negative at -0.5% as it did, after posting a 0.7% decline in July. Although, July was revised higher to -0.2% but that’s still a contraction in the activity. Construction output YoY came in at 1.2%. The previous number which stood at 1.1% was revised higher to 1.8%.

- A Brexit Deal is Struck – The parties involved in Brexit were getting closer in the last several days and earlier this morning we heard that a Brexit deal was said to have been reached. Later on, Juncker confirmed it, saying “Where there is a will, there is a deal – we have one!” Johnson tweeted: “We’ve got a great new deal that takes back control – now Parliament should get Brexit done on Saturday so we can move on to other priorities like the cost of living, the NHS, violent crime and our environment #GetBrexitDone #TakeBackControl”

- DUP is Not Accepting the Deal – The DUP said that there is no change to their earlier position, in response to the Brexit deal. They released a statement refusing the deal and saying that they won’t vote for Boris Johnon’s deal when it gets to the parliament.

The US Session

- US Philly FED Manufacturing Index – The US manufacturing index was released a while ago and it was expected to fall again to 7.3 points from 12 points in August. But, manufacturing index missed expectations today, declining to 5.6 points. This is another negative sign for US manufacturing, after the really soft ISM manufacturing report two weeks ago and prices paid also posted a big decline, falling to 16.8 points from 33.0 prior. But the other details were positive. New orders increased to 26.2 points from 24.8 previously, employment more than doubled to 32.9 points from 15.8 prior, while the six month index also increased to 33.8 points from 20.8 in August.

- US Housing Report – The US September housing starts also missed expectations, posting a 1256K increase against 1320K expected. Prior housing starts for August stood at 1364K and was revised higher to 1386K. Building permits for the same period moved higher to 1387K against 1350K expected, but down from 1425K in August. So, this report was also mixed. ADP September employment softened to 28.2K from 49.3K prior, which was revised much higher to 109.9K today.

- Canadian Manufacturing Sales and ADP Employment – Manufacturing sales have been negative in three out of the last four reading. They posted a big decline of 1.2% in July, but was expected to turn positive in August and increase by 0.7%, which they did. Sales increased by 0.8%.

- US Industrial and Manufacturing Production – The industrial production was expected to turn negative again in September and decline by 0.1%. But, it missed expectations, contracting by 0.4% instead. Prior was at 0.6% but was revised higher to +0.8%. Manufacturing production came in at -0.4%, missing expectations of -0.3%. Capacity utilization also declined by 0.5% against -0.3% expected.

Trades in Sight

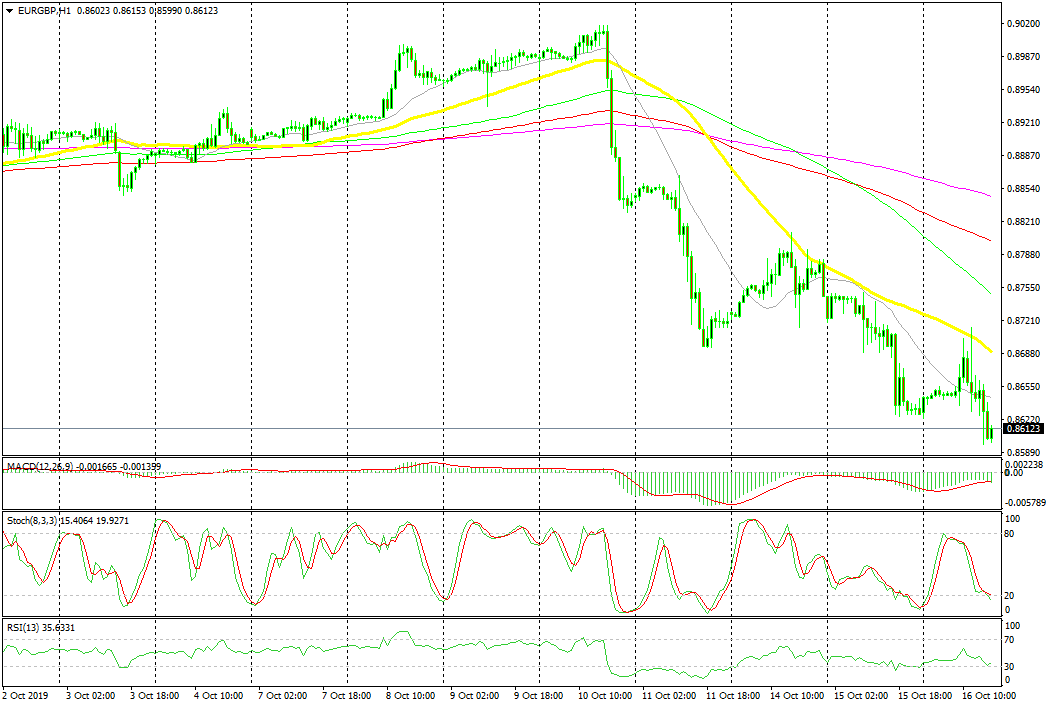

Bullish EUR/GBP

- The trend has turned bearish

- The 50 SMA is pushing the price down

- In case of a Brexit deal, the GBP will rally higher

The 50 SMA keeps pushing EUR/GBP lower

EUR/GBP has been bullish for months, but it turned bearish last week after rumours of a possible Brexit deal. The rumours are still being heard and despite the uncertainty and contradiction, the situation has improved for the GBP. The 50 SMA is also doing a good job on the H1 chart, providing resistance on pullbacks higher. If a Brexit deal is reached, then the Euro will rally but the GBP will rally harder, which would be negative for this pair, so we are keeping a bearish bias.

In Conclusion

The sentiment remains positive in financial markets today, as safe havens have turned bearish again. But, Commodity Dollars are still sliding, which means that we’re going through a phase of USD strength right now. Let’s see how long this can continue.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account