Forex Signals US Session Brief, Oct 28 – The GBP is Not Impressed by the 3-Month Brexit Extension

Markets still remain uncertain today, despite the Brexit extension. New elections are coming in the UK

The forex market turned quiet last week, after seeing some elevated volatility in the previous weeks. The partial trade deal between US and China, as well as the Brexit deal, improved the sentiment in the previous weeks, sending risk assets higher and safe havens lower. But, the Brexit deal didn’t quite pass the British parliament and the uncertainty increased again in financial markets. Traders were not sure how the situation would evolve, so they decided to remain on the sidelines until things became clearer.

It became clear that the UK was going to ask for another Brexit extension after the UK political scene didn’t agree on everything the deal offered. The EU offered a three month extension today, which EU’s Tusk labelled a “Flextention” since it doesn’t require another EU summit to become official. But, the situation is still unclear. Boris Johnson will push for a general election and will bring an election motion to the UK parliament today, although it remains to be seen whether the Labour Party will back that. Even if they do, the uncertainty will likely increase in financial markets and especially for the GBP, so traders are expected to remain sidelined.

The European Session

- Eurozone Money Supply – The M3 money supply has been increasing steadily in the Eurozone in the last several months, form around 4.7% back in April, to 5.7% in August, which was revised higher to 5.8% today. For September, M3 money supply was expected to tick lower to 5.7%, but it missed expectations coming at 5.5%. Private loans, on the other hand, remained unchanged at 3.4% YoY.

- Brxit Delay Until January 31 – France finally decided to go with the other EU countries and agree on a 3-month Brexit extension today. EU’s Donald Tusk confirmed that, tweeting on his official account: “The EU27 has agreed that it will accept the UK’s request for a #Brexit flextension until 31 January 2020. The decision is expected to be formalised through a written procedure.” The extension doesn’t need approval from the EU27, so it became official.

- UK Gov’t Backs Lib Dem’s for December Elections – Now that the Brexit extension for three months has been granted, chances are high that an election takes place in Britain. Business Insider political editor, Adam Bienkov, reported earlier that the British government said to back Liberal Democrats bill for 9 December election if it loses the election motion today. But, I think the motion today might just make it through.

- More Sanctions on Iran for Mnuchin – US Treasury secretary Steven Mnuchin made some comments earlier after meeting with Israel. He said that the US has executed on a maximum pressure campaign for sanctions. We will continue to ramp up, more, more, more… So, despite things calming with China, geopolitical tensions with Iran continue.

The US Session

- US Wholesale Inventories – Last month’s report showed that inventories increased by 0.4% in August, which was revised lower today to 0.2%. That’s positive since it would mean that production will likely increase. Inventories for September were expected to show a 0.3% increase, but they declined by 0.3% instead. This means that US firms will increase production to make up for the decline in inventories.

- Mario Draghi Preparing to Leave the ECB – Draghi will leave the ECB on October 31 and he made a speech today. Draghi said that Leaving the ECB is easier, knowing the presidency in capable hands. He means Christine Lagarde is capable. Public’s trust in the Euro is at its highest ever. The euro is irreversible. Monetary policy can still achieve its objective but it can do so faster and with fewer side effects if fiscal policies are aligned. A more active fiscal policy in the Eurozone would make it possible to adjust our policies more quickly.

- US Dallas FED Manufacturing Index – The Dallas FED manufacturing index has been declining and last month it fell to 1.5 points. it was expected to cool off further today to 1.0 points, but it missed expectations, falling in negative territory to -5.1 points. Manufacturing output also cool off to 4.5 points against 13.9 previously, but at least it still remains positive.

Trades in Sight

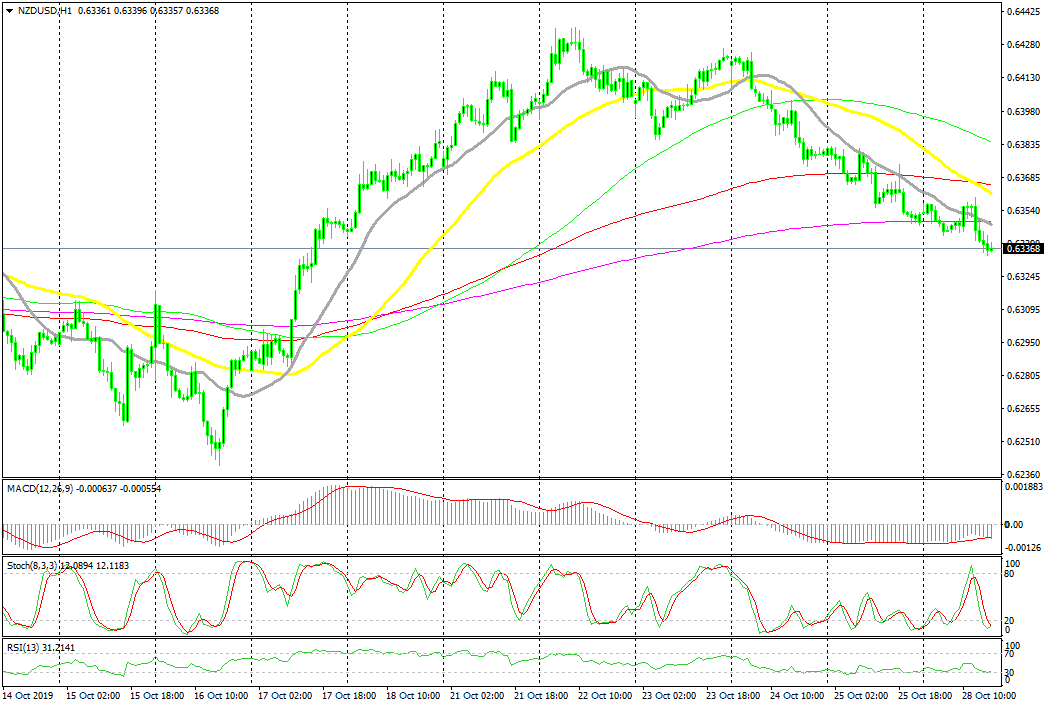

Bearish NZD/USD

- The trend has turned bearish

- The pressure is on the downside

- The 20 SMA is pushing the price down

The 20 SMA is defining the trend for NZD/USD

NZD/USD has turned pretty bullish in the third week of this month. The market sentiment improved, which helped risk currencies, while the USD has turned pretty soft recently as the FED turned dovish, cutting interest rates twice and preparing for another cut later this month. But, the trend shifted last week, as the sentiment deteriorated a little and NZD/USD has lost around 100 pips since then. Now the pressure is totally on the downside and the 20 SMA (grey) is pushing the price lower, so we have a bearish bias for this pair.

In Conclusion

Markets continue to remain pretty quiet today as the uncertainty remains in the air in financial markets. The UK got its third, and final in my opinion, Brexit deal, but the GBP doesn’t seem to mind much. Seems like traders are waiting for things to became clear, in order to get a direction. The JPY is the only currency which has been moving today and it is moving down, as USD/JPY climbs higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account