Forex Signals US Session Brief, Oct 18 – Markets on Standby Ahead of the Brexit Vote

Yesterday the GBP rallied on the Brexit deal, but today the situation looks uncertain after many UK politicians opposed it

Yesterday, the UK Prime Minister Boris Johnson and the EU finally reached a deal on Brexit. That improved the sentiment further in financial markets, especially for the GBP which surged around 250 pips higher. Markets were expecting such a deal for about a week because all comments from the UK, the EU and Ireland pointed to that, but the announcement of the deal had a decent impact on markets nonetheless, because Boris Johnson has made it clear that the UK is leaving on October 31, with or without a deal.

But, the DUP Party refused the deal on an official statement they released and other UK politicians joined them. That hurt the sentiment for the GBP which lost all the gains in the following hours. Now, the uncertainty surrounding Boris Johnson’s Brexit deal has increased again and BoJo is struggling for support. Tomorrow the UK Parliament will be voting on the deal but nothing is for sure. BoJo doesn’t have a majority in the Parliament, so this can go both ways. There are quite a few options open on where Brexit can go for now, so traders are waiting on the sidelines today in order not to get caught on the wrong side.

The European Session

- The DUP Party is Building Up a Fight Against BoJo’s Deal – DUP lawmaker, Sammy Wilson commented this morning that they will encourage Tory lawmakers to oppose Johnson’s deal. Voting down the deal will open up better opportunities for the government. If Johnson wins an election, he will have more leverage with the EU. The DUP leader Foster also reaffirmed that they will oppose Johnson’s Brexit deal. So, it will be tough for Johnson to pass the deal in the Parliament tomorrow.

- Eurozone Trade Balance – The trade balance in the Eurozone has been above €20 billion for quite some time, but it fell below that level in June. Although it returned above it in July when trade balance came at €20.5 billion, which was revised higher today at €21.6 billion. The trade balance was expected to come at €20.3 billion for August, but it beat expectations coming at €26.6 billion.

- Odds are Against Boris Johnson – The betting firm which predicted Theresa May’s failure to pass her Brexit deal through the parliament says that Johnson is set to lose by seven votes tomorrow. Sporting Index, a betting firm which called all three of Theresa May’s failed votes, said that Boris Johnson will win the backing of 313 lawmakers tomorrow, falling just short of the 320 votes he need to get his Brexit deal through. Their predictions were really close for the three attempts of Theresa May deals, so they might be right in this case as well.

- A Brexit Extension is on the Papers if the Deal Fails – Irish lawmaker Coveney said a while ago that Ireland would strongly back an extension if Brexit deal is rejected. German Chancellor Angela Merkel added that a Brexit extension is unavoidable if UK parliament rejects the deal. So, it seems like they are not expecting the deal to pass the UK Parliament tomorrow.

The US Session

- Germany’s Scholz is Not for a Fiscal Package Now – Recently we have heard rumours and comments coming out of Germany that it might induce some cash into the economy through a fiscal stimulus package. But, German finance minister Olaf Scholz said today that Germany is able to react if economic situation requires it to. Approval of Brexit deal would be good for economic growth in Europe.

- Bank of Italy Expects Stagnation in Q3 – The Bank of Italy released the quarterly bulletin for Q3. They saw the economic activity increased only slightly in Q2. Q3 growth is believed to be nearly flat. Firms indicated slightly more expansionary investment in September survey. New US tariffs will affect a relatively limited share of Italian exports to the US but indirect effects could be significant.

- FED’s Kaplan Feels Pessimistic on the Economy – FED member Kaplan commented just now, saying that global growth is decelerating, citing trade tensions. He added that the US is not immune to global growth slowdown, but expects the consumer spending to be strong, however, it is fragile.

Trades in Sight

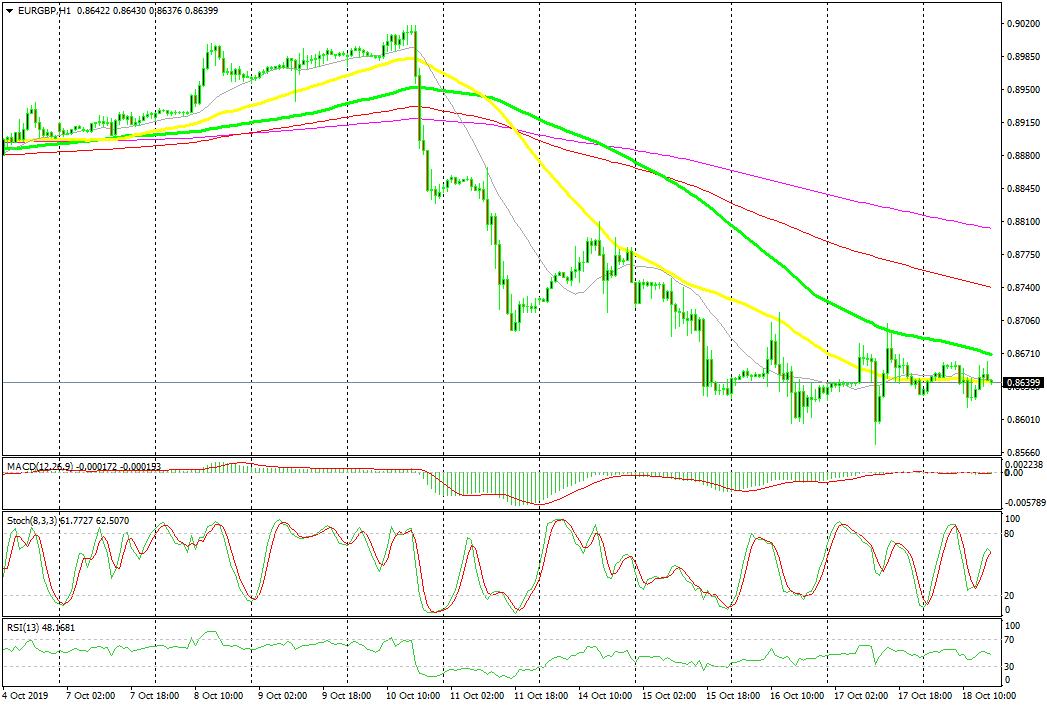

Bullish EUR/GBP

- The trend has turned bearish

- The 100 SMA has turned into resistance now

- The last two candlesticks are pointing down

The 100 SMA keeps reversing EUR/GBP lower

EUR/GBP has been bullish for months, but it turned bearish last week after rumours of a possible Brexit deal. The rumours are still being heard and despite the uncertainty and contradiction, the situation has improved for the GBP. The 50 SMA was doing a good job on the H1 chart, providing resistance on pullbacks higher. It was broken yesterday, although the 100 SMA (green) turned into resistance and it is reversing the price lower for the second time today. We just went short on this pair, after the last two candlesticks closed as a doji and an upside-down hammer, which are reversing signals.

In Conclusion

The sentiment in financial markets today is neither positive nor negative, showing the uncertainty ahead of the parliamentary vote tomorrow on Brexit. The price action is very slow, although, the only trend today is the slight softness in the USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account