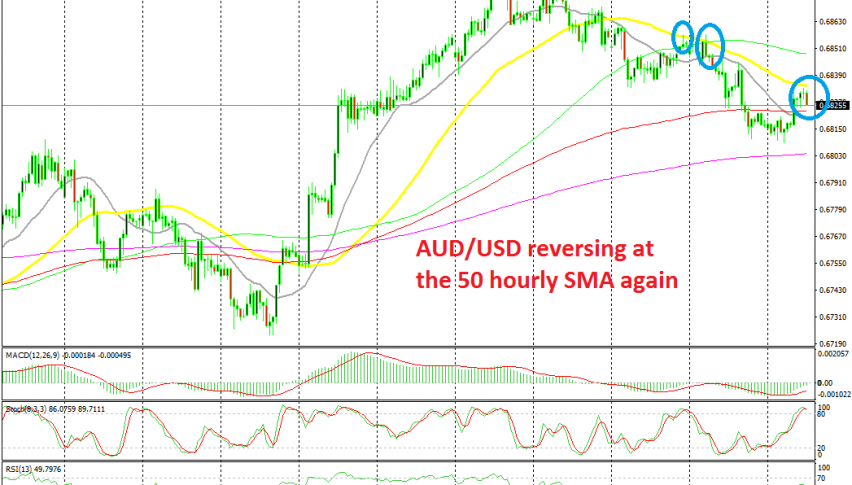

Selling AUD/USD at the 50 SMA as it Turns Into Resistance

AUD/USD has turned bearish this week and the 50 SMA has turned into resistance

[[AUD/USD]] turned pretty bullish last week as the sentiment in financial markets improved considerably. As a result, this pair climbed around 250 pips from the bottom to the top, but the climb ended this week, as it became increasingly obvious that Boris Johnson was going to lose the meaningful vote in the British Parliament.

AUD/USD failed to make new highs from Tuesday on, and eventually it reversed lower. The decline this week hasn’t been too convincing, which shows that there’s a lot of uncertainty in the markets right now, but lows keep getting lower and highs keep getting higher.

So, the trend has changed this week and the 50 SMA (yellow) confirms it on the H1 chart. This moving average has turned into resistance now, having reversed the price lower a few times already.

This morning we saw a retrace higher on this time-frame, but it ended at the 50 SMA once again. The price formed a doji candlestick below the 50 SMA and it started reversing down. We decided to sell this pair up there, so now we are short on AUD/USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account