Heading Into Elections Might Be A Win-Win Situation for the GBP

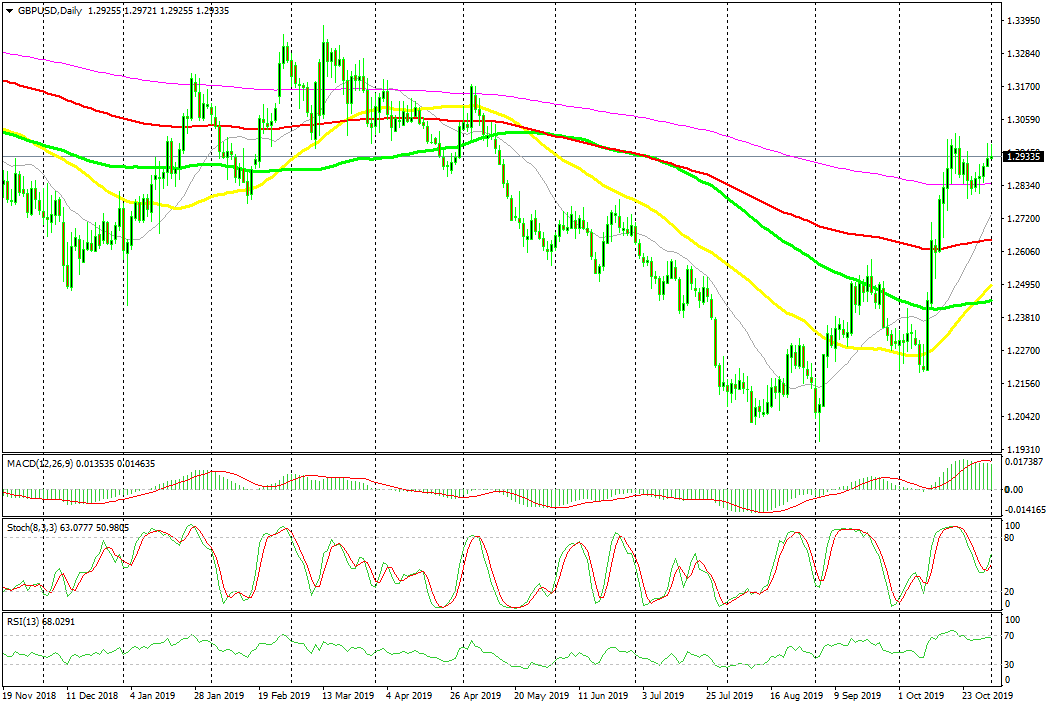

The GBP has been bearish for a long time, since the Brexit vote 3 and a half years ago. GBP/USD broke below the big round level at 1.20 early in 2017 and after a decent retrace higher, this pair returned below this level again on September this year. Although, we saw an 8 cent surge in the GBP in October after Boris Johnson reached a Brexit deal with the EU.

But, the deal didn’t pass the meaningful vote in the British Parliament and now we are heading towards new elections in the UK. After three failures from Theresa May to pass the deal and BoJo’s failure, there’s not much room left for anything else than let the people decide what they want to do next. What do elections mean for the GBP though?

Conservatives Take the Majority in the UK Parliament

Conservatives used to have a comfortable majority after the Brexit vote but Theresa May lost it when she called for snap election. So, it has been hard for Conservatives in the UK to pass the Brexit deals on four attempts and this has been the reason. Boris Johnson finally gave up after his first failed attempt and he announced new elections, since he removed some of the Tory rebels who voted against his deal, meaning that he doesn’t have a majority, whatever the deal might be.

His aim is to win a clear majority in the Parliament in December and push ahead with the Brexit deal. Conservatives odds have gone up and they lead by nearly 12% points now and are likely to grow further as we approach the election day. Not that polls are too trustworthy, after the miserable failure to predict the Brexit and Trump votes, which mans that Tories might get even more seats.

This goes in favour of the GBP, at least in the short term. If Boris Johnson wins a clear majority, the Brexit deal will finally pass in the parliament. This is GBP positive. It would remove the chances of a no Brexit deal, at least for now. The GBP will likely surge for some time. How far it will climb? GBP/USD is already pretty close to 1.30, so 1.35 is within sight and I think the GBP will climb higher as we approach election day, if conservatives keep the lead or expand it further.

GBP/USD surged after the Brexit deal between the Eu and UK government

Opposition Takes the Majority in the UK Parliament

The opposition Labour Party, led by Jeremy Corbyn, is down 0.4% to 24.9% as shown in the polls right now. That puts the gap at over 12%, but they have the option to team up with Jo Swinson’s Liberal Democrats – who have been gaining traction at the expense of Labour and stand at 17.8%. A coalition between them and the Greens would take them close to 47%, so they still have chances of forming the government.

Jeremy Corbyn has made it clear that he will push for a new Brexit referendum, while the Lib Dem’s Swinson has made it clear that she will ask the EU to revoke the withdrawal act from the UK. These are both positive for the GBP, although there would be a period of uncertainty right after the elections, which could hurt the GBP a little, but then the GBP would turn really bullish, especially if Brexit is revoked or if the UK votes against Brexit in another referendum.

Now, the UK and global economies are in a tough spot, so the GBP will also be heavily affected by that once it becomes clear which way Brexit will go. Besides, the Bank of England will likely start easing the monetary policy after that, especially if the GBP surges higher. So, nothing is ever smooth in Forex, but the GBP is likely to benefit, whatever the election outcome.

The next phase would be the transition period from now until leaving the EU. UK and the EU still have to reach a detailed trade deal until the end of this period which will stretch up to the end of 2020 or even beyond. But, I think that they will eventually reach a trade deal if Brexit goes well in UK.