Forex Signals US Session Brief, Nov 4 – Some USD Buyers Return, With Caution

The USD has been bearish during October, but it retraced higher during the European session today, which seem to be over now

Last month the USD turned pretty bearish. ISM manufacturing reports showed that this sector has been in contraction for three months now. Besides that, the FED cut interest rates for the third time in the last three meetings and despite them pausing the rate cuts for now, they let us know that the next move from them will likely be another cut, rather than a rate hike. This leaves the USD with an unclear future, and it extended the bearish move after that meeting.

Today though, it seems like USD buyers have returned again. During the Asian session, the risk sentiment improved and rick currencies such as AUD/USD and NZD/USD made some new highs, while the JPY was declining. But, risk currencies have retreated during the European session and the USD is the only currency making gains. Although, USD buyers seem cautious since fundamentals have turned sort of dovish for the USD. Crude Oil stretched the upside move further today after the Iranian Oil minister said that OPEC+ are discussing further production cuts. The manufacturing reports from the Eurozone this morning showed that this sector remains in deep recession, so there’s no reason for the Euro to rally.

The European Session

- European Manufacturing PMI – Manufacturing has been weakening in the Eurozone and now it is in the middle of a deep recession. The final manufacturing reading for Germany showed that this sector remains in deep recession, despite a small improvement. Italian and Spanish manufacturing are also in contraction and they deteriorated further today. Only French manufacturing remains in expansion, and today’s report showed a slight improvement for September.

- Eurozone Sentix Investor Confidence – The investor confidence turned negative in December last year in the Eurozone. It resurfaced again for a while in May, but it fell back in negative territory the following month and it has been deteriorating since then, falling to -16.8 points last month. For this month, the Sentix investor confidence was expected to improve slightly to -13.4 points, but it beat expectations,coming at -4.5 points, which is a good sign, but the sentiment still remains negative.

- UK Construction PMI – The UK economy has been weakening for more than a year, especially core sectors such as manufacturing, services and construction. Construction used to be at the forefront of the British economy’s growth, but it fell into contraction in May and contraction has been deepening since then. The construction PMI indicator declined to 43.3 points last year, although it was expected to show a slight improvement to 44.3 points today. It did improve but it missed expectations, coming at 44.2 points.

- Farage Predicts Labour Losses – The Brexit Party leader Nigel Farage commented on UK elections which are coming up in December. He predicts a hung Parliament. Farage said that ‘I am going to take loads of Labour votes in this election’. We are going to hurt the Labour Party in the most extraordinary way.

The US Session

- Iran Officials Hint at Further Oil Production Cuts – The OPEC+ cartel has cut Oil production earlier this year which helped Oil for some time, but the weakening global economy has kept Oil prices bearish. Today, the Iranian Oil Minister said that OPEC and their allies are already discussing more production cuts. They will likely decide for further production cuts at the meeting on 5th and 6th of December.

- US and China Almost There With “Phase One” Deal – The US National Security Advisor O’Brien commented a while ago today that the US is close to Phase 1 agreement with China. This is largely echoing recent comments from US policymakers with the latest from Commerce Secretary Ross who stated that they are far along in a Phase 1 deal with China.

- FED’s Kashkari Speaking – FED member Kashkari said that the balance of risks are tilted towards the downside right now. Until wage growth picks up, we’re not going to be at maximum employment. Average monetary policy has been too tight throughout US economic recovery. Fed should err on the side of more accommodation. Fed should not raise rates prematurely. US not immune to China and Europe slowdown. Fed does not think negative interest rates are a tool it would want to use, but does not rule out possibility. Dovish comments from Kashkari.

- US Factory Orders – Factory orders turned negative in August, declining by 0.1%. That wasn’t a good sign for manufacturing production and ISM manufacturing fell into deeper contraction in September. Today, factory orders are expected to show a further contraction, with expectations at -0.5%.

Trades in Sight

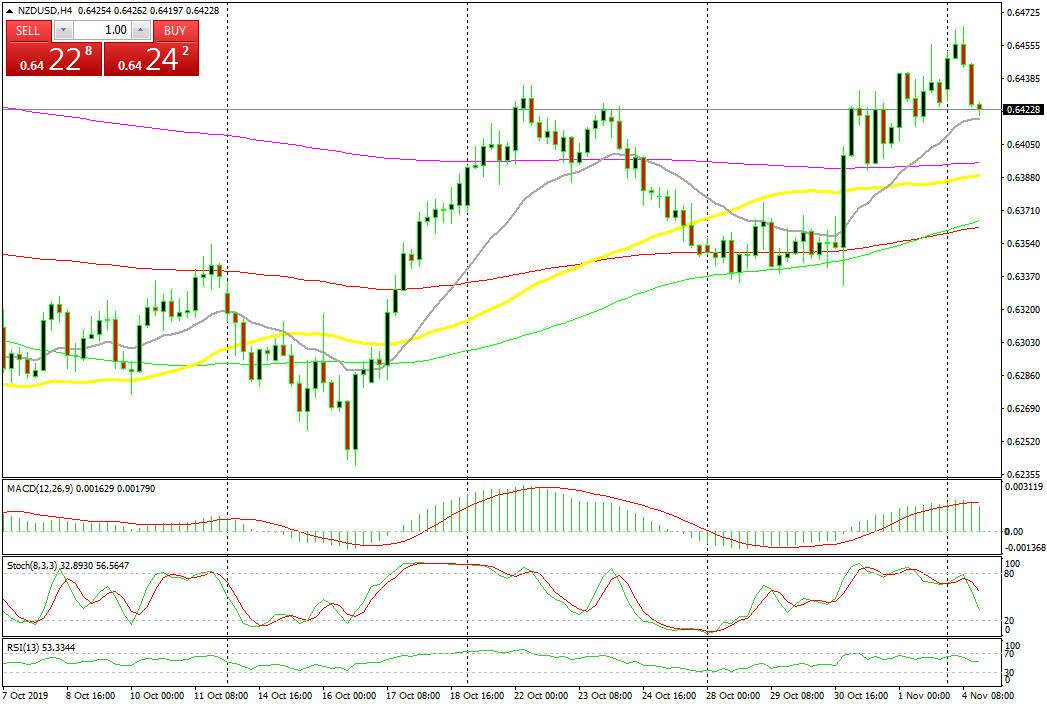

Bullish NZD/USD Again

- The trend has been bullish for a month

- The retrace down is complete on the H1 chart

- The 20 SMA has turned into support on the H4 chart

- Fundamentals point up

The 20 SMA is providing solid support for this pair on the H4 chart today

NZD/USD has been bearish for a long time, but it turned higher in the third week of October, after comments that US and China were reaching a partial trade deal. As a result, this pair climbed around 200 pips higher. Although it retreated lower two weeks ago, the bullish trend resumed again last week. But, the sentiment has turned slightly negative in the European session today and this pair has retraced lower. But the retrace is complete on the H1 chart and the 20 SMA (grey) is providing support on the H4 chart. We decided to buy earlier, so we are long on this pair.

In Conclusion

The Eurozone manufacturing PMI was pretty weak once again today, showing that this sector remains in recession and there are no signs of improving anytime soon. The US has been sort of bullish during the European session, but i assume this will end soon since the FED is keeping a dovish bias, as Kashkari pointed out.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account