Forex Signals US Session Brief, Oct 22 – Markets on Standby for the Meaningful Brexit Vote

The fourth Brexit vote in the UK Parliament will take place later and traders have sidelined ahead of that event, leaving markets slow today

It’s that time again when we get to see if the Brexit deal will pas the British parliament once again. This is the fourth attempt to pass the Brexit deal through the UK Parliament after the previous UK PM Theresa May consumed three attempts with hear Brexit deals, all of which failed to make it through. Chances for Boris Johnson’s deal passing the parliament are 50/50, considering the opposition and the DUP Party of North Ireland have made it clear that they won’t vote the deal. If that happens, then the UK will get another extension of Article 50 since the UK lawmakers made it illegal to leave on October 31 with no deal. We will likely have new general elections in the UK, so the uncertainty will be elevated.

Although DUP has softened the tones in the last few days, which is a good sign. Yesterday we heard the ERG offer their support as well. So, there’s a real chance that BoJo makes it this time and passes his Brexit deal. The GBP will surge in this case and GBP/USD will likely reach 1.35 in no time and remain bullish for a few days/weeks. But, looking at the longer term, the situation will still be quite uncertain. A Brexit deal doesn’t mean much without a trade deal, and the UK is not sure what trade deal it wants. It could be a Canada style trade deal with the EU, a Ukrainian, a Turkish, a Swiss or a Norwegian style deal. Whichever they pick, it is going to take years to be reached; it took 7 years for Canada. But, the transition period finishes at the end of 2020; so if a trade deal is not in place by then, the UK will end up with a no deal Brexit anyway, just 14 months later. Therefore, the situation will remain uncertain for a long time, deal or no deal.

The European Session

- UK CB Industrial Expectations – The CB industrial expectations indicator turned negative at the beginning of this year as the global and the UK economies weakened and it has been deteriorating since then. We saw a slight improvement in August, but it fell further into negative territory in September to -28 points. Today, the CB indicator was expected to improve slightly again to -25 points, but it fell further to -37 points.

- EU on Italian Budget Debt – It’s that time of the year again and the EU is back at Italy’s throat on the budget. The European Commission said that Italy’s draft budget is not in line with policy requirements. That means that the debt is too high for the EU. Although, Italy isn’t the only country having issues with France’s 2020 budget plan also called into question as the commission is demanding clarification as they view that the budget seems to be in breach of the rules.

- EU’s Tusk and Juncker Speak on Brexit – EU’s Tusk commented this morning saying that he is still consulting European leaders on Brexit extension. The extension request makes things more complex, any delay depends on what UK lawmakers decide or don’t. The EU is to react to the request in the coming days. A no-deal Brexit will never be our decision. Juncker also chipped in. He said that Brexit is a waste of time and energy. It is painful spending so much time on Brexit. Will always regret UK’s decision to leave the EU. It is not possible for EU to ratify Brexit before the UK does.

- Chinese Diplomat Blames the US for the Trade War – Senior Chinese diplomat Wang Yi commented a while ago, saying that China did not want to fight a trade war, but US forced it on China. China must take necessary countermeasures to protect its interests. It’s not really an indication of tensions escalating again but more of general commentary.

The US Session

- Barnier Speaks on the Trade Deal – EU’s Brexit negotiator Michel Barnier spoke a while ago on the trade deal issue, in case Brexit passes the UK Parliament today. He said that a trade deal with the UK will take two, three or maybe more years. He added that the consequences of Brexit have been underestimated in the UK.

- Canadian Retail Sales – Retail sales from Canada were released earlier. Headline sales were expected to have increased by 0.4% in August, while core sales were expected to be flat. But, headline retail sales missed expectations of 0.4% and posted a 0.1% decline for August. Core sales came in negative for July, declining by 0.1% as the report released last month showed. They were expected to be flat today for August at 0.0%, but turned even more negative, showing a 0.2% decline for that month. Although, the previous headline retail sales number was revised higher from 0.4% to 0.6%. Nonetheless, this is a really weak report as sales turn negative again.

- UK PM Spokesman Trying to Pressure the Parliament – UK PM spokesman James Slack commented a while ago, saying that voting down programme motion would have serious implications. It would mean the legislation will drift on and on and that is not in the UK or EU’s interest. Voting down the programme motion risks handing control back to the EU. There is no guarantee of the EU granting an extension

- The Brexit Vote – The British Parliament will be voting on Boris Johnson’s Brexit deal later today. The debate is heating up and Johsnon is trying everything to convince the Parliament to vote, even with threats. He has a good chance of making it through, but no one knows for sure. We will follow it live.

Trades in Sight

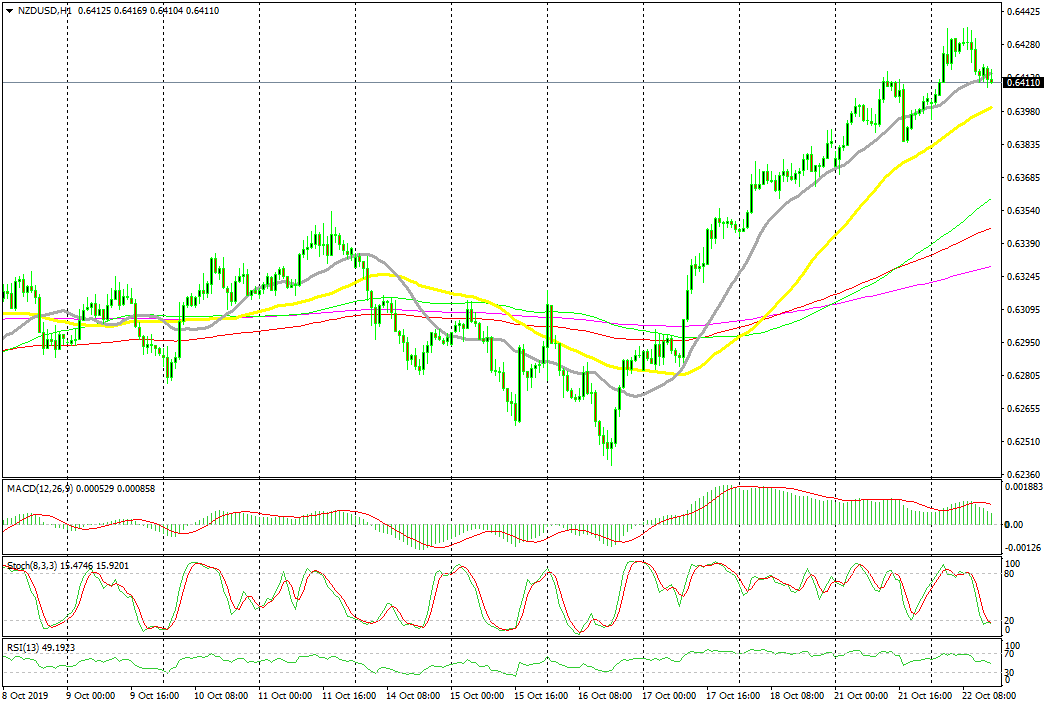

Bullish NZD/USD

- The trend has turned bullish in the last week

- The 20 SMA is providing support

- The retrace lower is complete

The 20 SMA has acted as support for NZD/USD on the H1 chart

NZD/USD has turned pretty bullish in the last week or so. The market sentiment has improved, which helps risk currencies, while the USD has turned pretty soft recently as the FED turned dovish, cutting interest rates twice and preparing for another cut later this month. During the uptrend, the price has been finding solid support at the 20 SMA (grey) on the H1 chart which has been pushing it higher. Right now the price is back at the 20 SMA after retracing lower, but the pullback seems complete now as stochastic shows.

In Conclusion

Markets continue to be pretty quiet, with most majors pairs trading in very tight ranges and the price action has been quite slow. There has been some volatility in the GBP as it moves up and down, but GBP traders are also waiting on the sidelines for the Brexit vote to take place.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account