Forex Signals US Session Brief, Oct 24 – Hopes For An Economic Rebound Were Shot Dead At Sight Today

The data from Europe and the US today didn't leave much room for hopes of an economic rebound

Today the economic calendar was loaded, with many events on it. It started with the services and manufacturing reports coming out of Europe this morning. In France, services and manufacturing PMI moved higher for this month, showing that manufacturing in particular moved away from stagnation. But, German services PMI remained quite soft and manufacturing remained deep in recession. The Eurozone manufacturing also remained deep in recession, so hopes for an economic rebound in the Eurozone faded pretty quickly. The price action in the Euro this morning shows just that, as the Euro jumped higher initially, but reversed back down pretty quickly.

The European Central Bank meeting took place later. There were no expectations for another rate cut this month, after the ECB cut deposit rates by 10 bps last month. Although anticipations are for two cuts from the ECB until the end of the year, but there’s still time until then for another cut. The press conference didn’t offer anything new either; the ECB confirms the weakness in the economy and inflation and will restart the QE (quantitative easing) programme on November 1, buying 20 billion Euros worth of assets monthly.

The durable goods orders report was released before the US session started and was another disappointing economic report form the US. Headline durable orders posted a big decline of 1.1% for September. The ISM manufacturing fell deeper in contraction last month in the US. The decline in orders confirms the shape of this sector and since orders declined last month, its likely that production declines as well in the coming months.

The European Session

- European Manufacturing PMI – French manufacturing has been softening and last month the manufacturing PMI fell pretty close to contraction at 50.3 points which was revised even lower to 50.1 points. This month, manufacturing was expected to fall in stagnation at 50 points,but it jumped higher to 50.5 points. German flash manufacturing for September was revised higher in the final reading from 41.4 to 41.7 points. This month, manufacturing PMI indicator was expected to move higher to 42.0 points but missed expectations, coming at 41.9 points. Eurozone manufacturing PMI for September was revised higher to 45.7 points in the final reading, from 45.6 points in the first estimate. In October, flash manufacturing was expected to move higher to 56.1 points, but missed expectations and remained unchanged at 45.7 points, as in September.

- European Services PMI – French Services PMI also improved today, from 51.1 points in September to 52.9 points this month. German services PMI also missed expectations and edged closer to stagnation at 51.2 points against 52.0 expected, down from 51.4 in September. This is a 3-year low. Composite services PMI came in at 48.6 points against 48.8 expected, ticking higher from 48.5 points in September. Eurozone Services PMI also missed expectations coming at 51.8 points against 51.9 expected, but higher form 51.6 points in September. Composite services PMI came at 50.2 points against 50.3 expected, ticking higher from 50.1 points previously.

- New Elections Increasingly Likely in UK – Reuters posted some headlines earlier today, citing a senior government source saying that “we shall have to see” on pre-Christmas election. UK will ultimately leave the EU on the terms of Johnson’s Brexit deal. The Parliament has taken back control.

- ECB Rate Decision – The ECB was expected to keep rates unchanged today after cutting deposit rates by 10 bps last month, bringing them down to -0.50%. There was a small chance that they could cut rates again today, since markets are expecting two rate cuts this year. But the ECB kept them unchanged, with deposit rates at -0.50% and refinancing rates at 0.00%.

The US Session

- US Durable Good Orders – The durable good orders report from the US was released a while ago. Headline orders were expected to turn negative and decline by 0.5% in September, but they were even softer at -1.1%. Core orders which exclude transportation were also expected to turn negative and decline by 0.2%, but they missed expectations as well, declining by 0.3%. Previous core durable goods orders stood at 0.5% but was revised lower to 0.3%. Capital goods orders non-defense excluding air came at -0.5% against -0.1% expected. Prior capital goods orders non-defense excluding air were revised lower as well to -0.6% from -0.4%. Capital goods shipments non-defense excluding air missed expectations of -0.2%, coming at -0.7%.

- ECB Press Conference – ECB’s Draghi’s opening comment was that the downside risks are prominent, inflation is muted. The ECB is providing substantial monetary policy support. Services and construction show ongoing resilience but there is some moderation. Underlying inflation to pick up over medium term. Weak growth delays pass-through to inflation. Ample degree of monetary policy is still necessary. Fiscal stance is ‘mildly expansionary’ and providing some support. Governments with fiscal space should act in a timely manner.

- US Markit Flash Manufacturing PMI – This manufacturing indicator has been performing better than ISM manufacturing lately. It got pretty close to stagnation in August, but last month it moved higher to 51.1 points. This month, the manufacturing PMI was expected to cool off again and fall to 50.7 points, but it moved higher to 51.5 points.

Trades in Sight

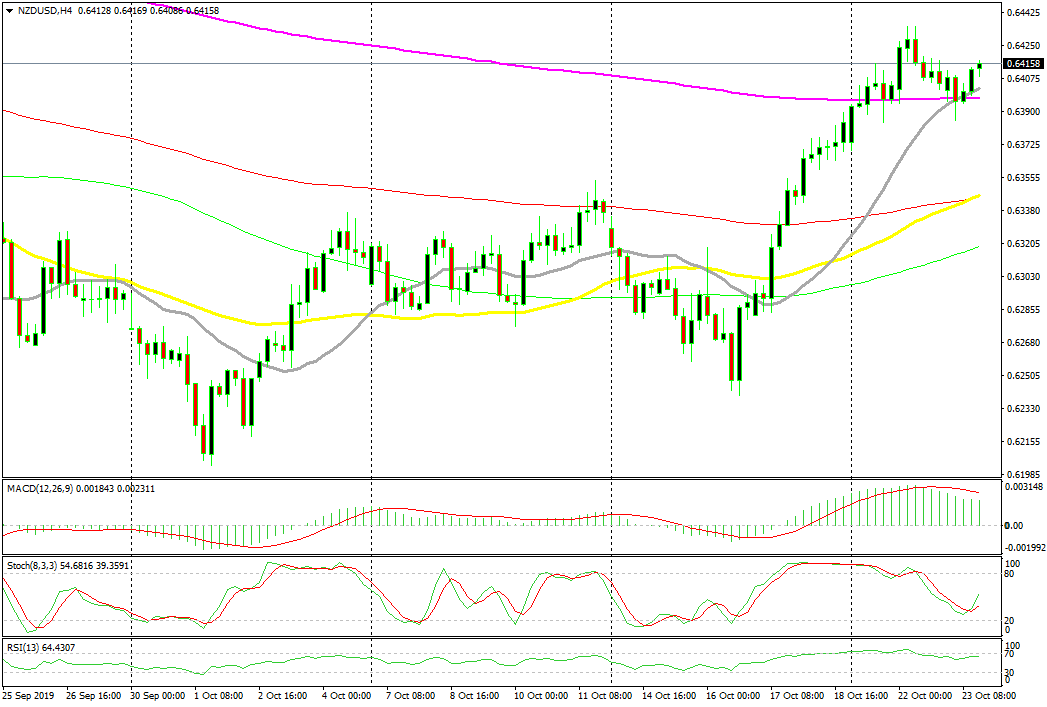

Bullish NZD/USD Again

- The trend has turned bullish in the last week

- MAs are providing support

- The retrace lower is complete on the H4 chart

The 20 and the 200 SMAs have acted as support for NZD/USD on the H4 chart

NZD/USD has turned pretty bullish in the last week or so. The market sentiment has improved, which helps risk currencies, while the USD has turned pretty soft recently as the FED turned dovish, cutting interest rates twice and preparing for another cut later this month. During the uptrend, the price has been finding solid support at the 20 SMA (grey) on the H1 chart, but today it found support at this moving average and the 200 SMA (purple) on the H4 chart. Now the retrace is over as stochastic is turning upwards and the price is bouncing off those moving averages.

In Conclusion

Hopes for an economic rebound in the Eurozone which increased after the services and manufacturing figures from France, dissipated after the German and Eurozone reports were released. US markit manufacturing PMI also came in higher today, but the decline in durable goods orders will affect this sector in the coming months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account